Gold Demand Soars on Inflation and Deflation Fears

Worldwide sales of gold last year soared 29 percent to a record high as two groups of investors, each with mutually exclusive views of economic and financial threats, flocked to the yellow metal and related assets.

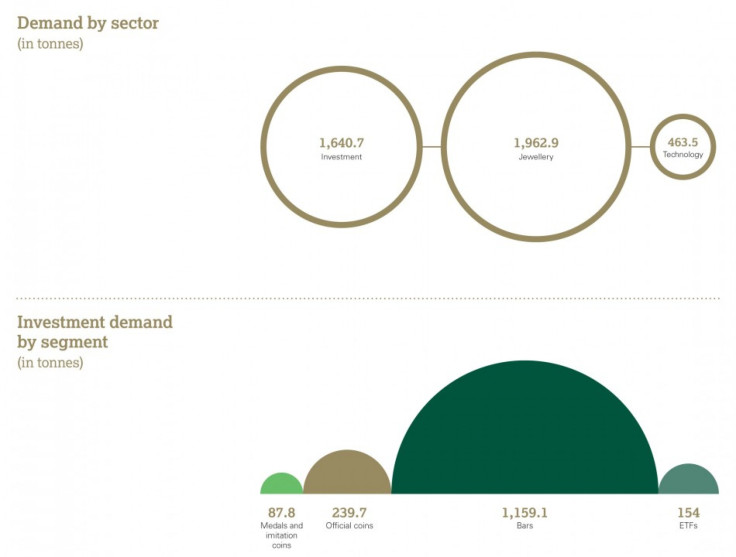

The World Gold Council said Thursday in a widely followed report that global gold sales climbed to $205.5 billion, the first time worldwide demand has exceeded $200 billion. The volume of gold demanded last year rose to 4,067.1 metric tons, the greatest volume since 1997, according to the WGC's 2011 Global Demand Trends.

Marcus Grubb, managing director-investment for the WGC, said investment demand last year came from buyers concerned primarily about inflation and buyers concerned primarily about deflation.

In Europe (gold) is being bought out of fear of deflation, recession, Grubb said. In India and China, however, their fears are the other way around, a fear of inflation. There's no fear of deflation there yet.

He said the perfect position for gold is more of the same. It's a Goldilocks argument, not too hot and not too cold.

The one thing both kinds of buyers -- those worried about inflation and those worried about deflation -- have in common is their contribution to gold demand as investors, rather than as buyers of jewelry, for example. The WGC report said global investment demand contributed 1,640.7 metric tons to last year's overall gold demand of 4,067.1 metric tons.

The pre-eminent markets for investment demand in 2011 were India, China and Europe, the report said.

Indian demand last year was 933 metric tons; Chinese demand rose 20 percent to 769.8 metric tons. Together the two countries accounted for 55 percent of global jewelry demand and 49 percent of global demand.

Germany and Switzerland were the main drivers of demand growth in Europe, which posted its seventh consecutive annual gain to 374.8 metric tons of gold.

What we can see from these 2011 figures is that there were two main factors driving the results: Asian growth and optimism on the one hand and western desire to protect assets against uncertainty on the other, Grubb said in a statement.

Looking particularly at Asia, there was a major boost to the overall figures from the increase in Chinese demand, which is a trend that we see continuing over the next year. It is likely that China will emerge as the largest gold market in the world for the first time in 2012. What is certain is that the long-term fundamentals for gold remain strong, with a diverse and growing demand base, coupled with constrained supply side activity.

The most actively traded gold contract on the Comex was around $1,725 in afternoon trading.

© Copyright IBTimes 2024. All rights reserved.