Federal Reserve Seen Approving Further Quantitative Easing This Week As Fiscal Cliff Looms Large

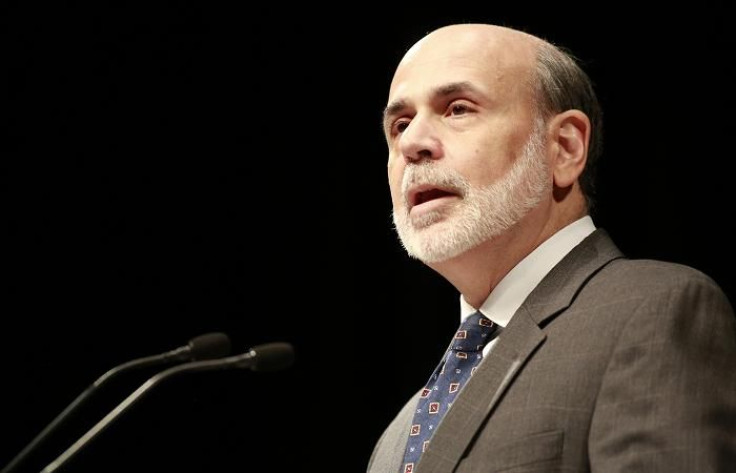

Like a child who didn’t find what he expected underneath the Christmas tree last time around, Federal Reserve Chairman Ben Bernanke has spent most of the past year loudly and explicitly making sure anyone willing to hear would know what the one thing he wanted this December was.

“Under current law, on Jan. 1, 2013, there's going to be a massive fiscal cliff of large spending cuts and tax increases,” Bernanke said in his testimony to the U.S. House of Representatives last February, in his first of many agitations on that topic, adding he hopes “that Congress will look at that and figure out ways to achieve the same long-run fiscal improvement without having it all happen at one date.”

Flash-forward 11 months, and it appears that, even though Hannukah, Christmas, Kwaanza and Festivus are all around the corner, Bernanke is about to get nothing more than another ugly sweater from U.S. political leaders.

What’s more, when Bernanke releases a statement Wednesday at the conclusion of the Fed rate-setting committee’s monthly meeting, the markets are expecting the bearded economist to play Santa, announcing further monetary easing that will likely result in a year-end rally in risky assets.

“The FOMC [Federal Open Market Committee] appears set to replace the expiring Twist program with another round of Treasury purchases when they conclude their meeting next Wednesday. We expect the FOMC to announce a $40 billion to $45 billion per month Treasury purchase program targeted on longer-dated Treasuries, expanding their total purchases (including MBS) to $85 billion per month,” Maury Harris, an economist with Swiss bank UBS, said in a note to clients, echoing the view most on the Street were expressing. “The ultimate size of the program will depend on whether the Fed believes market liquidity is currently impaired and whether they view Twist as having been a successful program.”

Even those that presupposed the announcement of further quantitative easing “would surprise the markets” were discussing the future round of bond-buying as a given; they were mostly discussing how much the Fed would buy and how the purchases would be distributed.

“The Fed can potentially move on two fronts at the FOMC: communications and QE purchases. We think the former unlikely; the latter very likely,” wrote Joseph LaVorgna, an economist at Deutsche Bank, in a weekly note to clients.

LaVorgna’s team noted the most likely scenario is one in which the Fed keeps purchasing the $45 billion per month in long-dated securities it has been snapping up under Operation Twist but stop selling an equivalent amount of shorter-term securities to finance those purchases, instead simply printing the money it needed.

Various analysts have pointed out that instead of continuing to buy long-term U.S. Treasuries, the Fed could direct at least some of its cash toward buying mortgage-backed securities, in an attempt to further solidify the housing finance market. In spite of the fact that their intervention has mostly served to pad loan originator’s bottom lines recently, various Fed officials have recently praised the particularly stimulative effect they believe buying these kinds of bonds has on the economy.

Not that it’s a given that the Fed will announce more easing. The meeting of the Federal Reserve bank heads and associated central bankers is the first since the U.S. presidential election and occurs as economic data distorted by the effects of superstorm Sandy is just coming out. A highly difficult to decipher unemployment reading last Friday could be used by those for and against looser monetary policy to argue opposing points. The Fed has erred on the side of caution and is waiting to see how its actions have worked in the past, so holding steady for a few months might be an option.

Beyond discussing if further quantitative easing is necessary, how much to buy and how to distribute the purchases, the Federal Reserve meeting is seen as likely continuing the ongoing discussion officials have had in recent months as to how to communicate their monetary goals more efficiently. Since August, officials at the U.S. central bank (and at peer institutions around the world) have been grappling with the idea that using alternative measures of economic goals and specific numerical targets might be useful in promoting their ends.

“This is all about signaling,” Kathy A. Jones, fixed-income strategist for the Schwab Center for Financial Research, explained recently to the New York Times.

There are also rumblings, from both policymakers that support further easing and those that oppose it, that the Fed will have to begin seriously discussing an “exit plan” -- that is, what to do with the Federal Reserve’s massive cache of bonds once further easing is no longer necessary.

This likely brings the Fed to a point it never wanted to be in the first place: having to make up yet more unconventional policy on the fly to address the failure of Washington in providing a solution to the economy-killing fiscal Doomsday device the last U.S. Congress came up with last year.

“If the fiscal cliff isn’t addressed,” Bernanke said at a news conference in September, “I don’t think our tools are strong enough to offset the effects of a major fiscal shock, so we’d have to think about what to do in that contingency.”

But in spite of such pronouncements, the Fed is unlikely to ignore the $100 billion gorilla in the room, especially depending on how wacky things get in Washington.

A recent proposal that was being floated around policy circles last week, for example, suggested President Barack Obama’s administration could do an end run on Congress and keep government spending at his preferred levels by authorizing the Treasury Secretary to mint $2 trillion in platinum coins. Such an action, while highly unlikely, could be the "kaboom moment" some of the more outspoken hedge fund managers in the U.S. are predicting will happen in the near future, where political intervention and the increase in risk assumptions creates an existential crisis for central banks and threatens the credibility the entire economic system relies on.

With that as a possibility, the Fed is likely to use its statement after this week’s meeting to ask Washington again for something, anything, even a hunk of coal.

© Copyright IBTimes 2024. All rights reserved.