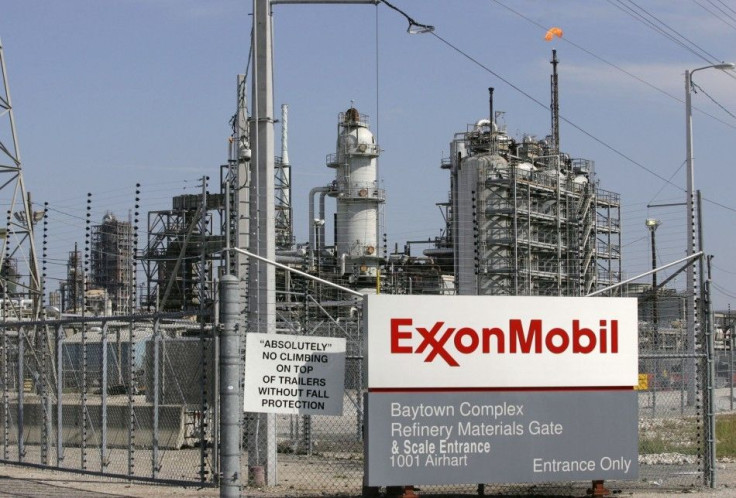

ExxonMobil's 4Q up but Misses Street View, Shares Down

ExxonMobil Corp., the world's largest integrated oil and natural gas company, Tuesday reported fourth-quarter earnings up six percent, less than analysts expected, as higher crude oil profits offset weaker refining margins.

Earnings rose to $9.4 billion, or $1.97 a share, compared with $9.25 billion, or $1.85, a year earlier, the Irving, Texas-based company said.

Analysts with Barclays Capital expected ExxonMobil to report $10 billion in net income and earnings per share of $2.15 for the fourth quarter.

Higher crude prices drove growth in the fourth quarter, as 93 percent of the company's revenue comes from its upstream operations. For much of this period crude oil sold for just under $100 per barrel.

The increase in oil prices helped offset a $725 million drop in refining earnings during the fourth quarter to $425 million.

Price increases were prompted by geopolitical tension in the Middle East and North Africa, which threatened to curtail oil shipments, and weak the U.S. dollar, the predominant global currency for oil sales.

In the fourth quarter of 2011, ExxonMobil spent $10 billion in reinvestments and exploration.

For all of last year, earnings rose by 35 percent to $41 billion compared to $30.4 billion the year before. ExxonMobil spent a record-setting $36.8 billion on exploration, up 14 percent from 2010.

ExxonMobil recorded strong results while investing at record levels to develop new supplies of energy that are critical to meeting growing world demand, and supporting economic recovery and growth, said ExxonMobil Chairman Rex Tillerson.

Shares fell in premarket trading $1.24 to $85.49.

Last week, ExxonMobil's rival, Chevron Corp., posted its biggest quarterly earnings decline in two years as total sales of refined products fell 12 percent and refining losses undercut gains from fuel sales.

© Copyright IBTimes 2024. All rights reserved.