As Class Gap Widens, Obama Shifts Campaign Focus To Income Inequality

Most Americans are earning more than their parents and grandparents did. Yet if they are born poor, they are more and more lilkely to stay that way.

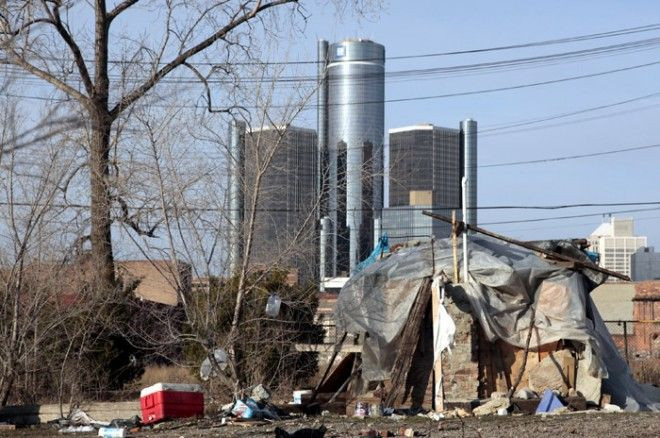

As President Barack Obama risks the allegiance of some fellow Democrats to make income inequality a focus area of his campaign against former corporate buyout king Mitt Romney, income disparities in the U.S. are widening to alarming proportions, with African-Americans and the less educated getting the worst of it.

About 84 percent of Americans earn higher family incomes than their parents did at their age, even adjusted for inflation, according to a new report from the Pew Economic Mobility Project. But 43 percent of those born into the lowest fifth of income distribution will remain there, and exceeedingly few will rise to the top. Moreover, median family wealth increased only in the top two tiers - 27 percent for families in the topmost quintile and 29 percent for the next level down.

Economists say the widening wealth and income gap will hurt the U.S. economy in addition to raising questions of social injustice.

A lot of it originates from what economists call rent-seeking. Rents are what you get not from your effort but from just ownership of something, Nobel Prize-winning economist Joseph Stiglitz, a professor at Columbia University, told CNN Money in a recent interview. Well, trying to get that rents actually can have a negative effect. America is becoming an increasingly rent-seeking society.

The U.S. is high on the list of 34 industrial countries that have morbid levels of income inequality and relative poverty - a key income inequality measure that determines income shortfalls over living costs - according to a new report by the Organization of Economic Cooperation and Development.

The U.S. economy is projected to grow at a rate of 2.6 percent in 2013, according to the OECD, which has urged Washington to address its income inequality problem by extending more educational opportunities to disadvantaged groups and levying higher taxes on top-earning Americans.

The effectiveness of the government's tax and benefit structure in reducing poverty is also being called into question.

Policy planners are going to have to make some really hard changes, like figuring out what to do about the tax cuts scheduled to expire (at the end of this year) and the spending caps put in place last August in lieu of the debt ceiling, said Josh Gordon, a policy director at Concord Coalition, a non-partisan fiscal advocacy outfit founded by the late Sen. Paul Tsongas, D-Mass.

Washington currently faces pressures to avoid a dreaded fiscal cliff -- the effects of tax increases and automatic government spending cuts on economic growth -- a looming possibility at the end of the year that is alarming investors and economists.

We do not have a fiscally sustainable budget, said Isabel Sawhill, a senior fellow of economic studies at the Brookings Institution.

Last year's Budget Control Act made it possible for Congress to raise the debt ceiling and cut expenditures on discretionary programs, by $741 billion - a move that has triggered a spate of concerns about the country's fiscal sustainability.

The OECD has recommended that the U.S. government pay more attention to the need to address issues of long-term unemployment, create sustainable jobs, raise wages and bridge the differences between workers' skills and the requirements of jobs that are available.

In the face of disappointing U.S. jobs data, where the economy added only 80,000 jobs last month, missing expected gains of 100,000, the Obama administration is now shifting the floorboards of its re-election campaign from health-care and unemployment to income inequality -- an effort that could antagonize pro-business Democrats.

Obama and Republican Mitt Romney tied at 47 percent, among registered voters, in a Washington Post / ABC News Poll released on Tuesday. Obama's push for tax increases on households in the $250,000-plus income bracket could tilt the balance in favor of a GOP takeover of the Senate and dash Democrats' hopes of regaining the House, some political analysts warn.

Meanwhile, some Democrats contend that Obama's $250,000 threshold for letting the Bush taz cuts expire is too low. They are pushing for an annual ceiling of $1 million as the bar for tax increases -- a figure that they say is truer gauge of being wealthy.

© Copyright IBTimes 2024. All rights reserved.