March FOMC Meeting Preview: Fed’s Forward Guidance, QE Taper And Janet Yellen’s First Press Conference

Further tapering of quantitative easing, or QE, is widely expected at Janet Yellen’s first policy-setting meeting as chair of the U.S. Federal Reserve this week. The real challenge Yellen faces is how to tweak the Fed’s guidance about the likely future path of interest rates, especially at a time when the unemployment rate is falling faster than expected. (Live Blog: Janet Yellen Press Conference)

The Federal Open Market Committee will issue a policy statement and updated economic forecasts at 2 p.m. EDT on Wednesday. A half hour later, Yellen will hold a press conference that will be live-streamed here.

“We expect her to reiterate the FOMC’s stance that the outlook remains positive once weather distortions dissipate, and that the hurdle to change the taper path remains high,” Michael S. Hanson, U.S. economist at Bank of America Merrill Lynch, said in a note. “She should also note that the Fed will continue to monitor the inflation outlook and stand ready to defend the inflation target from above and below.”

Hanson added that investors should look for additional questions on the extent of slack, the global risks to the outlook, how the Fed might further strengthen forward guidance and the regulatory environment. Overall, Hanson expects Yellen’s comments to reinforce the Fed’s commitment to continued accommodation and a gradual, data-dependent exit.

Asset Purchases

The Fed’s bond-buying program is barely in the spotlight this week, as the central bank will almost certainly move ahead with another $10 billion reduction in its monthly asset purchases, taking it down to $55 billion.

This would be the third straight Fed policy meeting with a gradual reduction in the pace of purchases. If this rate of reduction is continued the program will end by October.

Comments by a number of Fed officials in recent weeks suggest that, despite the recent turmoil in some emerging markets, the Ukraine crisis and the softer news on activity at home, the Fed is sticking to its tapering timetable.

In her recent testimony to Congress, Yellen attributed most of the softer data to the unusually bad winter. “It's really quite a range of data that has been soft recently. I think it's clear that ... unseasonably cold weather has played some role in much of that,” she told lawmakers on Feb. 27.

A week later, the Fed Beige Book survey of regional economies mentioned the weather 119 times in explaining sluggish activity in much of the country.

In an interview with the Wall Street Journal earlier this month, New York Fed President William Dudley said the threshold for altering the Fed’s tapering timetable is “pretty high.”

Dudley, who also serves as vice chairman of the FOMC, added that for the Fed to deviate from its current steady pace of cuts in the bond buys, “the outlook would have to change in a material way relative to my expectations.”

Forward Guidance

The more important development is that the Fed will probably drop its current quantitative thresholds in favor of more “qualitative” guidance.

Since December 2012, the Fed has said it would not raise the target for short-term interest rates until the medium-term outlook for inflation rose above 2.5 percent or the unemployment rate fell to 6.5 percent.

Inflation is still very low, but with the unemployment rate now at 6.7 percent and economic activity set to accelerate, it seems likely that the unemployment threshold will be breached soon. Yet most Fed officials don’t foresee a rate hike until 2015.

“The shift to qualitative guidance has been well telegraphed, and the only question is not if, but when, it occurs,” said Societe Generale economist Aneta Markowska in a note.

As reported in the minutes, the FOMC has been actively considering alternative formulations for forward guidance more or less continuously since last fall. “The minutes to the last FOMC meeting and recent statements by FOMC members suggest that additional changes to the FOMC’s forward guidance are likely at its next meeting,” said Lewis Alexander, chief economist at Nomura Holdings Inc., in a note.

To avoid creating volatility in the financial markets, Yellen needs to replace the qualitative threshold with guidance that’s less specific while also making it clear that interest rates won’t rise anytime soon.

Jan Hatzius and the rest of the economics group at Goldman Sachs see two options for doing so.

The first, according to Goldman, would be to split the current guidance paragraph into two: one that reaffirms policy intentions above 6.5 percent unemployment and one that describes policy intentions below 6.5 percent in qualitative terms.

