Wall Street Hit By Walmart Wipeout, Gas Woes Knock Europe

World shares skidded and bond markets rallied on Tuesday as some disappointing earnings, the prospect of another super-sized U.S. interest rate hike this week, and Europe's looming gas crisis all kept investors on edge.

Asia had been buoyed overnight by a new Chinese plan to tackle its property crisis and as tech giant Alibaba sought a primary listing in Hong Kong [.SS], but Europe and Wall Street could not keep up.

A Walmart profit warning and another cut in the International Monetary Fund's global growth forecast shoved Wall Street's main markets lower as they opened [.N]. Europe's STOXX 600 started to buckle too after an earlier boost from a profit upgrade from consumer goods giant Unilever and higher commodity stocks [O/R].

But they were offset by broader recession fears as European Union leaders agreed to cut their countries' gas usage and as a 9% dive in UBS shares hit the banking sector. [.EU]

"The key question we have as these earnings come out is how much pricing power do these (consumer facing) firms have," said Diamond Hill international equities portfolio manager Krishna Mohanraj, referring to the pressures of higher inflation.

"The other issue is will the Fed be able to control inflation without killing the economy."

A turbulent Wall Street restart left Walmart's shares down around 9% after it had slashed its forecasts on Monday due to those exact issues. [.N].

General Electric rose 6% though after growth in its aviation business helped it beat estimates. Coca-Cola gained 1% after it raised forecasts while Unilever rose 2.5% after an earnings beat, with chief executive Alan Jope saying "strong pricing" had enabled it to mitigate cost inflation.

European Union countries approved a weakened emergency plan to curb their gas usage earlier too after striking compromise deals to limit the hit for some countries as they brace for further Russian supply cuts.

The Kremlin warned again that state monopoly Gazprom would reduce its supply further this week due to another maintenance issue on the Nord Stream 1 pipeline, halving already reduced current flows.

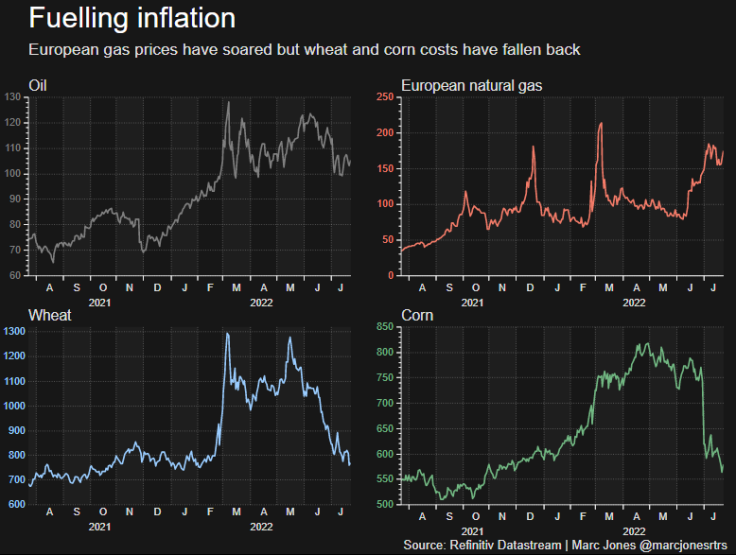

That sent European gas prices up almost 10% and they are now more than 450% higher than a year ago, though still below record highs hit shortly after Russia began its invasion of Ukraine in February.

"It is game of cat and mouse," said Christopher Granville Managing Director of EMEA & Global Political Research at TS Lombard.

"The Russia position will always be that it will continue to supply the gas within the constraints caused by the West's sanctions. But they will then find lots of problems that suddenly pop up."

GRAPHIC - Europe's gas price surge

FED UP, IMF DOWN

Investors are also waiting for a likely 75 basis point Federal Reserve interest rate increase on Wednesday - with markets pricing about a 10% risk of a larger hike. They will also want to see whether economic warning signs prompt a shift in rhetoric.

The IMF cut global growth forecasts again on Tuesday, warning that high inflation and the impact of the Ukraine war will push the world economy to the brink of recession if left unchecked.

It now sees global real GDP growth of 3.2% in 2022, down from 3.6% predicted in April, adding that the world economy had actually contracted in the second quarter due to downturns in China and Russia.

For the United States though, the IMF confirmed its July 12 forecasts of 2.3% growth in 2022 and an anaemic 1.0% for 2023, which it had cut twice since April.

"The outlook has darkened significantly since April. The world may soon be teetering on the edge of a global recession, only two years after the last one," IMF Chief Economist Pierre-Olivier Gourinchas said.

NOT SO HIGH TECH

Global tech giants Microsoft and Google are both reporting after the Wall Street session later, followed by Facebook owner Meta tomorrow and Apple and Amazon on Thursday.

It adds up to more than $7.5 trillion of market cap, Deutsche Bank's Jim Reid said, while pointing out that those five stocks were still valued at close to $10 trillion at the start of the year.

In Asia, MSCI's broadest regional index outside Japan had bounced 0.5%.

Chinese stocks had jumped after reports the country would set up a fund of up to $44 billion to help property developers. [.SS]

Hong Kong's Hang Seng Index ended 1.7% higher on the Alibaba news although Japan's Nikkei fell 0.16%. [.T]

In currencies, the dollar was pushing for recent milestone highs as uncertainty continued to swirl around the interest rate and economic outlook. [/FRX]

The euro tumbled back to $1.0139 from $1.0250 hemmed in by concers over Europe's energy security.

The yen steadied at 136.44 per dollar. The U.S. dollar index, which touched a 20-year high this month, was up 0.6% on the day at 107.132. [FRX/]

Oil prices rose further on expectations Russia's gas supply cuts could encourage a switch to crude, with Brent futures last up 1.5% at $106.68 a barrel and U.S. crude up 1.6% at $98.21 a barrel.

Benchmark 10-year Treasury yields tumbled to 2.73% from 2.87% at the end of last week. Germany's benchmark 10-year bond yield has slumped back under the psychological 1% threshold too as Europe's recession worries have intensified. [US/] [GVD/EUR]

Tuesday also marked the 10-year anniversary since then ECB President Mario Draghi pledged to do "whatever it takes" to prevent a break up of the euro zone.

© Copyright Thomson Reuters {{Year}}. All rights reserved.