OECD Cuts World Growth Projections, Warns Over Austerity And Financial Instability

The developed world's top economic group trimmed its projections of global growth for the next two years, warning member countries about financial instability and the drawbacks of fiscal austerity.

"Global GDP growth in 2016 is projected to be no higher than in 2015, itself the slowest pace in the past five years," the Organization for Economic Development and Cooperation (OECD) announced Thursday in a report that slashed projections in light of "disappointing recent data."

The 34-member group projected world economic growth at an even 3 percent for 2016, revised down from expectations of 3.3 percent in November. Output in the U.S. was notched down to 2 percent from 2.5 percent previously, following a two-month bout of global financial turmoil and slumping commodity prices.

The release went on to note that cost-cutting efforts in budget-conscious nations threatened to drag on economic growth, a conclusion at odds with previous OECD declarations. "A stronger collective policy response is needed to strengthen demand," the OECD said. "Monetary policy cannot work alone. Fiscal policy is now contractionary in many major economies."

Instead of slashing infrastucture investments and public programs in the face of meager economic advances, the OECD said, countries ought to be taking advantage of historically low interest rates to borrow for stimulus spending. "A commitment to raising public investment collectively would boost demand while remaining on a fiscally sustainable path," the OECD said.

As developed nations have worked to balance their budgets, one nation has bucked the trend: China. As world financial markets have buckled under fears that the second-largest economy in the world is slowing faster than expected, China has embarked on stimuls spending, which the OECD said "should promote the transition to stable consumption-based growth."

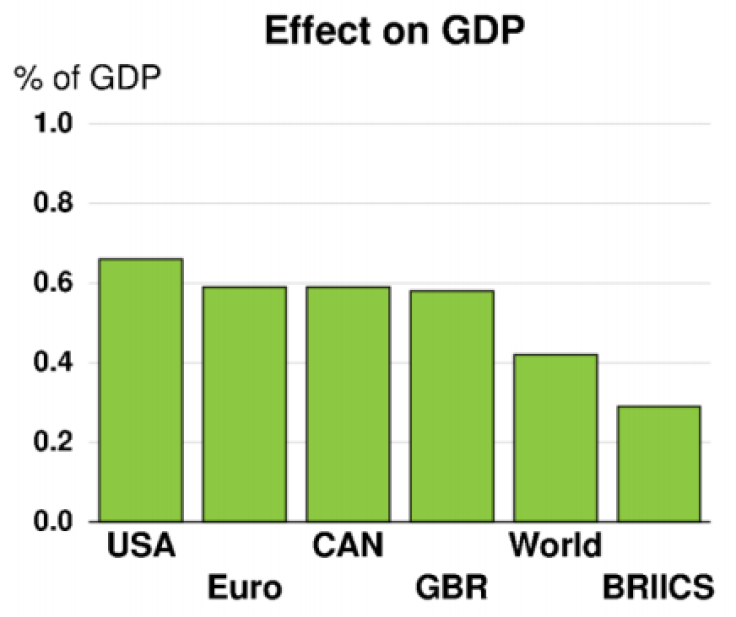

A public investment program costing half a percent of gross domestic product could give developed nations upwards of 0.6 percent additional economic output, the OECD estimated. In the U.S., that would equate to stimulus spending of some $90 billion.

Shortfalls in fiscal spending and structural reforms — changes in market and labor policy — have placed an unworkable burden on central banks, the OECD said. In recent years central bankers around the world have explored the frontiers of monetary policy, plunging interest rates into negative territory in Japan and Europe in an extraordinary last-ditch effort to shore up sluggish economic growth.

But those policies have their limits, the OECD said. "Experience to date suggests that reliance on monetary policy alone has been insufficient to deliver satisfactory growth, so that greater use of fiscal and structural levers is required."

© Copyright IBTimes 2024. All rights reserved.