Inflation - Retail Friend or Foe?

Robert W. Baird forecasts inflation to upswing during the course of 2011, while inflation overall is expected to remain rather benign by historical standards. The brokerage said food and gasoline are among the items poised to see upward price pressure this year.

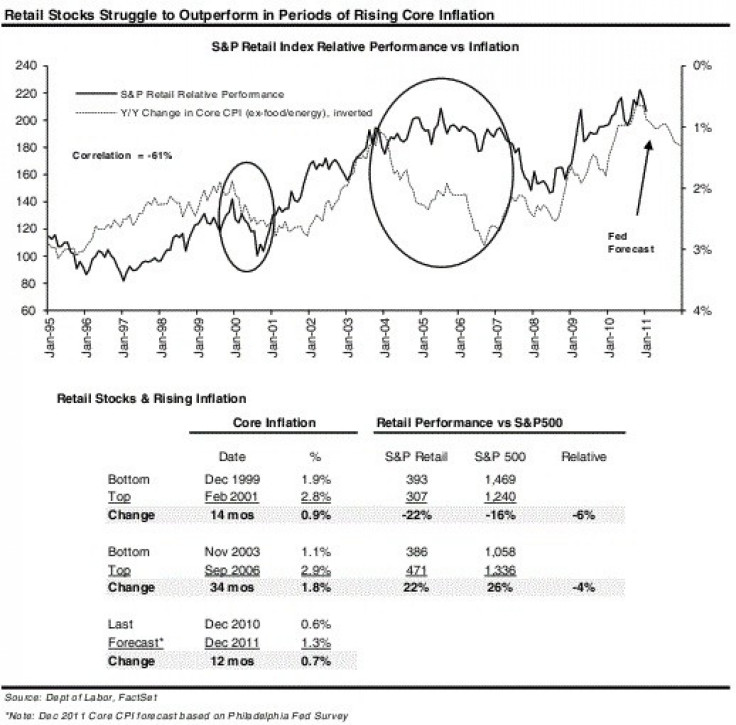

With many forecasters projecting an uptick in inflationary pressures during 2011, we thought it would be useful to look at how retail stocks have performed during past periods of rising inflation, said Peter Benedict, an analyst at Robert W. Baird.

Benedict said retail stocks have generally struggled to outperform the market during inflationary periods. While higher prices can help support comps, cost pressures can weigh on margins, and an overall uptick in prices effectively serves as a tax on consumers' ability to spend.

As the last two core inflation cycles demonstrate, rising inflation doesn't preclude retail stocks from going up -- it just tends to work against outperformance.

With retail having outperformed the S&P 500 since the March 2009 market bottom and the latest Philadelphia Fed Survey forecast pointing to an uptick in inflation during 2011, prospects for continued sector outperformance appear somewhat limited.

Benedict said inflation does not impact all retailers equally. As a result, Benedict recommends investors keep retail exposure to those companies best positioned to successfully pass through these higher input costs and thus show a benefit to comps without materially damaging profit margins.

Among the companies best equipped to deal with this inflation dynamic, in our view, are the clubs Costco Wholesale Corp. (COST): about 56 percent of sales food/sundries, higher income customer profile; BJ's Wholesale Club Inc. (BJ): about 65 percent of sales food, said Benedict.

Benedict said Wal-Mart Stores Inc. (WMT), with 51 percent grocery, is also well positioned, though their relatively high exposure to lower income consumers may make full pass-through tougher to achieve.

Finally, inflation in pet/animal feed would likely prove incremental to comps at PetSmart, Inc. (PETM) and Tractor Supply Co. (TSCO) as well.

Which Retailers Can Accelerate Comps in 2011?

Benedict said the recent rebound in consumer spending has brought a number of retailers back close to (or even above) prior peak sales productivity levels. While inflation will likely prove additive to comps for some retailers in the coming year, increasingly difficult comparisons suggest many companies will be hard-pressed to show an acceleration in comp momentum in 2011.

While comp momentum alone is not necessarily a reason to own or not own a retail stock, Benedict believes the table below provides a useful snapshot for investors looking to assess relative top-line/comp momentum opportunities across the sector.

Benedict sees the best opportunities for improved comp momentum at companies leveraged to food inflation (Wal-Mart, Costco, BJ's Wholesale) and those with identifiable comp driving initiatives in place -- Target Corp. (TGT).

While comps may not accelerate much at The Home Depot, Inc. (HD) and Lowe's Companies Inc. (LOW), Benedict views those two as being in the early stage of a multi-year cycle of recovering comps, and one which he believes investors should have exposure to.

Which Retailers Can Drive Margins Meaningfully Higher in 2011?

Along with the recovery in sales productivity, retail margin profiles have snapped back as companies took steps to right-size their cost structures. As a result, some of the 'low hanging fruit' in terms of recoverable margin potential has been exploited at a number of retailers, Robert W. Baird said in a note to clients.

Of course, just because a company is operating below / at historical peak levels that doesn’t alone make it an attractive / unattractive investment idea. In addition, Benedict believes all of his covered companies are poised to expand margins in 2011.

However, Benedict believes the charts below help frame the discussion around which retailers still have significant runway ahead on the margin front, and which ones are expected to drive the most material improvement.

Among Benedict's covered companies, names like Costco, Williams-Sonoma Inc. (WSM), Dick's Sporting Goods Inc. (DKS), and Vitamin Shoppe, Inc. (VSI) appear particularly well positioned to expand operating margins during 2011, while Home Depot and Lowe's remain in the early stages of what he believes will be an attractive multi-year cycle of margin improvement for those companies.

© Copyright IBTimes 2024. All rights reserved.