Apple Pay Set To Open For Business In The US, But Will It Take Off?

Apple Pay, the mobile wallet service with which Apple Inc. seeks to simplify and secure payments at once, opens for business today with a reported 220,000 stores accepting the option from consumers who own an iPhone 6.

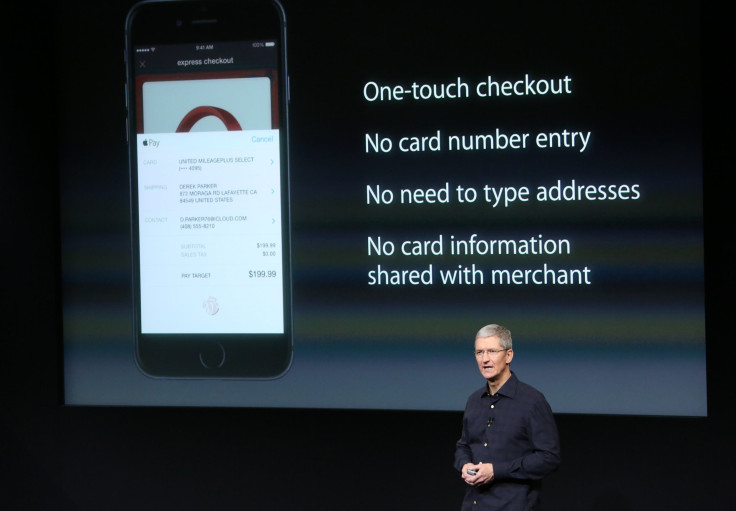

Since launching Apple Pay with America’s biggest banks and major credit card networks already on board, the Cupertino company has garnered support for Apple Pay from an additional 500 banks, according a statement last week. The simplicity comes from a one-time capture of card details or authorization on Apple’s iTunes store. Subsequently, a user need only place a finger on an iPhone's fingerprint scanner and hold the handset close to a reader at stores equipped with a radio technology called near field communication, or NFC.

“As one expects with Apple, the user interface is slick,” Duncan Brown, a cyber security expert in Britain at Pierre Audoin Consultants, said in a blog post following Apple Pay’s launch in September. “Many payment apps fail because they’re clunky – difficult to set up and use. Apple Pay simplifies set up – just take a photo of your credit card and its details are stored in the Passbook wallet.”

The security comes from not storing actual card details on the phone and further isolating a unique device account number from iOS, the operating system on the phone. It isn’t backed up to iCloud, Apple’s Internet storage service, either.

Apple Pay could “revolutionize” mobile and digital payments, Jayanth Kolla, a partner at Bangalore-based telecom consultancy Convergence Catalyst had said in an interview with International Business Times after Apple Pay’s launch.

Apple’s entry into payments using NFC could finally accelerate the adoption of this method, which has been around for years but hasn’t really taken off, said Rajashekara Maiya, head of product strategy at Finacle, the banking software unit of India’s second-largest IT services company Infosys Ltd.

Apple Pay is an indication that the future of payments rests with banks, retailers, telecommunications carriers and technology providers, Maiya had said in an interview in September.

For now, as a Wall Street Journal report on Monday pointed out, many retailers including Wal-Mart Stores Inc., America’s largest retailer, don’t support Apple Pay yet. Also, Apple Pay doesn’t support cards issued by the retailers themselves, such as those by Macy’s or Bloomingdale's, the Journal’s report said.

It also remains to be seen if Apple Pay will succeed where other NFC-based services have failed to take off. The 220,000 stores that currently support Apple Pay are a small fraction of between 7 million and 9 million retail stores in the U.S., a Time report pointed out.

There are other uncertainties too, according to Brown, including whether Apple will extend the system beyond the U.S.

While some banks “will undoubtedly be attracted to the Apple brand halo,” those with smartcard-based systems -- which banks are already under pressure to implement in place of the commonly used magnetic strip -- “will see little benefit,” he said.

That there are more handsets running on Google Inc.’s Android software than Apple’s devices could also be an impediment, Brown said in his post.

© Copyright IBTimes 2024. All rights reserved.