Gold’s Journey West To East Via Switzerland

This story was updated on September 10, 2013, at 8:15am.

A recurring theme in gold markets this year has been gold’s massive geographical shift from West to East, as gold flows out from investment funds in North American and Europe into the hands of Asian buyers of physical gold.

But in a research note Wednesday, UBS analyst Joni Teves notes the importance of an interesting intermediate stop along the route from London to Hong Kong and China: Switzerland.

“Aggressive investor liquidation in the West appears to have comfortably filled the physical demand gap: As investor gold positions were cut back, the stocks that were released made their way to Swiss refiners, to be refined or re-melted into products that meet the specifications of buyers in Asia,” wrote Teves.

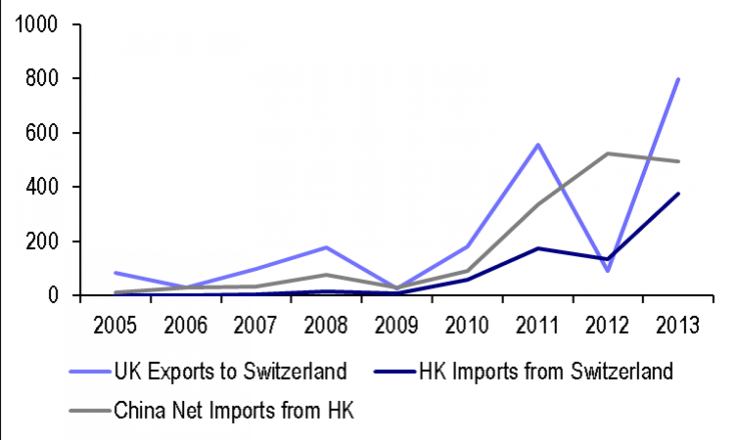

Teves argues that data point to a strong correlation between gold flows from the UK to Switzerland and spikes in physical gold demand. The suggestion is that gold flows to Switzerland to meet physical demand elsewhere in the world -- or at least, that has happened this year.

“Spikes in volumes occurred in 2008, 2011 and 2013 YTD [year to date], corresponding with instances when the gold price dropped sharply and physical buyers stepped in to scoop up cheaper metal,” she said in her note.

Poor gold-scrap supply, down 21 percent in the second quarter, may have contributed to the easterly flow of gold as Asian buyers needed a source other than recycled scrap.

In fact, the flow of gold from London to Switzerland, at 798 metric tons in the first half of 2013, is apparently the highest on record since 1988 and is already 44 percent higher than the full year movement in 2011.

There were also strong links between Hong Kong imports of Swiss gold and China’s imports of gold from Hong Kong.

Switzerland is a global hub for gold refining, with more than two-thirds of global gold transiting through the country, according to a top Swiss news broadcaster.

Edmund Moy, chief gold strategist with Morgan Gold, told IBTimes that Swiss refineries have the best reputation worldwide for purity in refining, partly because there's a unique law there which requires all refineries to have on-site government inspectors responsible for purity controls.

Swiss refineries are also flexible in the gold products they output, he wrote in an email.

"Swiss refineries now produce custom products, so for example, a 400oz bar can be re-refined and made into a bar or smaller bars with the Shanghai Gold Exchange stamp," wrote Moy, who also noted a traditionally close relationship between the London Bullion Market Association, a key bullion exchange, and Swiss refineries.

Meanwhile, Chinese gold producers have made record acquisitions this year as they grow their production portfolios, just as their more-bloated global gold producing rivals cut back on capital costs, reports Bloomberg.

There’s also ample room for expansion of a Chinese gold consumer market, as per capita gold holdings in China are about 5 grams, compared to a 20-gram average in developed nations.

That contrasts with skyrocketing physical demand in China, which could beat India this year as the world’s largest consumer of gold.

© Copyright IBTimes 2025. All rights reserved.