Alibaba IPO: 5 Reasons Why China’s E-Commerce Giant Is Going Public

Until this week, few Americans -- outside of tech and investment circles -- were overly familiar with Alibaba. But the Chinese company is fast becoming a household name as it prepares to launch an initial public offering that may be the largest in U.S. history.

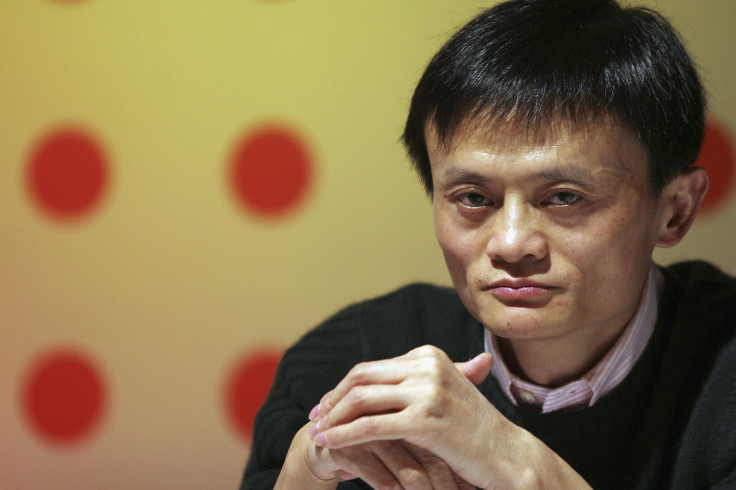

Alibaba Group Holding Ltd. was founded in 1999 by flamboyant entrepreneur Jack Ma, who last week celebrated his 50th birthday. Think of it as Amazon, eBay and PayPal rolled into one. Alibaba.com connects buyers and sellers of industrial and commercial goods and services in China. Its Taobao unit is the country’s largest online shopping portal, and its Tmall group is China’s biggest business-to-consumer platform.

In the second quarter, Alibaba posted revenue of $2.5 billion, up 46 percent from the previous year.

So why does Ma want to be answerable to a board of directors, regulators and, ultimately, shareholders by going public with an IPO slated for Friday? Alibaba’s filings with the U.S. Securities and Exchange Commission shed little light on his motivations.

“We plan to use the net proceeds from this offering for general corporate purposes,” Alibaba said in boilerplate language included in its F-1 registration document.

But clues to Ma’s goals can be gleaned from his past statements, from sources close to the company, and by looking at Alibaba’s future opportunities -- and current weaknesses.

Here are five reasons why Alibaba may be about to launch an IPO that analysts estimate could raise as much as $20 billion to $25 billion:

1. Investor payback: Alibaba paid more than $7 billion to buy back an equity stake it previously sold to Yahoo Inc., which will retain roughly 20 percent ownership after the IPO. International lenders, including Barclays, Citi and Credit Suisse, chipped in about $1 billion. Asia-centric investors -- Boyu Capital, Temasek Holdings and CIC International among them -- contributed the rest.

Sources told International Business Times that Ma promised to repay his lenders by going public within a specific timeframe. “This is payback,” said a Chinese investor with knowledge of the transactions.

2. Flip the script and acquire Yahoo: Ma has made no secret of his intention to expand Alibaba into North America, but the company has little in the way of brand awareness, infrastructure or partners in the U.S. “I think the most likely outcome that we could see just after the Alibaba IPO … is that either Alibaba or SoftBank buys Yahoo” IronFire Capital founder Eric Jackson said in a July column in Forbes.

Yahoo’s core business is worth about $11 billion, based on Alibaba’s valuation of its own stake in the Marissa Mayer-led company.

3. Fill portfolio gaps: Alibaba leads the Chinese market in a number of key categories, most notably e-commerce. But its growth potential is limited if it can't increase its presence in some crucial footholds. For example, Alibaba has a hard time converting mobile visits to its websites into sales. Its mobile monetization rate is just 1.49 percent, according to PNC Bank analyst William Stone. That’s less than half of its non-mobile monetization rate of 3.03 percent. The company recently acquired UC Web, China’s top mobile browser developer, for an undisclosed sum. But it may need to do more to become a player in mobile as well as other hot categories like the cloud and social media.

4. Gain some currency: Whether for acquisitions, expansion or to incentivize top talent, Alibaba will need to have the means to fund Ma’s far-reaching plans. Beyond cash, the ability to issue and award stock is an effective way to backstop growth. “It gives them a currency,” BlackRock Managing Director Jeffrey Rosenberg said in an interview with Bloomberg. “You can make acquisitions, you can pay people with it. That’s a big reason why companies go public. It changes your financial flexibility.”

5. Build brand awareness: Ask the average American about Alibaba and they might mention something about 40 thieves. Until this week, that is. With the IPO just hours away, public interest in the company has doubled since August, according to Google Trends. If the adage about there being no such thing as bad publicity is true, Ma’s plan to take Alibaba public may be his most savvy move to date.

--Peter S. Goodman contributed to this report from Tianjin, China.

© Copyright IBTimes 2025. All rights reserved.