Inflation Debate Rages in UK, while lone hawk retires in US

The inflation debate is raging in the UK among policy makers. Meanwhile, the only inflation hawk (in 2010) and dissenting voter on the Federal Open Market Committee (FOMC), Thomas Hoenig, is no longer a voting member this year.

In the latest policy rate meeting of the Bank of England (BOE), the opinion divide was quite evident. The nine voting members actually managed to come up with four different course of actions. Below is the breakdown.

Keep rates at 0.5 percent, expand asset purchases (i.e. provide even more liquidity)

Adam Posen

Keep rates at 0.5 percent, without expansion of asset purchases

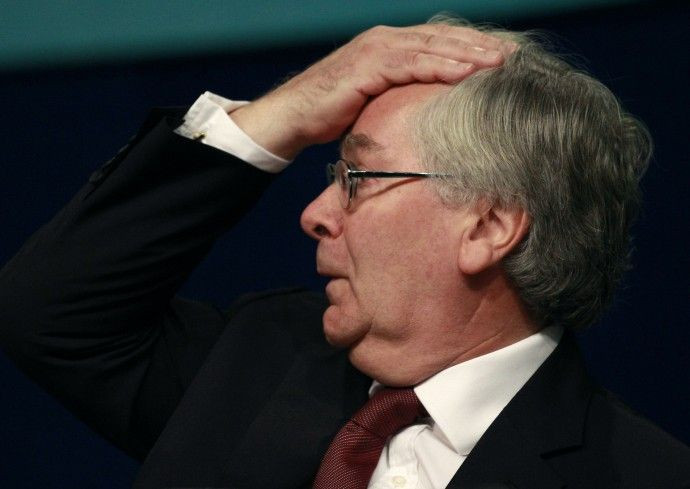

Mervyn King

Paul Fisher

David Miles

Charles Bean

Paul Tucker

Raise rates by 0.25 percentage point

Spencer Dale

Martin Weale

Raise rates by 0.50 percent point

Andrew Sentance

Momentum seems to be shifting to the hawks. Sentance upped his view from a 0.25 percentage point hike to a 0.50 percentage point hike. Meanwhile, Dale switched from keeping rates at 0.5 percent to raising it by 0.25 percentage point.

The hawks do have a valid concern: inflation in the UK has been accelerating, hitting an annual rate of 4 percent in January 2011, or twice the BOE’s target of 2 percent.

Inflation doves attributed inflation to the (temporary, they argue) factors of the increase in the valued added tax (VAT) rate, weak pound sterling, and rising commodities prices.

Nevertheless, the fact that inflation pressures are building cannot be disputed. Moreover, as evidenced by the latest vote, the Monetary Policy Committee (MPC), as a whole, has turned more hawkish.

Meanwhile, the Federal Reserve has continued on with its program of quantitative easing (expanding liquidity). All the voting members of the FOMC agreed with the decision, except for the lone dissenting voice of Kansas Fed Chief Thomas Hoenig.

Hoenig objected to quantitative easing and the statement that the Fed will keep rates low “for an extended period.”

In 2011, Hoenig has been rotated out of the voting circle. Furthermore, he is expected to retire later this year.

With Hoenig gone, and the fact that US inflation is lower than that of the UK and Europe, the US may become the last major economy to raise interest rates.

However, the currencies market, which usually pushes up the currencies of countries that are expected to raise rates sooner, has not behaved as expected.

Since the beginning of February, the pound sterling is almost unchanged against the US dollar. On the day the voting breakdown of the MPC was released, the pound sterling briefly surged higher as some traders bet on the growing hawkishness of the Committee.

However, that rally was short-lived and the pound sterling began to decline and eventually gave back its earlier gains against the dollar.

Email Hao Li at hao.li@ibtimes.com

Click here to follow the IBTIMES Global Markets page on Facebook

Click here to read recent articles by Hao Li

© Copyright IBTimes 2025. All rights reserved.