The Cost Of Failure: Who Are The Most Overpaid CEOs On Wall Street?

As of May 31, 2013, the highest-paid CEO in banking was Lloyd Blankfein of Goldman Sachs Group Inc. (NYSE:GS), with $26 million a year. He made this sum despite seeing Goldman’s revenues drop this third-quarter by 22 percent from the second-quarter and 20 percent from a year ago, while presiding over a share price drop of 2 percent.

No one is surprised any longer by exorbitant amounts made by the top men at banks. In 1965, the average CEO made 20 times as much as his average employee, whereas today's CEOs make roughly 270 times as much, according to a study by the Economic Policy Institute, a liberal think tank.

From 1978 to 2011, the gap between executive salaries and regular pay has grown by around 876 percent, but who is really worth that sort of money?

Overview

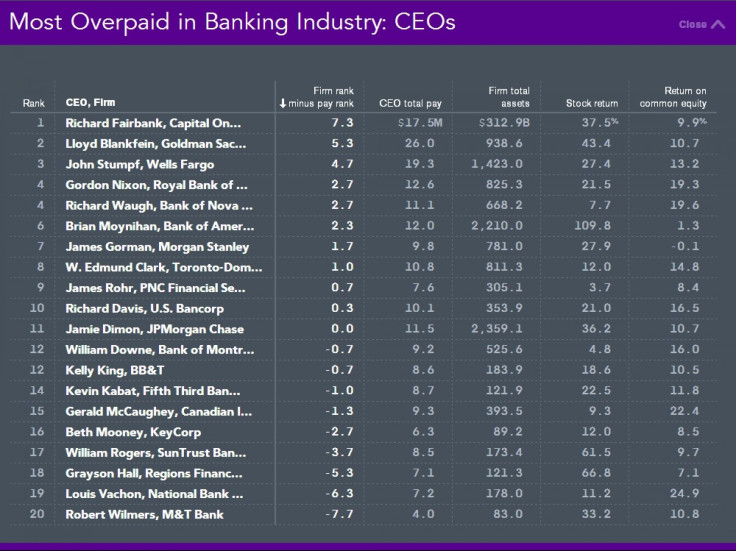

Bloomberg ranked the 20 biggest North American banks by assets on whether their CEOs were overcompensated or undercompensated.

Methodology

First, the banks were ranked on three measures to assess their results and size at the end of each one's 2012 fiscal year: stock performance, return on common equity and total assets, including cash and investments. Then the average of the share performance, return on investment and asset scores for each bank was calculated to establish an average rank. Each CEO's compensation was subtracted from his or her bank's average rank. (Total compensation includes salaries, stock awards, bonuses and long-term incentive awards given to CEOs for their performance in 2012, which is not always the same as the figures that appear in proxies' Summary Compensation Tables.) The CEOs with the biggest difference between the two rankings were regarded as the most overcompensated.

© Copyright IBTimes 2024. All rights reserved.