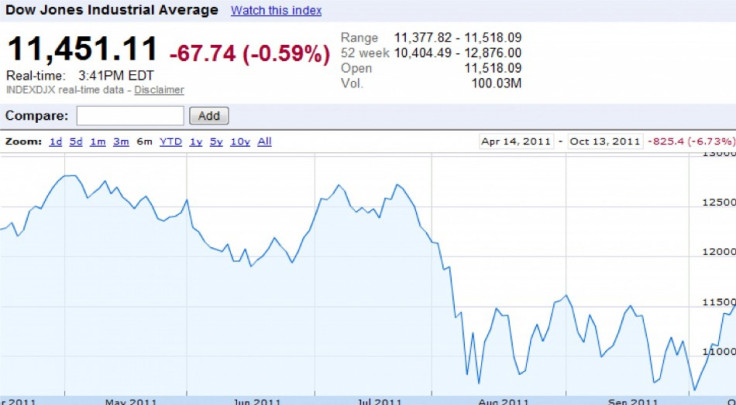

Can the Dow Break out of its Range?

Since early August, the U.S. stock market has been stuck in a range.

The Dow Jones Industrial Average has vacillated between a low of 10,655 and a high of 11,614.

On Thursday, U.S. stocks are mixed, with the Dow down 0.51 percent at 11,459.82, the S&P 500 down 0.46 percent at 1,201.66, but the Nasdaq Composite up 0.35 percent.

(Image below courtesy of Google)

U.S. stocks fell from their early May high on fears of a global economic recession and a global financial meltdown.

The fears of a global recession has subsided as U.S. economic data have helped to dispel them. Many analysts, however, think the European debt crisis – and fears of its impact on the global financial system – is not yet over.

“Until we know Europe is dealing with its problem, it’s hard for the market to move substantially to the upside,” David Kelly, chief market strategist at JPMorgan Funds, told CNBC TV.

While Europe has been focused on efforts to recapitalize its banking system, Kelly said it needs to address the root of the problem, which is weak Eurozone states.

He said Europe must find a way for countries like Greece to grow economically in order to solve their sovereign debt crises.

He expects earnings and U.S. economic data to be solid but does not believe they are enough to drive the market higher. From a long-term perspective, though, Kelly noted that U.S. stocks are trading at attractive valuations.

Before the market opened Thursday, banking giant JPMorgan Chase (NYSE:JPM) reported disappointing earnings and its shares are currently down 5.51 percent.

Google (NASDAQ:GOOG) is set to report earnings after the market closes. Its shares are currently up 1.19 percent.

© Copyright IBTimes 2025. All rights reserved.