Marijuana Price Wars: Colorado Recreational Pot Prices Expected To Fall Fast This Year

Colorado is on the verge of a marijuana price war. As competition heats up in a market where demand is particularly sensitive to low prices, analysts are expecting a drop this year in prices for the state’s recreational pot.

As the number of retailers increases, the competition is only getting tougher. Analysts at New Frontier Financials say that "the rate with which new cultivators are entering the market is accelerating, greatly increasing the market's capacity and creating more competition on price."

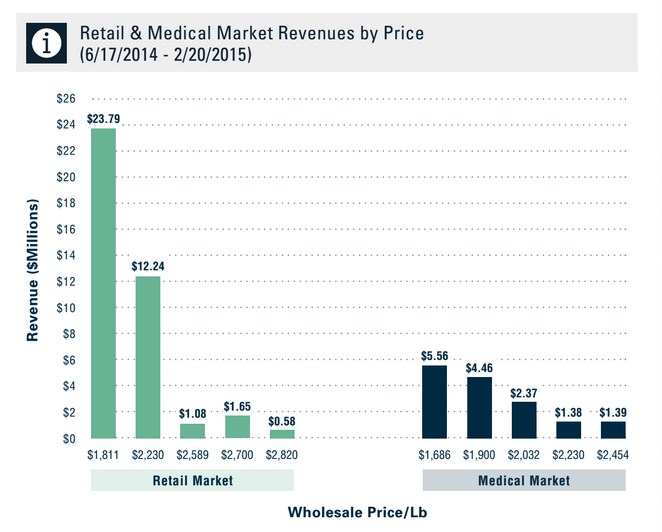

A decline in the price per pound of recreational marijuana, even from just $1,900 per pound to $1,800 per pound, could increase sales by as much as 20 times, New Frontier's analysts wrote in a report this week. The firm tracked hundreds of wholesale transactions in Colorado’s retail and medical markets between June 2014 and February 2015 to reach its conclusion.

Before retailers started selling recreational marijuana in January 2014, medical cannabis had been legal in Colorado for more than a decade. Though more retail licenses are issued for medical pot than recreational, the number of recreational stores increased 110 percent, Colorado’s Marijuana Enforcement Division says. In January of this year, recreational marijuana sales were worth $36.4 million, a CNBC report says.

This incredible boom, analysts say, is creating fertile ground for a “price war” that is likely to bring the cost of recreational cannabis down drastically in 2015. Industry insiders say a prediction of a sudden drop may be exaggerated, but lower prices are definitely in the future.

“The Colorado market is extremely competitive. Price wars happen from time to time,” Frank Falconer, of the Denver Consulting Group, who works with wholesale retailers and other companies in Colorado, told International Business Times.

He explained that it’s nothing to be shocked about, and is a basic model of supply-and-demand. For instance, when the recreational market first opened in January last year, pounds were being sold for up to $4,000. Since then, wholesale and retail prices have fallen by more than half.

And while Falconer said a twentyfold increase in demand may be a bit excessive, he still expects the prices to keep going down.

“There will be a tipping point in the market where demand highly outweighs supply,” he said, though admitting that nobody “has access to the crystal ball that tells when and how.”

Any business struggles with finding the right price to sell material that will increase volume and profits. But marijuana business owners face a unique problem -- black markets.

“The biggest factor we see in all this is the price war between recreational shops and the black market,” said Dan Nelson, founder of Wikileaf, a website that tracks prices of marijuana around the country.

“Most people who’ve been using cannabis for years in these legal states still have the same friends and connections that can supply them with cannabis that they had before,” he said. “For the most part, many of these people are still using these connections simply because of price.”

For example, Nelson said a relatively good strain of cannabis can sell for $400 an ounce in a retail store in Seattle, but goes for roughly half that on the black market.

Though he also agrees that the massive increase in demand predicted by Frontier is a bit excessive for now, Nelson said there will be a time when that might happen.

“I believe," he said, "that when we see prices in legal stores become comparable to what the black market fetches, that’s when you’ll start to see this increase in demand to the tune of 20 times or more.”

© Copyright IBTimes 2025. All rights reserved.