Fed’s QE2 is a gamble, can lead to asset bubble: Top Indian official

The US Federal Reserve' s quantitative easing can lead to asset bubbles as the money goes in search of equity, property and other such assets in a low-interest rate scenario, said Kaushik Basu,chief economic advisor to India's finance minister, in an interview to Indian financial daily Mint.

The plus side of QE2 is the impact on long-term employment. The main problem in the US is not high unemployment, but the alarming rise in the proportion of the unemployed that has been unemployed for a long time.

When this happens, there is de-skilling of labour that begins to occur, and this can have an impact on the long-run productivity of workers and do serious damage to long-term growth prospects. So the US Fed is making a move to create greater demand in the economy that will presumably quickly re-employ the unemployed. This is what the US is gambled on but there is no getting away-it is a gamble, Basu was quoted as saying in the interview published on Monday.

Basu said the world is increasingly becoming a single economy and the impact of anything like QE is going to be different from what it would have been in the old world order when economies were not integrated as they are now.

The quantitative easing by the US taking place right now would, in the older global economic structure, generate greater demand for goods in the US, create new jobs and create upward inflationary pressures in the economy. What's happening with American quantitative easing now is that it is not creating enough demand increases and new jobs in the US economy because a part of the easy money is leaking out to other nations. In today's world, one country's creation of money-especially if that is a convertible one like the dollar-leaks out into other economies, something that would not have been happening earlier.

So the US quantitative easing can cause inflationary pressures in China, Argentina, Turkey and India, Basu added.

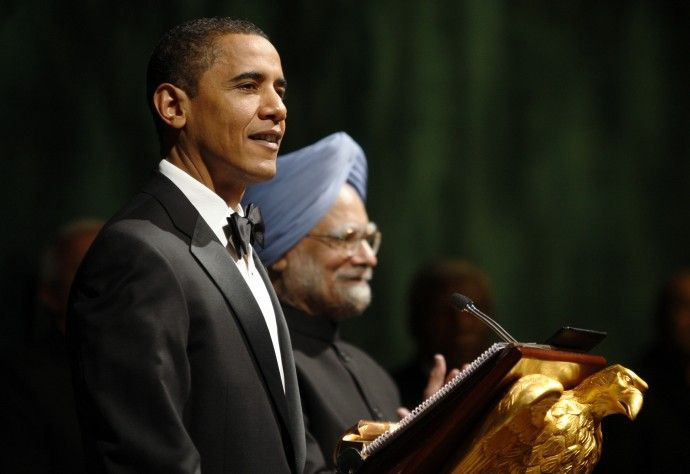

The timing of such comments by a key official representing Asia's third largest economy is important as the world is waiting for the results of the G-20 Summit to be held in the coming days, which is expected to discuss global trade imbalances, concerns over a currency war and the like.

© Copyright IBTimes 2025. All rights reserved.