Case-Shiller Price Index Falls More than Forecast For Quarter Ended September

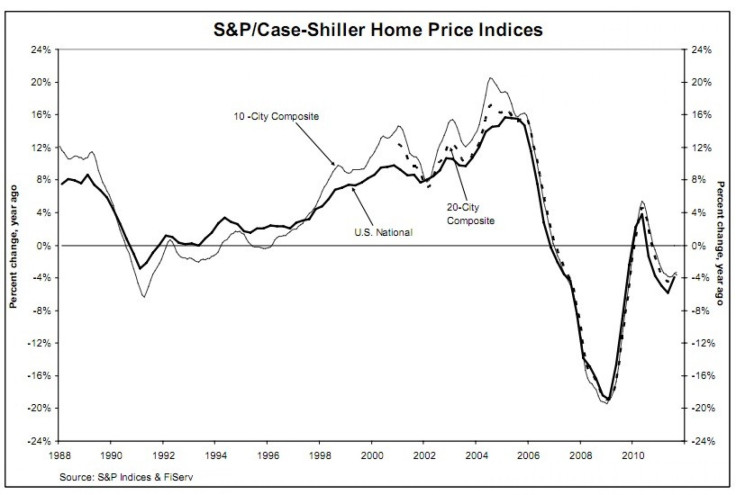

U.S. housing prices fell in the third quarter ending in September by 3.9 percent compared to the previous year, according to the Case-Shiller Home Price Index, a larger drop than forecast. Economists polled by Bloomberg had predicted an annual drop of 3 percent. Home prices are now equal to 2003 levels.

The decrease was smaller than the second quarter decline of 5.8 percent, but demonstrated continued weakness in the housing market, despite record low interest rates.

Prices were relatively flat in the third quarter ending in September compared to the second quarter, increasing by 0.1 percent nationwide. Prices fell 0.6 percent between August and September, with only New York, Washington D.C. and Portland, Ore. posting price increases.

Over the last year, home prices in most cities drifted lower. The plunging collapse of prices seen in 2007 to 2009 seems to be behind us, said David Blitzer, chairman of the Index Committee at S&P Indices, in a statement. Any chance for a sustained recovery will probably need a stronger economy,

Eighteen of the 20 major metro regions covered by the report had price declines in September compared to the previous year. Washington D.C. and Detroit were the only areas with positive price changes of 1 percent and 3.7 percent, respectively. Detroit, boosted by the recovery of the auto industry, has had three months of positive price increases.

Fourteen of 20 major metro regions had smaller declines in September compared to the previous month, but still saw prices fall. Atlanta, Las Vegas and Phoenix hit new record index lows in September.

It is a bit disturbing that we saw three cities post new crisis lows. For the prior three or four months, only Las Vegas was weakening each month, said Blitzer.

Now Atlanta and Phoenix have fallen to new lows too. On a monthly basis, Atlanta actually posted a record low rate of -5.9 percent in September over August. The markets are fairly thin, and the relative lack of closed transactions might be exacerbating the downside.

© Copyright IBTimes 2025. All rights reserved.