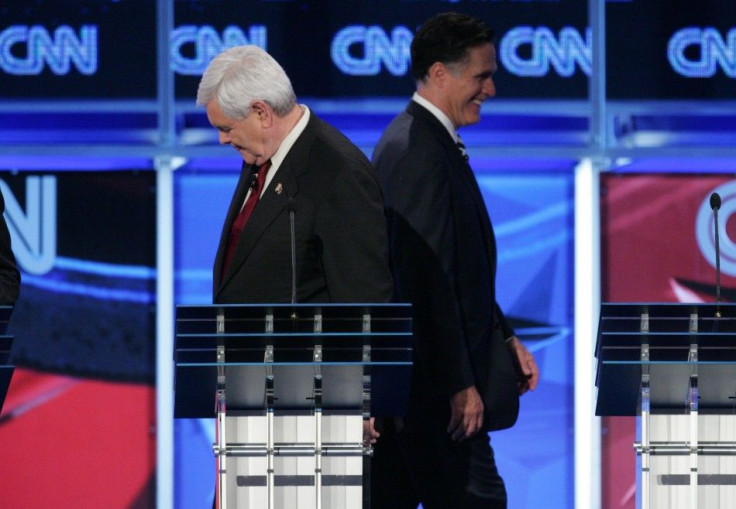

Mitt Romney, Newt Gingrich Clash Over $1.6 Million Freddie Mac Fees

Republican presidential candidate Mitt Romney called on Newt Gingrich on Monday to return $1.6 million in fees from consulting work for Freddie Mac in the wake of Saturday's Iowa debate.

He was on a debate saying that politicians who took money from Freddie and Fannie should go to jail, which is outrageous in itself, but look, he says he was in the consulting business, said Romney during an appearance on Fox News. That's very different than the consulting business other people have been in. He was in the business of connecting folks with government. He was on K Street. This was a connection with government kind of business. It's very different than the private sector.

One of the things that I think that people recognize in Washington is that people go there to serve the people and then they stay there to serve themselves, Romney added, calling Gingrich the highest paid historian in history for his work at Freddie Mac.

Gingrich responded in a press conference with references to Romney's history at investment fund Bain Capital and his offer of a $10,000 bet with Rick Perry over healthcare during Saturday's debate.

I love the way he and his consultants do these things, said Gingrich. I would just say that if Gov. Romney would like to give back all of the money he's earned from bankrupting companies and laying off employees over his years at Bain, that I would be glad to listen to him. And I bet you $10 -- not $10,000 -- that he won't take the offer.

Freddie Mac and Fannie Mae, the government-sponsored enterprises that guarantee residential mortgages, have come under fire from Republicans for backing subprime mortgages prior to the housing collapse. However, the agencies entered the subprime market after Wall Street banks popularized the practice by bundling the mortgages into securities, which were sold to investors.

But as mortgages went bad, the two agencies required a government takeover in 2008 and have cost taxpayers over $150 billion to date. More recently, the agencies have been critcized by Congress over executive compensation and last week, Senator Johnny Isakson proposed a plan to unwind the agencies.

© Copyright IBTimes 2024. All rights reserved.