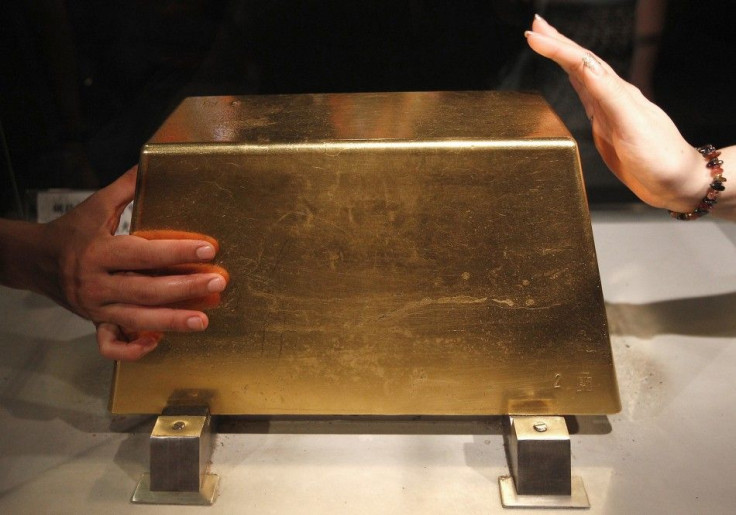

Long-Time Gold Investor Switches Postions

After gold's 10-year winning streak shattered all but the most bullish forecasts, it takes a brave man to call for a correction. It takes an even braver man to do so at the year's biggest bullion conference.

Christoph Eibl, CEO and founding partner of the $2 billion Swiss commodity hedge fund Tiberius Group, says he knows all the arguments that have underpinned bullion's long rally, which has accelerated with a 50 percent gain in the past 12 months.

At one time Eibl liked gold, having written a book five years ago extolling the virtues of trading gold, counting himself among the hard-core bugs.

But Eibl's and Tiberius' attraction to the precious metal has been fading. Late last year, Tiberius said it was neutral on gold for 2011 saying investor demand was about double that for jewelry and other industrial purposes. Plus, high prices had hurt demand by jewelers.

This week, Eibl said the fundamentals of global supply and mining do not justify the current $1,800 an ounce price of gold. In fact, it barely justifies a price half that high, with him suggesting it could eventually drop under $1,000.

From a strategic long-term perspective, you don't want to be investing in precious metals, referring to gold and silver, Eibl told Reuters Monday on the sidelines of the London Bullion Market Association (LBMA) annual conference in Montreal.

While his admission is in stark contrast to the majority of experts and analysts, many of whom have scrambled to keep ahead of the market as gold prices race higher, powered by investor and central bank demand for a haven from the European debt crisis, a double-dip recession or further dollar depreciation.

His reliance on basic tenets -- such as consumer demand from India, the world's biggest buyer, and the cost of mine production -- is also unusual for a market where the normal laws of commodity fundamentals rarely applies.

The moment when you have no ETF buying or investment buying, who would buy your gold? Not the Indians, they will not jump in at these levels, Eibl said.

Eibl urges other gold bears not to be too apologetic about their unpopular views.

GOLD BELOW $1,000?

Asked how low gold prices could fall, he said Below $1,000, which better reflects bullion's production cost.

Eibl said investors are better off investing in platinum group metals, with their market fundamentals more attractive because both platinum and palladium are likely to remain in or close to deficits.

Eibl noted that, 10 years ago, silver was trading at around $4 an ounce when the market was at a 10 percent deficit, and now silver is trading at around $40 with a 30 percent market surplus.

I don't have to be a rocket scientist to see that something is going wrong, he said.

Spot gold traded at around $1,800 an ounce on Tuesday. The price of gold has rallied furiously in the past 10 years. The metal traded at just $250 in 2001.

All that said, Tiberius, which trades a range of commodity futures with funds from pension funds, insurance companies and family offices, is not necessarily betting its billions on that major correction coming soon.

While the global frenzy over gold showed signs of fraying over the past month as extraordinary volatility tarnishes its status as a stable bet, Eibl knows better than to bet big against the collective conscience.

We know it's too dangerous to stand in front of a truck that may run you over, he said.

The LBMA annual get-together is attended by a record attendance of more than 500, whose sentiment appears joyous with little worries about the downside risk of gold even as bullion has held within $100 of its record of $1,920 an ounce.

© Copyright Thomson Reuters {{Year}}. All rights reserved.