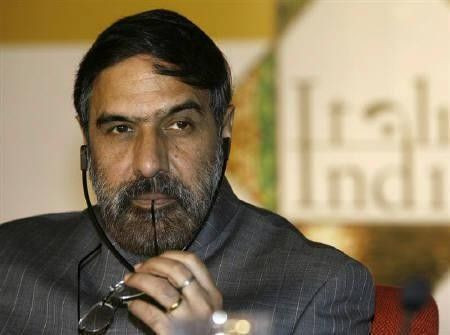

Anand Sharma signals opposition to RBI rate hike

Trade Minister Anand Sharma said on Tuesday monetary policy may not be the right tool to fight high food inflation, in a strong political signal against a rate hike in next week's Reserve Bank policy review.

In a letter written to Finance Minister Pranab Mukherjee, which was released to the media, Sharma also said a selective restriction on credit may be necessary to check inflationary pressures.

India battled double-digit inflation through most of 2010, the highest rate of any major Asian economy. Spiralling food and fuel prices have damaged voter confidence in the government and highlighted stresses in the multi-party ruling coalition.

Although Asia's third-largest economy made a faster than expected recovery from the global financial crisis, it has had to balance between growth and tightening rates to combat inflation.

The high inflation in primary articles, particularly vegetables is more on account of supply side constraints and monetary policy may not be the most suitable intervention to deal with the situation, Sharma said in the letter.

Highlighting the political challenge before the government, hundreds of opposition supporters protested against high food and fuel prices near the parliament on Tuesday.

India's headline inflation rose an annual 8.43 percent in December on higher food prices, cementing expectations of a rate increase by the central bank next week to cool prices.

Beset by the highest inflation of any major Asian economy, the Reserve Bank of India is widely expected to raise key rates by at least 25 basis points in its Jan. 25 review to squeeze inflation to its projected level of 5.5 percent by March.

© Copyright Thomson Reuters 2024. All rights reserved.