Emerging Markets 'Resilience Indicator' Reveals Which Countries Are Prepared For Financial Crisis

Argentina, Brazil and Chile are setting themselves up for disaster. So says an economist who has devised a way to gauge an emerging country’s ability to survive a global financial crisis.

“Conditions in the period before the eruption of an adverse external shock are central in determining the resilience of an emerging market economy to the shock,” writes Liliana Rojas-Suarez, a researcher at the Center for Global Development, in a recent paper on the subject. “In 2007, an analyst studying a few variables in emerging markets would have been able to predict, with high accuracy, the relative economic and financial resilience of these countries to the global financial crisis.”

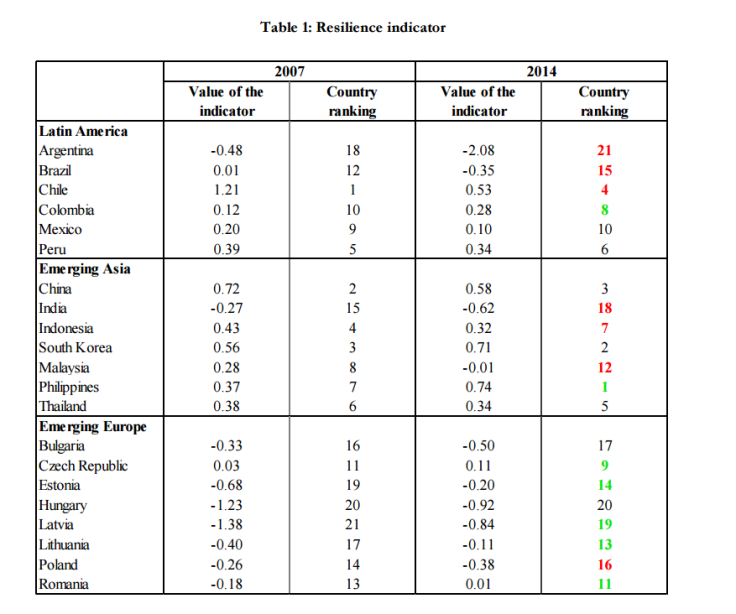

Rojas-Suarez ranks 21 countries on a “resilience indicator,” according to how each one is likely to fare in the event of a worldwide economic downturn.

In her most recent ranking, India and Malaysia have moved downward, but Argentina holds the lowest rank. The country has lost access to international capital markets, due to its debt dispute with the United States, and it continues to be fraught with domestic problems. It doesn’t help that it’s also part of a region that doesn't fare well.

“The ranking does not deliver good news for Latin America,” Rojas-Suarez wrote, noting that four of the six Latin American countries have fallen in the overall ranking, due to “some bad luck in unfavorable terms of trade, but also the squandering of opportunity to implement needed reforms in the good post-crisis years are the main reasons behind this outcome.”

On Rojas-Suarez’s diagram, countries whose rankings are marked in green are those that have improved their status since the last crisis, while red countries have gone down by two or more positions. Looking at indicators such as inflation, government debt and current account balance, Rojas-Suarez noticed that a few patterns emerged. Some countries are better prepared than others.

According to the data, emerging Europe is the most improved region, mainly because “the region displayed huge economic imbalances in the pre-crisis period that are now being corrected.”

Though the indications sound dire, the author warns that the study is not about predicting a crisis, but helping countries better prepare themselves.

“My goal in this paper has been to emphasize that the lessons from the global financial crisis should not be forgotten,” she wrote. “Time is still on the side of emerging markets.”

© Copyright IBTimes 2024. All rights reserved.