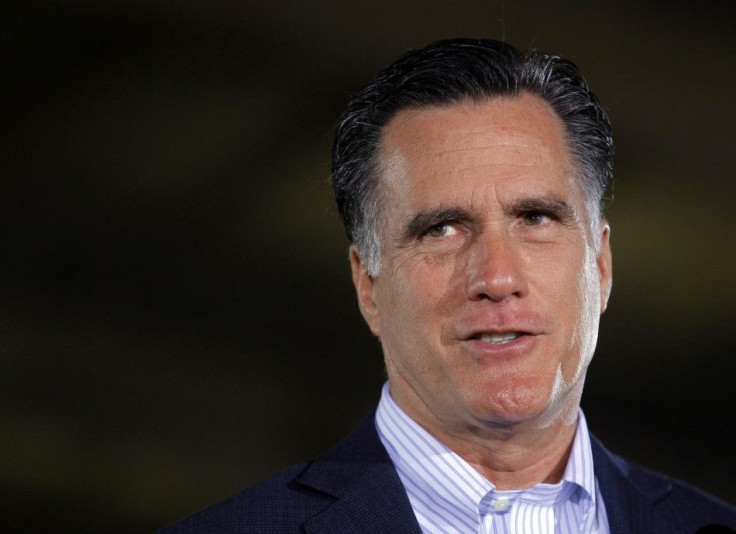

Mitt Romney's Tax Returns, In Context: How Do They Compare to Previous U.S. Presidents?

The news cycle may have changed, but Americans' curiosity about Mitt Romney's income tax returns has not been stemmed.

In fact, according to a new survey from the Pew Research Center, few Americans are interested in learning more about the Republican presidential candidate's family and upbringing or Mormon faith. Instead, 41 percent of respondents said they wanted to hear more about Romney's record as governor of Massachusetts -- Democratic, Republican and Independent voters expressed an equal amount of interest in that aspect of his background -- while 36 percent said they wanted to hear more about his tax returns, and 35 percent wanted more information about the candidate's tenure as CEO of Bain Capital.

After releasing his 2010 tax information earlier this year, in addition to an estimated 2011 filing, the Romney campaign has refused to offer more information about the former governor's personal finances. The Romneys, as Ann Romney herself stated last week, believe they have released everything "you people need to know and understand about our financial situation." But as more information has emerged regarding Romney's offshore investments and Swiss bank accounts, it appears that many voters actually don't think know enough about the sources of Romney's wealth and lifestyle.

But even without additional tax information, Romney's 2010 and 2011 information demonstrates just how much Romney's income, and effective tax rate,differ from previous U.S. presidents over the past three decades. Using data from the Tax History Project, the Sunlight Foundation created a scatterplot showing that the Republican candidate has made more money than any of those presidents -- including Barack Obama -- while simultaneously paying the lowest effective tax rates.

The highest income years highlighted above are Romney 2011 ($21.6 million) and Romney 2010 ($20.9 million), on which he paid effective tax rates of 13.9 percent and 15.4 percent - a much lower rate than most middle-class Americans.

While nobody else's income even comes close to matching Romney's, Obama came the closest, when he pulled in $5.5 million in 2009 and $4.1 million in 2007, on which he paid a tax rate of 32.6 percent and 33.7 percent respectively.

The discrepancy is rooted in the source of those incomes. Most of Romney's money in 2010 and 2011 came from investments, which are taxed at a rate of 15 percent. Meanwhile, during his highest-earning year's a majority of Obama's income came from book sales, which is considered normal business income subject to the top marginal rate of 35 percent.

Romney pulled in $12.6 million and $10.7 million in capital gains income in 2010 and 2011, far more than his closest competitor, Ronald Reagan. And even that difference is remarkably stark. Reagan only reported a capital gains income of $256,978 in 1982 -- 49 times less than than Romney's 2010 haul.

© Copyright IBTimes 2024. All rights reserved.