Magazine Newsstand Sales Q1 2015: Retail Declines, Smaller Print Runs Show Losing Battle Against Facebook And iPhones

The cast of the forthcoming “Star Wars” film is on the cover of the June issue of Vanity Fair, but chances are you won’t pick up a copy the next time you’re standing in line at the supermarket. Why would you, when a thousand free pictures of Chewbacca are readily available in your Facebook news feed?

That choice is at the heart of an ongoing crisis facing the country’s largest magazine publishers, which are increasingly discovering they can no longer rely on the lucrative impulse buys that once supplemented their subscription revenue and boosted their circulation numbers. Retail magazine sales in the United States and Canada declined considerably in the first three months of 2015, marking yet another dismal quarter for a segment of the publishing industry that has been decimated since the mobile revolution transformed the way people consume content on the go.

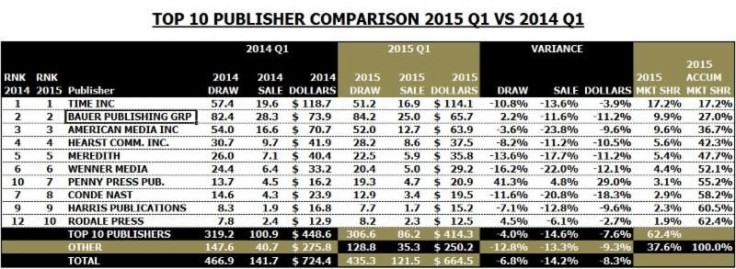

According to new figures from the Magazine Information Network, or MagNet, the number of magazines sold at retail outlets plummeted 14.2 percent in the first quarter compared to the same period last year. Dollar sales dropped 8.3 percent, thanks to higher cover prices on many titles. The declines weren't as bad as those seen in the last quarter of 2014, when unit sales fell 15.6 percent and dollar sales fell 9 percent.

Fortunately for publishers, newsstand sales account for only a small portion of the total circulation for most titles, about 7 percent as Pew Research reported in April. But the hollowing out of newsstand sales has been a consistent trend over the last few years, and in a news release Friday, MagNet said there appeared to be no light at the end of the tunnel.

“Unfortunately, we see nothing on the horizon that provides hope that newsstand sales will have a significant turnaround in the foreseeable future,” the organization said. “The continued rise in social media and mobile technology use is influencing how consumers view and absorb content.”

Declines were seen across almost every category, with the two largest categories -- celebrity and women’s magazines -- falling 18 percent and 15 percent, respectively. Food and wine magazines, the third largest category, fell 10.6 percent. Together those three categories accounted for more than a third of the $664.5 million in total sales seen in the quarter.

There were a few bright spots, notably in the health and fitness category, which rose 13.1 percent thanks to $3.6 million in sales generated from Hearst’s new title Dr. Oz The Good Life.

Last year was a particularly tough one for magazine retail sales, which took a hit in May 2014 when Source Interlink Distribution, the country’s second-largest magazine wholesaler, abruptly went belly-up, leaving piles of unsold magazines sitting undelivered in printing plants and warehouses.

Publishers are adjusting for the retail sales decline by cutting their print runs. Wholesalers distributed 31 million fewer copies in the first quarter, compared to the same period last year.

But MagNet said the smaller draws are also partially to blame for the decline in sales because some high-volume retail outlets are not getting enough copies to meet demand. At the same time, many stores are dedicating less prime retail space to magazines, or displaying smaller fixtures at the front of their shops. MagNet said publishers, wholesalers and distributors should work together to encourage retailers to focus more strongly on magazines, or at least not give up on them altogether.

“Magazines at retail are an impulsive purchase,” the group said. “If consumers can’t find our product, they can’t purchase it.”

Christopher Zara is a senior writer who covers media and culture. News tips? Email me here. Follow me on Twitter @christopherzara.

© Copyright IBTimes 2024. All rights reserved.