For example, the committee could state: “although the unemployment rate is approaching 6.5 percent, the committee judges that employment remains well below its maximum sustainable level. Once the unemployment rate has declined below 6.5 percent, the committee therefore intends to maintain the current exceptionally low target range for the federal funds rate of 0 to 0.25 percent as long as employment or inflation remain well below their longer-run goals.”

Once the unemployment rate has fallen below 6.5 percent, the FOMC could simply delete the “6.5 percent” paragraph and be left with a qualitative description of their intentions.

“This approach would follow the Bank of England’s approach, which simply added a paragraph to their guidance statement that describes policy intentions after the threshold, in their case 7 percent, has been reached, but kept the original threshold statement,” Hatzius and his colleagues said.

The second option, according to Goldman, would be for the FOMC to switch entirely to qualitative guidance and drop the 6.5 percent threshold at this week’s meeting.

For example, Fed officials could simply state that “the committee intends to maintain the current exceptionally low target range for the federal funds rate of 0 to 0.25 percent as long as employment or inflation remain well below their longer-run goals.”

“The FOMC could then follow the Bank of England in providing additional color on the committee’s view on how far away the economy currently is from full employment and price stability,” economists at Goldman said. “While the Bank of England published a separate document providing those details, Fed officials could include this information in Yellen’s prepared remarks at the start of the press conference.”

Either option is possible. But which option the Fed opts for probably does not matter as much as the precise form of the new language and how the “dots” move, according to Goldman.

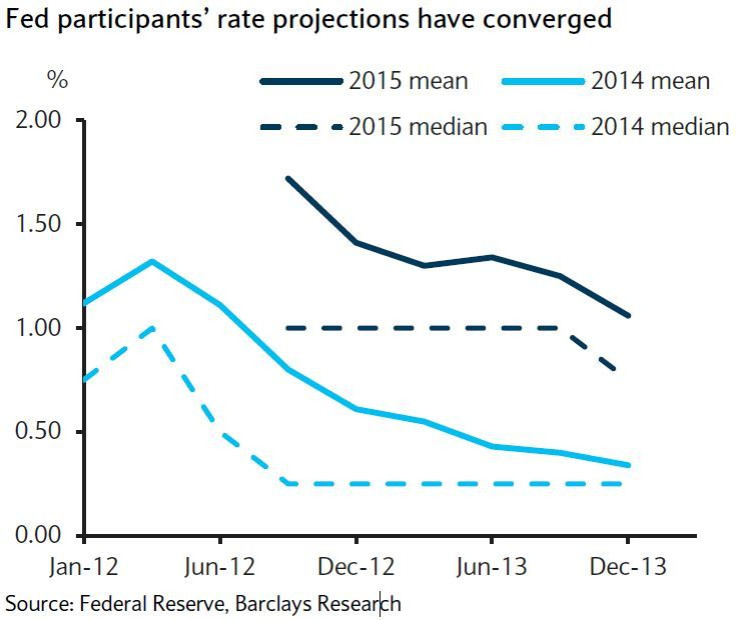

In addition to the language changes, the FOMC may place greater emphasis on the “dot plot” of funds rate forecasts of individual policymakers in the Fed’s Summary of Economic Projections.

The median rates are likely to remain the same for 2014 and 2015 at this week’s meeting, but a further narrowing of this gap would be a sign of greater comfort with that outlook across the participants, according to Barclays Capital economist Peter Newland.

“The bottom line is that, although the Fed may change how it is communicating what it plans to do with interest rates, it probably won’t change the plan itself,” said Paul Dales, chief U.S. economist at Capital Economics, in a note. “We agree that rates will remain at near-zero for some time yet, but a rise in wage growth could mean that the first hike takes place a little sooner than expected, perhaps around the middle of next year.”

© Copyright IBTimes 2024. All rights reserved.