American Drugmaker Akorn Weighing Bid That Would Move Taxes Overseas

U.S.-based specialty drugmaker Akorn Inc. (AKRX.O) is weighing a bid for Belgian drugmaker UCB SA’s (UCB.BR) American subsidiary, a deal that would allow Akorn to file taxes overseas instead of in the U.S. in a practice known as inversion, Reuters reported.

UCB is asking for as much as $2 billion for its Princeton, New Jersey, generics subsidiary, Kremers Urban Pharmaceuticals.

Akorn, which produces specialty over-the-counter drugs like ophthalmic medicines to treat dry eyes, is one of only a handful of businesses looking to bid, people familiar with the matter told Reuters.

Valued at $3.8 billion, Akorn is taxed at a relatively high rate for the industry at about 37 percent in 2014 compared to an average tax rate of 23 percent for all pharmaceutical companies, according to auditing firm PricewaterhouseCoopers.

If Akorn buys Kremers Urban, it would join a growing list of American companies that have acquired foreign businesses or their divisions to cut tax costs and increase access to cash overseas. Inversions are particularly popular in the healthcare industry but have been on the rise among other industries this year, renewing fresh debate in Washington.

In July, the Obama administration called for immediate action from lawmakers to prevent U.S. businesses from reincorporating overseas for lower taxes.

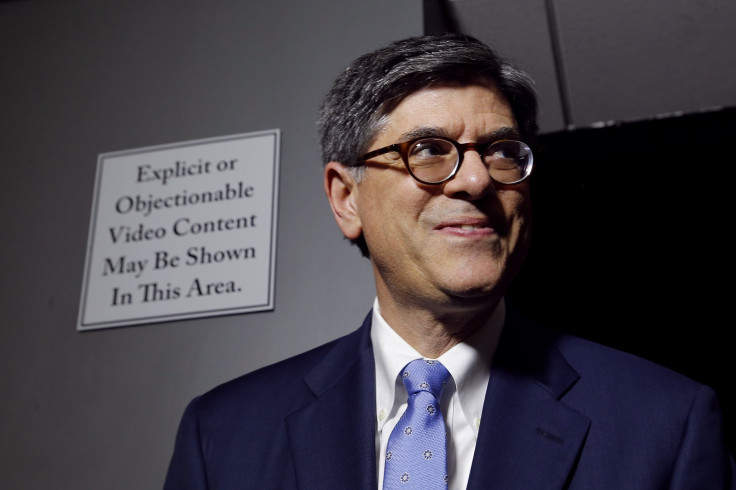

On Monday, Treasury Secretary Jack Lew called for lawmakers to slow the bleeding of U.S. businesses moving their tax-generating powers overseas. He said the Treasury Department is evaluating "what we can do to make these deals less economically appealing, and we plan to make a decision in the very near future."

© Copyright IBTimes 2024. All rights reserved.