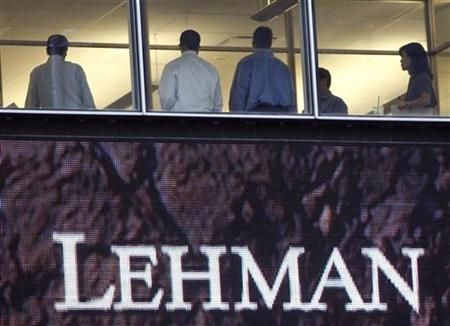

Lehman Brothers Comes Back From the Dead

MARKET COMMENTARY: Bankrupt Broker-Dealer's Trustees Set to Announce New Board and Pursue Deals, All to Zip Up Bankruptcy

A slain giant, whose unexpected demise once made people the world over gasp in shock and awe, comes back to life. The Goliath, dead for three years now, seeks passage from the great beyond back to the world of the living to take care of unfinished business. It seeks to do battle with a titan: an alchemist whose own affinity for the world of the dead and dying has earned him the nickname "Grave Dancer."

It might sound like a passage from Greek mythology, the beginning of a Brothers Grimm tale, or perhaps the background to a 1990s slasher film. That storyline, however, more or less accurately describes the current state of Lehman Brothers, the bankrupt broker-dealer whose collapse in 2008 is commonly understood to be the beginning of the ensuing financial crisis and a harbinger of the "Great Recession" to come.

Over the past few days, Lehman Brothers Holding (Over-the-counter:LEHMQ) has taken part in several actions one might not expect from what is arguably the most notorious bankrupt company of the last decade. It is looking to name a new board of directors and is engaging in a bidding war for another company.

The board of directors news was reported unofficially Monday by the Wall Street Journal, citing “people familiar with the matter” in saying the new Lehman board will be made up of seven people, mostly experts in restructuring. According to the Journal, those interviewed for the seats include Sean Mahoney, a current director of once-bankrupt auto parts maker Delphi Automotive, and John J. Ray III, a former chairman of the other most notoriously bankrupt company of the last ten years, Enron.

The bidding war news was less exclusively-guarded. Reported on Sunday by the Financial Times and confirmed since then by other media outlets, the offer by Lehman involves matching a $1.3 billion offer for residential real-estate developer Archstone, of which Lehman already owns a substantial stake. Entering such a deal would put Lehman in direct competition with Sam ‘Grave Dancer’ Zell, a private equity manager and one of the richest men in America, who made his fortune buying distressed real estate companies and turning their rubbish assets into gold.

All the action does not mean Lehman will actually be sprouting back into a functional investment bank any time in the future. The bank, whose bankruptcy proposal was approved by over 98% of creditors on November 29, and is expected to make more announcements as to the finalization of its bankruptcy proceedings Tuesday, is actually getting ever closer to dissolution. The actions are just a way to ensure its current directive -- to make good on its outstanding debts as well as it can -- is met.

But it is not likely to be the last thing heard on the Street about Lehman. Among other things, Lehman’s caretakers are currently pursuing several lawsuits against JPMorgan Chase for what they claim were actions that accelerated the bankruptcy.

Like Kurt and Elvis, it seems, Lehman lives.

© Copyright IBTimes 2025. All rights reserved.