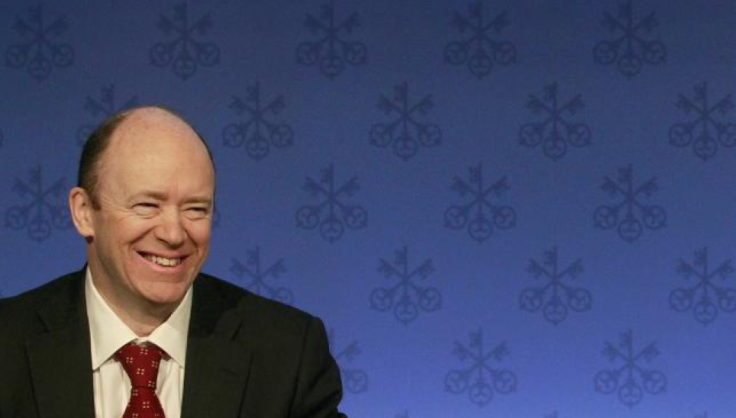

Deutsche Bank Appoints John Cryan CEO After Juergen Fitschen, Anshu Jain Resign

FRANKFURT, Germany -- Deutsche Bank AG appointed John Cryan as its new CEO Sunday after co-CEOs Juergen Fitschen and Anshu Jain resigned in the wake of criticism by investors. Cryan, 54, has been on the bank’s supervisory board since 2013 and was a former chief financial officer of the Swiss UBS AG. He will replace Jain July 1 and become the sole CEO when Fitschen steps down next year, the bank said.

Deutsche Bank has struggled to restore an image tarnished by a raft of regulatory and legal problems, which include probes into alleged manipulation of benchmark interest rates, misselling of derivatives, money laundering and tax evasion.

In a last-ditch effort to restore confidence in its leadership, the German lender presented a radical management shakeup May 21, only to face calls for Jain to resign from staff situated in its own headquarters in Frankfurt.

Some investors demanded more changes to restore confidence.

Deutsche Bank declined to comment on the resignation offers made by the co-CEOs. Jain did not respond to a message left on his phone. Paul Achleitner, chairman of the supervisory board, could not be reached for comment. Cryan was not immediately available.

Reached by phone, Marcus Schenck, Deutsche Bank’s chief financial officer, said, “I will not comment on anything.”

Jain landed the top spot at Deutsche Bank in 2012 after the investment-banking division he ran consistently delivered as much as 85 percent of group profit and frequently outperformed peers.

But tougher regulatory requirements and litigation, including a $2.5 billion fine to settle allegations that Deutsche Bank traders rigged benchmark interest rates, took the shine off a division often referred to internally as “Anshu’s army.”

Making Jain directly responsible for cutting Deutsche Bank’s costs by 4.7 billion euros ($5.2 billion), selling its Postbank retail business and paring back its investment bank put huge pressure on the former trader.

Fitschen was hired as co-CEO to maintain the bank’s German profile, but his ability to sell the group’s strategy to domestic shareholders has been impaired by his own legal problems. He is required to appear every week at a criminal court in Munich to defend himself against allegations that he misled investigators in a dispute with the heirs of the Kirch media empire.

Cryan will take power at an awkward time, after investors roundly criticized the bank’s new strategic plan as too little, too late. He will now need to review the plan and decide how to implement it or whether a different plan entirely is needed, said Chris Wheeler, bank analyst at Atlantic Equities in London.

“If Cryan or someone else takes over, what do they do with that plan? A lot of detail is still needed on it. Does the new person say they want to review it or say it’s fine,” Wheeler said. “It’s a massive job still to do. It’s one of the world’s biggest investment banks and Germany’s national champion.”

(Reporting by Thomas Atkins and Edward Taylor; Additional reporting by Steve Slater in London; editing by Philipa Fletcher)

© Copyright Thomson Reuters 2024. All rights reserved.