India's 4G Smartphone Sales Soar In July-September Period, Samsung Retains Market Lead

Smartphone sales in India soared during the July-September period, rising 20 percent over the same quarter last year, as India approached its festive season, Counterpoint Technology Market Research said in a release Tuesday. Samsung, which retained its lead in the Indian smartphone market, led the 4G segment too, helped by its J series mid-tier smartphones.

Sales also reversed the sluggishness of the previous two quarters to increase 12 percent from the April-June period, according to the Hong Kong-based market research company. More than one in three mobile phones shipped in India is now a smartphone.

The "Indian smartphone market is being fueled by two device trends, one is LTE (long-term evolution) and other being phablet" size, Tarun Pathak, a senior analyst at Counterpoint Research said in the release. LTE refers to the high-speed 4G wireless technology, and Phablet typically refers to smartphones with screen size of 5 inches or more.

4G smartphone sales more than doubled to 10 million units during the three-month period over the previous quarter, and rose almost 2400 percent over the year-ago period. Additionally, one in three smartphones sold during the quarter was a 4G phone and one in two smartphones sold was a phablet, the researcher said.

"We are seeing significant proliferation of LTE and larger display smartphones in sub-$100 price band as these features reach mass market level" in India, he said.

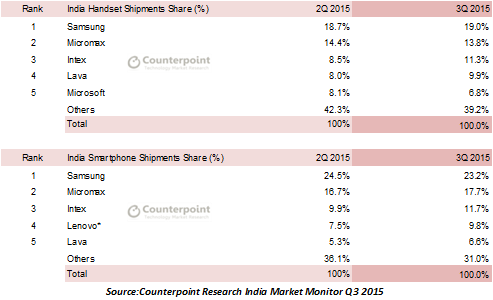

Samsung continued to lead the smartphone segment during the quarter with a market share 23.2 percent. Samsung benefitted from expanding its critical mid-tier portfolio with the launch of its J series 4G smartphones during the quarter, which drove volumes for the vendor, Counterpoint said.

However, in the sub $100 segment -- the fastest-growing in the Indian smartphone market -- Samsung lost share from the previous quarter to Indian and Chinese competitors. At the more premium level, Samsung’s A series that are slim all-metal body phones with strong specs and good batteries, exemplified by the A7 and A8 phablets, helped the company at a time when the top-end Galaxy S6 sold fewer models than originally anticipated.

The A series' design language is also trickling down to the new J series, helping Samsung strengthen its position in that segment. The company's strong offline distribution has also helped Samsung drive J series shipments during the quarter, Counerpoint said.

China's Xiaomi faced strong competition from India's Micromax Informatics, which maintained its second position in the smartphone segment. Micromax, which had a 17.7 percent share of India's smartphone market at the end of the July - Sept. quarter, sold more of its "Yu" brand smartphones than all of Xiaomi's phones put together, in online sales, Counterpoint said.

The Yu phones run on a verion of the Android software called Cyanogen Mod, built by a U.S. startup of the same name, Cyanogen Inc. During the quarter, Micromax launched its cheapest Yu 4G model, Yunique, and the brand has been growing steadily, according to Counterpoint.

© Copyright IBTimes 2024. All rights reserved.