Asian Stocks Decline On Growth Concerns, Fading Fed Stimulus Hopes

Asian stock markets declined Friday as hopes for a strong policy action from the U.S. Federal Reserve faded and disappointing economic reports on China and the euro zone revived concerns over the faltering global economy.

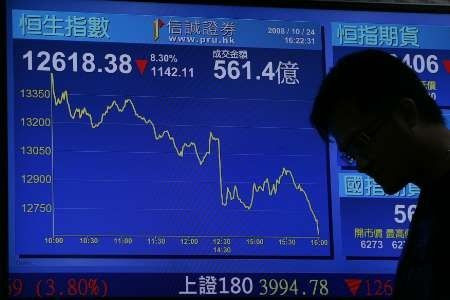

Japanese benchmark Nikkei declined 1.17 percent or 107.36 points to 9070.76, Hong Kong's Hang Seng plunged 1.25 percent or 252.21 points to 19880.03. Chinese Shanghai Composite fell 0.99 percent or 20.97 points to 2092.10 while South Korean KOSPI Composite plunged 1.17 percent and Indian benchmark BSE Sensex slipped 0.47 percent.

The hopes for another round of stimulus from the Federal Reserve to bolster the U.S. economy took a back seat after James Bullard, the president of the Federal Reserve Bank of St. Louis, observed that FOMC minutes were a bit stale as data released indicated that the economy had picked up throughout the last few weeks, hinting that additional stimulus was not required.

Market sentiment was boosted earlier on details from the Federal Reserve's most recent policy meeting, which suggested that the central bank was ready to deliver another round of stimulus fairly soon unless a substantial and sustainable strengthening of recovery occurred.

Bullard's comments poured cold water on the intensified QE3 expectations. Moreover, the disappointing Chinese flash manufacturing PMI and the lack of progress in resolving the euro zone crisis by European leaders also dampened sentiment, said a note from Credit Agricole.

Weak economic reports from the euro zone and China also weighed on the sentiment. A private sector report Thursday showed that the Chinese manufacturing activity fell in August compared to that in July and continued to shrink for the tenth straight month, signaling that further monetary measures might be needed to secure a second half rebound in the world's second largest economy. The August purchasing managers' index (PMI) for the euro zone has given further indication that the region is in recession.

Tech and exporter companies' shares led the declines in Tokyo stocks. Alps Electric Co plunged 5.23 percent and Advantest Corp fell 1.80 percent, while Sony Corp and Komatsu Ltd declined 1.18 percent and 1.52 percent, respectively.

In Hong Kong, the Poly Property Group Co Ltd plunged 2.63 percent and the Zijin Mining Group Co fell 2.59 percent, while China Unicom Hong Kong Ltd gained 0.61 percent.

The financial and resource related stocks went down across the region. Nomura Holdings Inc fell 2.79 percent and JX Holdings declined 1.73 percent in Tokyo while Bank of China Ltd fell 1.34 percent and China Petroleum & Chemical Corp plunged 2.58 percent.

© Copyright IBTimes 2025. All rights reserved.