Wage Crisis: Nearly 50% Workers Will Earn More In Unemployment Benefits Than From Work

KEY POINTS

- After factoring in state benefits, half of workers can make more on unemployment

- This exposes the issue of stagnant wages more than anything

- For the last 50 years, productivty has risen while wages have not

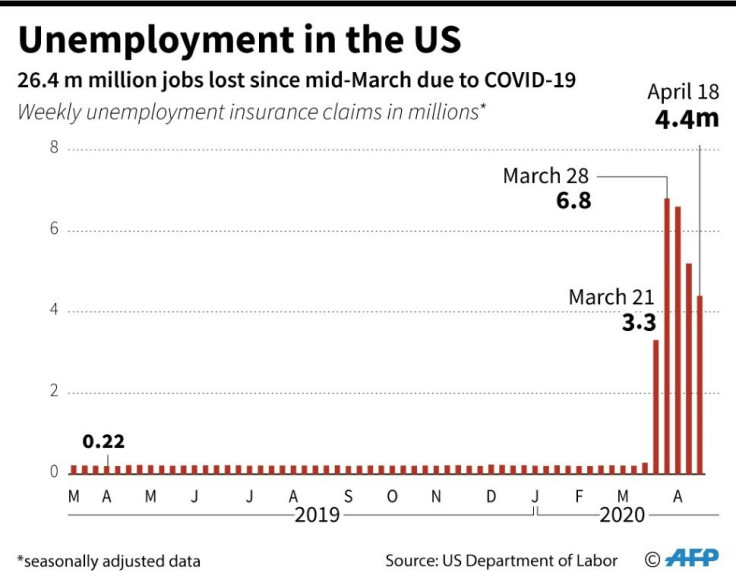

Roughly half of American workers will make more money in unemployment benefits than they do in wages from their job, The Wall Street Journal found after factoring in state benefits allocated during the COVID-19 pandemic. The WSJ wrote that “the average weekly payment to a laid-off worker should rise to about $978 from the $377.97 the Labor Department said was paid on average late last year,” and that “Labor Department statistics show half of full-time workers earned $957 or less a week in the first quarter of 2020.”

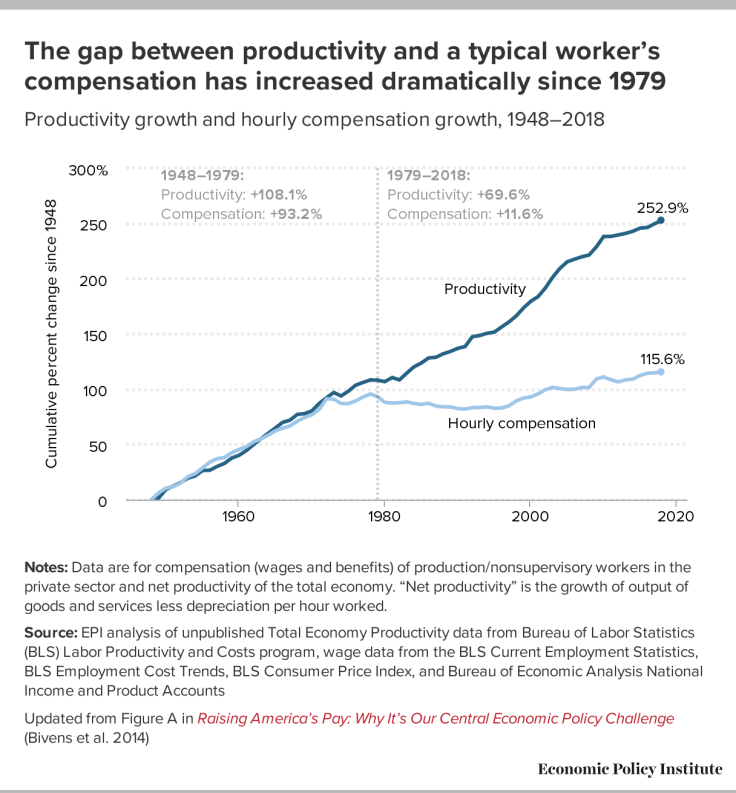

Many have reacted to this surprising news by attacking the supposed generosity of the unemployment benefits system, but it actually highlights the general inadequacy of wages in the United States. Productivity has continued to rise at a steady pace, but the wages paid to the workers creating that productivity have remained stagnant since the 1970s. These are the conditions that create a world where workers can make more money on unemployment than they can from wages at their job.

Unemployment benefits are generated by taxes on employers, and states have a lot of flexibility in the size and scope of these taxes. Most systems replace half of prior weekly earnings with unemployment benefits, with the national pre-crisis average at $387 per week, paid out for 12 to 26 weeks depending on the state.

While the economy is too complex for a single answer, the reality that half of workers can make more money on unemployment than while working reflects the realities of the economy more than the inefficiencies of the unemployment benefits system. America has entered a new Gilded Age with inequality levels not seen since the turn of the 20th century, and stagnant wages are at the heart of this issue.

As this thread from Princeton economist Atif Mian demonstrates, the top 1% has not only seized most of the available money, but they have become creditors to the bottom 90% of Americans, creating a debt-fueled feedback loop that exacerbates the underlying issue with stagnant wages.

Here is one picture that summarizes this result: Since 1980, top 1% have become net creditors largely to the bottom 90%, who have in turn become more and more indebted!

— Atif Mian (@AtifRMian) April 21, 2020

8/ pic.twitter.com/fqFZN2p4Rl

According to the United States Bureau of Labor Statistics, the 10 largest occupations in America are retail salespersons, fast food and counter workers, cashiers, home health and personal care aides, registered nurses, office clerks, laborers and freight, stock and material movers, customer service representatives, waiters and waitresses, and general/operations managers.

These occupations likely comprise most of the American workers making more on unemployment benefits than they were at work, as BLS data reveals that most workers in these fields earn a median wage between $11 and $15 per hour (40 hours of work at these wages amounts to an annual salary between $22,880 and $31,200 per year, with the lower end of that range falling below the poverty line for a family of four).

So long as the United States continues to rely on an economy wholly dependent on low-wage workers whose earnings are not commensurate with the production they create, this dynamic will only worsen with time.

© Copyright IBTimes 2025. All rights reserved.