December US Auto Sales Preview: Nissan Seen Growing Sales 13% From Last Year; Honda, Volkswagen Could Top 20% Growth From November; Incentive Spending Leaps At Ford, Honda And Hyundai/Kia

UPDATE, Friday, Jan. 3, 2014: Click here for the live blog of U.S. auto sales for December and 2013. Click here for the final results.

For the world’s top automakers and U.S. dealers, this December brings not just holiday cheer but also cause to celebrate auto sales as 2013 closes on a high note.

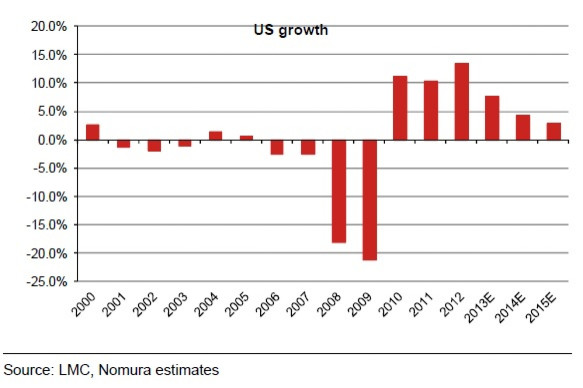

December’s seasonally adjusted annualized rate – the monthly sales tally that indicates the direction the auto market is heading – is expected to meet or slightly top 16 million units, which would make it the strongest December since 2006 when the SAAR hit 16.6 million. Auto manufacturers will present their December and yearly sales figures on Jan. 3.

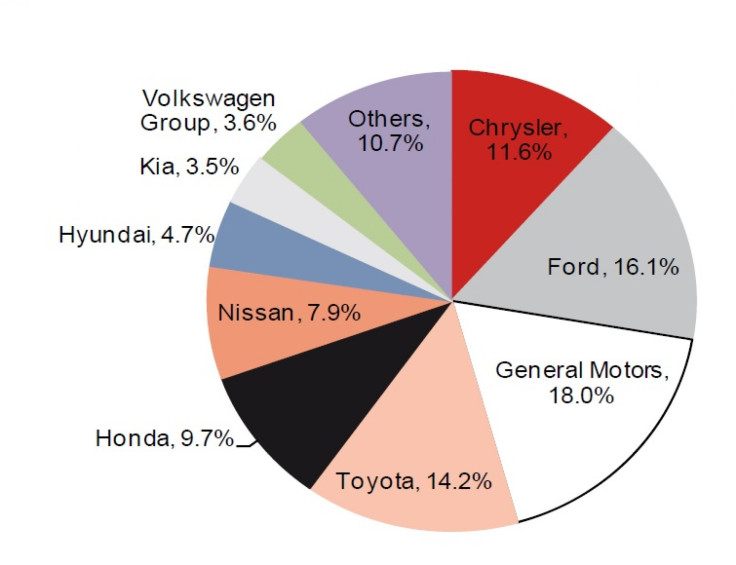

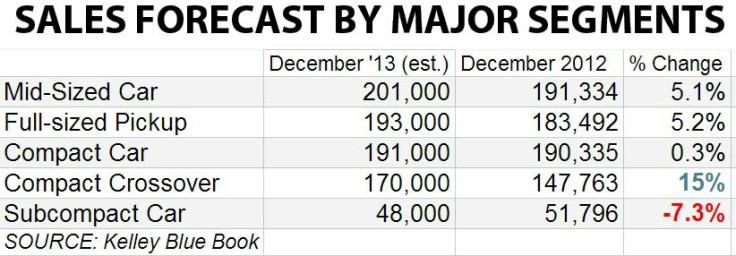

Analysts expect total U.S. new vehicle sales for 2013 to come in around 15.6 million, or 8 percent above the 14.5 million unit sales in 2012. If December’s SAAR is higher than the actual new-vehicle sales figure for the year, it means the U.S. auto market is picking up speed going into 2014. Most estimates see next year’s total new car and truck sales topping 16 million for the first time since 2007. For the month, analysts expect new vehicle sales to come in around 1.4 million vehicles, or about 5 percent more than in December 2012.

“Similar to November, sales will be heavily skewed toward the final week of the month as automakers and dealers try to beat year-end sales targets,” said Alec Gutierrez, senior analyst for Kelley Blue Book, the automotive pricing and data provider. “For consumers, this is generally the best time of year to purchase a new vehicle. Dealers are trying to clear remaining 2013 model-year stock.”

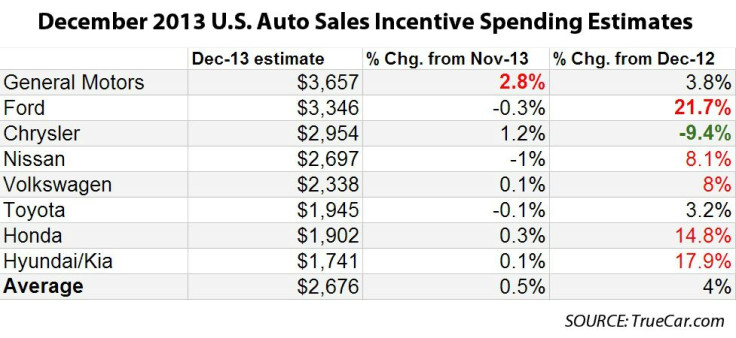

December sales of Honda’s top models – the Civic compact and Accord sedan – should benefit from an increase in incentives to claw back some market share lost in recent months. Toyota has also upped margin-eating incentives to maintain the Camry’s top spot as the best-selling passenger car in the U.S. Generally speaking, the Detroit 3 spends more on incentives than foreign automakers. Three of the top eight global auto manufacturers have increased their incentive spending by double digits compared to December 2012: Ford, Honda and Hyundai/Kia, according to esitmates from auto pricing and data provider TrueCar.com. GM topped the month-over-month increase in incentives, by 2.8 percent.

Luxury car sales have been stronger this year, too, and that should get a holiday bump to luxury carmakers, especially BMW and Mercedes Benz, which typically boost incentives to lure wealthy buyers to their brands during their seasonal car shopping.

Amid this industry rebound from the doldrums of 2008 to 2011, automakers have been boosting inventory, which has led some to wonder if there’s an oversupply of product languishing in dealer lots, especially from General Motors Co. (NYSE:GM). Ford has been scaling down production a bit, but for the most part it seems few are worried that current inventories are too high.

“There is a buildup,” said Michelle Krebs, senior analyst for the automotive pricing and information provider Edmunds.com. “We’re seeing some of the highest inventory levels in years, but we’re also expecting sales next year to be 16.4 million, and December is a huge month for sales. Considering the estimates for next year, inventory isn’t at an alarming level yet.”

December is also the month buyers and dealers come together to clear out the previous model year’s inventory. According to autotrader.com, one in four cars on dealer lots were 2013 models entering the final month of the year. Clearance specials will continue into the new year, helping pump up January 2014 sales.

“We expect December to finish strong,” said Larry Dominique, president of auto industry forecaster ALG and executive vice president of TrueCar.com. “Consumers are taking advantage of low lease rates and inexpensive financing, which continues a shift from buying used to buying new.”

--

(Note: Chevrolet Camaro photo by Shutterstock.com.)

© Copyright IBTimes 2024. All rights reserved.