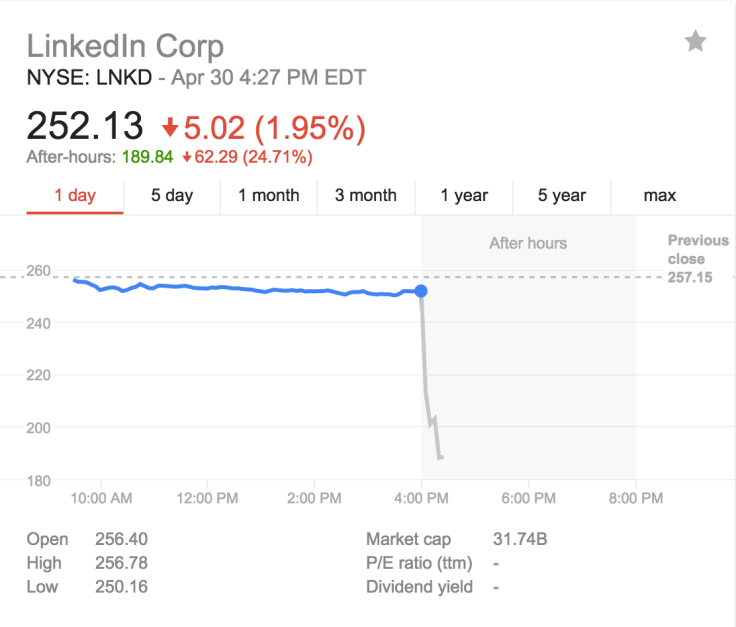

LinkedIn (LNKD) Sees 25% Drop Due To Lowered Forecasts, Slowing Growth

Despite beating analysts' estimates on both revenue and earnings per share, professional social network LinkedIn saw a massive 25 percent drop in after-hours trading Thursday following the release of its first-quarter earnings. The drop is due to the company's forecast for the second quarter and the rest of 2015, which came in below the average analyst estimate.

The Mountain View, California, company's revenue was $638 million, up 35 percent year-to-year and ahead of the $636.48 million analysts were expecting. LinkedIn's earnings per share came in at 57 cents, also slightly ahead of the 56 cents analysts had estimated.

“Q1 was a solid quarter in which we made meaningful progress against our multiyear strategic road map,” said Jeff Weiner, CEO of LinkedIn, in a statement. “During the quarter, we maintained steady growth in member engagement while achieving strong financial results.”

LinkedIn's forecasts, however, were not so good. The company advised shareholders to expect second-quarter revenue to be between $670 million and $675 million and that 2015 revenue will be approximately $2.90 billion, below estimates of $717.5 million and $2.98 billion.

As with other companies in the online space this quarter, LinkedIn blamed the lowered forecasts on the wild fluctuations of foreign currencies. "Due to recent currency moves, we expect an additional $50 million impact throughout the remainder of 2015 compared to our original forecast," LinkedIn Chief Financial Officer Steve Sordello said in a statement.

The company also saw drastic slowdowns in the growth of its three revenue streams. Talent solutions revenue was up 36 percent on the year, down from 80 percent growth last year. Marketing solutions was up 38 percent, down from 56 percent growth last year, and premium subscriptions were up 28 percent, which was much less than the 73 percent growth the company saw from the first quarters of 2013 to 2014.

© Copyright IBTimes 2025. All rights reserved.