Apple Q1 2013 Earnings Report Disappoints: Analysts React To Falling Stock And Shares, Offer Outlook Moving Forward

Apple (Nasdaq: AAPL) may have beaten its own conservative estimates when it announced its financial earnings for the quarter ended Dec. 29, 2012, but Wall Street was not so impressed.

For the second quarter in a row, Apple fell below street expectations. In its Q1 2013 earnings report, Apple posted record quarterly revenue of $54.5 billion and a record net profit for the quarter of $13.1 billion on $13.81 per diluted share. Based on an independent consensus from 67 different analysts, Wall Street had expected $58.84 billion in revenue on $15.11 earnings per diluted share.

Regarding unit estimates, Wall Street’s consensus expected Apple to have sold roughly 50 million iPhones and 23 million iPads; in the final earnings report, however, Apple reported selling only 47.8 million iPhones and 22.9 million iPads.

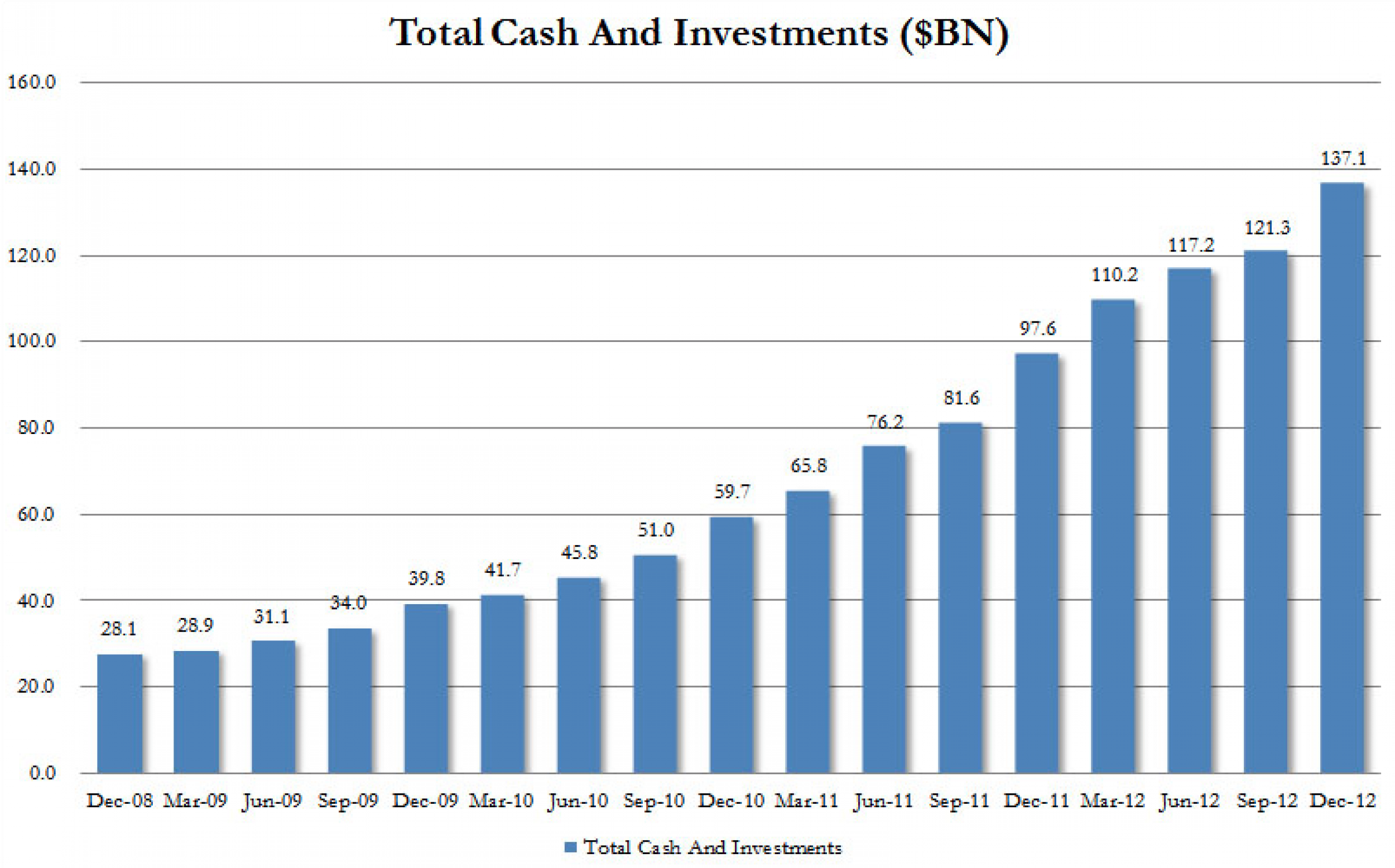

“We’re pleased to have generated over $23 billion in cash flow from operations during the quarter,” Peter Oppenheimer, Apple’s CFO, said. “We established new all-time quarterly records for iPhone and iPad sales, significantly broadened our ecosystem and generated Apple’s highest quarterly revenue ever.”

Apple had a strong outing in 2013, but while the brand is still very strong, analysts are extremely worried about the company’s stock (Nasdaq: AAPL). After reporting its record-breaking quarterly revenue on Wednesday afternoon, AAPL shares took a major tumble, dropping roughly 10 percent in after hours trading. As of Thursday afternoon, AAPL shares are listed at 450.50, dropping another two percent in after-hours trading.

Apple may have plenty of new and exciting products in its ultra-secretive pipeline for 2013, but its freefalling shares value is leaving many investors, consumers and fans in doubt. Apple needs to shore up its AAPL stock and quickly; they may benefit by listening to what some of its more prominent analysts and investors have to say. From Barclays to Goldman Sachs to JP Morgan, check out our slideshow to see what the biggest players on Wall Street had to say about Apple’s disappointing Q1 2013 earnings report.

© Copyright IBTimes 2024. All rights reserved.