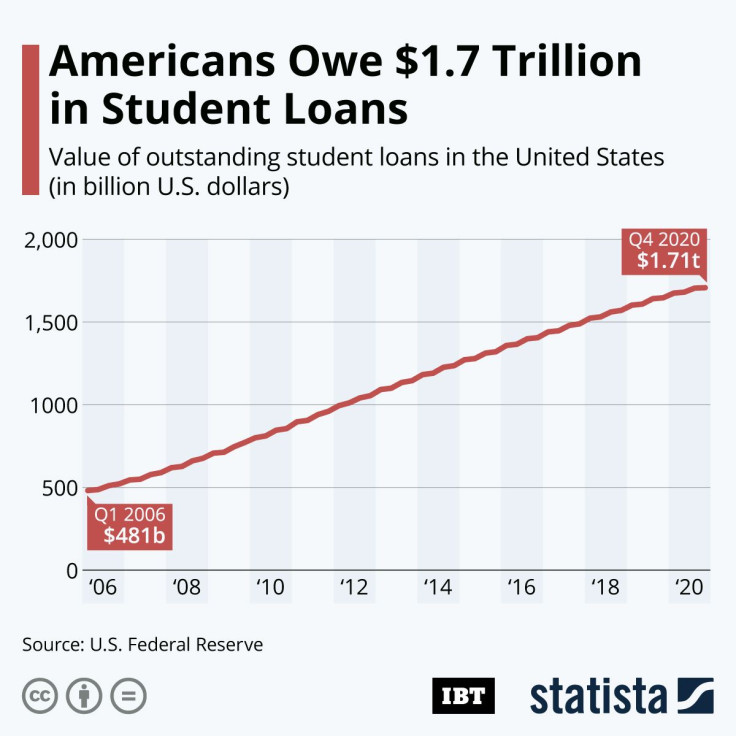

Which States' Residents Owe The Most In Student Debt? Total Amount Is Over $1.7 Trillion

Student debt in the U.S. is a trillion-dollar problem that has bedeviled policymakers and adds fuel to the concerns of young people looking to get a college education. The total student debt held by U.S. graduates is $1.73 trillion, up more than 91% from a decade ago, when it reached $906 billion.

The debt burden felt by American students is not evenly felt across the country. An analysis from August by personal finance website WalletHub found that borrowers from West Virginia owned some of the worst ratios of student debt to income. West Virginia was followed by New Hampshire, where debt holders have the highest average student totals and the highest proportion of students with student debt.

States with the lowest debt burdens were in the West: Utah, New Mexico, Nevada and California.

Appearing on CNBC, Oliver Schak, research director for The Institute for College Access and Success (TICAS), touched on how there are identifiable concentrations of states where debt burdens tend to be higher. Schak pointed to states in the Northeast like New Jersey, New Hampshire and Massachusetts, as areas where students hold more debt compared to lower-debt states. Schak noted how New Hampshire bachelor-degree graduates hold an average debt of $39,400 -- more than half the debt load of comparable degree holders in Utah, which averages $17,950 in debt.

He added that there has been a consistent trend on which states have the highest and lower debt burdens. Research from TICAS and the Federal Reserve Bank in New York showed a correlation between lower debt burdens and the level of investment in public education in a given state.

There is another surprising trend that shows why some states’ residents owe more than others. Data shows that states with students who borrow lower amounts in fact have higher debt burdens than students who take out more. While it may sound counterintuitive, it has been shown that students who borrow more have a higher likelihood of earning larger incomes that lets them handle their debt loads better. Those who borrowed smaller loans from — $5,000 to $10,000 — saw a higher chance to default on their loans, whether it be from dropping out of a college or university program early or lower job prospects.

The COVID-19 pandemic has bought time for many student borrowers. Debt service companies and the U.S. federal government have offered pauses to loan repayments when the economy was bleeding jobs throughout 2020.

President Joe Biden extended the pause on federal student loan repayments on Aug. 6 until Jan. 31, 2022, and announced plans to cancel $5.8 billion in debt for 300,000 disabled student borrowers.

Some Democratic members of Congress are pushing for the president to do more to tackle the student loan problem.

Sens. Elizabeth Warren of Massachusetts and Majority Leader Chuck Schumer of New York have already called on Biden to cancel $50,000 in student debt through executive action, a move that is reportedly under review by the Justice Department.

© Copyright IBTimes 2025. All rights reserved.