Berkshire Hathaway Shares Shrug Off Buffett News

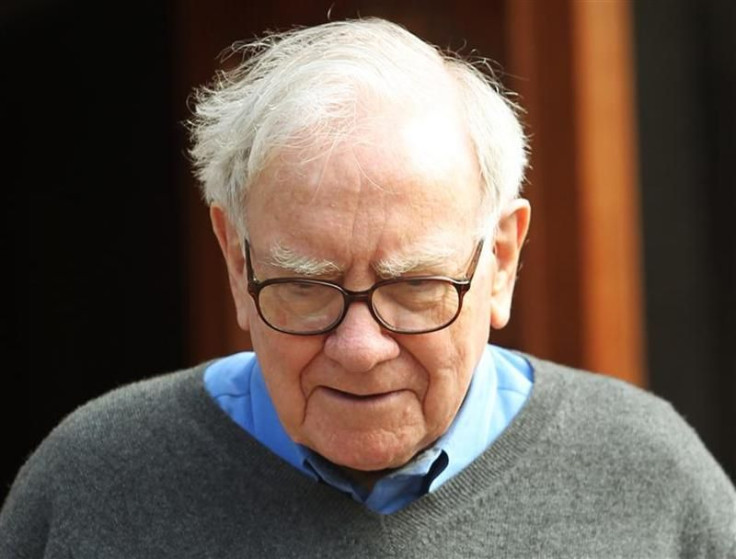

Shares of Berkshire Hathaway (NYSE: BRK/A) shrugged off news that CEO Warren E. Buffett has prostate cancer and will require treatment soon.

At Wednesday's close, Berkshire Hathaway shares fell $1,560 to $119,750, down 1.3 percent, only slightly down from their 52-week high of $125,599.

Buffett, 81, is the veteran CEO and chairman of the Omaha, Neb., holding company whose properties include Geico Insurance, the BNSF Railway, International Dairy Queen, The Buffalo Evening News and the Omaha World-Herald newspapers.

The company also holds major stakes in companies including Coca-Cola (NYSE: KO), Washington Post (NYSE:WPO) and Procter & Gamble (NYSE: PG). Last year, it became one of the biggest investors in International Business Machines Corp. (NYSE: IBM).

After the market closed Tuesday, Buffett announced he's in the early stages of cancer and will be treated soon.

Buffett has said a successor has been designated but the identity hasn't been disclosed. Speculation has surrounded several internal candidates from the insurance and investment side of the business.

Buffett's son, Howard, a farmer, has said he never wanted to be considered to succeed his father.

Berkshire's market capitalization is $198.1 billion.

© Copyright IBTimes 2025. All rights reserved.