Hillary Clinton And Wall Street: Financial Industry May Control Retirement Savings In A Clinton Administration

While Hillary Clinton has spent the presidential campaign saying as little as possible about her ties to Wall Street, the executive who some observers say could be her Treasury Secretary has been openly promoting a plan to give financial firms control of hundreds of billions of dollars in retirement savings. The executive is Tony James, president of the Blackstone Group.

The investment colossus is most famous in politics for its Republican CEO likening an Obama tax plan to a Nazi invasion. James, though, is a longtime Democrat — and one of Clinton’s top fundraisers. The billionaire sculpted the retirement initiative with a prominent labor economist whose work is supported by another investment mogul who is a big Clinton donor. The proposal has received bipartisan praise from prominent economic thinkers, and James says that Clinton’s top aides are warming to the idea.

It is a plan that proponents say could help millions of Americans — but could also enrich another constituency: the hedge fund and private equity industries that Blackstone dominates and that have donated millions to support Clinton’s presidential bid.

The proposal would require workers and employers to put a percentage of payroll into individual retirement accounts “to be invested well in pooled plans run by professional investment managers,” as James put it. In other words, individual voluntary 401(k)s would be replaced by a single national system, and much of the mandated savings would flow to Wall Street, where companies like Blackstone could earn big fees off the assets. And because of a gap in federal anti-corruption rules, there would be little to prevent the biggest investment contracts from being awarded to the biggest presidential campaign donors.

A Washington power player who reportedly turned down a slot in President Barack Obama’s cabinet, James first outlined the retirement savings initiative in a speech a year ago to the Center for American Progress (CAP). The liberal think tank was founded by Clinton’s current campaign chairman, John Podesta, and is run by her former top policy adviser Neera Tanden. James and Blackstone made six-figure donations to CAP that year, and the group gave him a platform to propose a new payroll tax that he said would fund guaranteed retirement benefits.

Rather than funneling the hundreds of billions of dollars of new tax revenue into expanding Social Security benefits, as many Democratic lawmakers have called for, James proposed something different: A decade after George W. Bush’s failed attempt to divert Social Security revenue into private retirement accounts, the Blackstone president outlined a plan to create individual retirement accounts, some of whose assets would be managed by private financial firms.

“Managing the Guaranteed Retirement Accounts in a pooled fashion would let them leverage that scale to pay lower fees,” James said. “They would also have access to [the] highest quality managers who could adopt long-term investment horizons and invest in less liquid, but higher returning, asset classes that are more appropriate for retirement funding.”

In the blueprint of the plan, James lamented that 401(k) systems “don’t invest in longer-term, illiquid alternatives such as hedge funds, private equity and real estate,” and said the new program could invest in “high-yielding and risk-reducing alternative asset classes.” In a CNBC interview, James said he wants the billions of dollars of new retiree savings to be invested “like pension plans.” He noted that in “the average pension plan in America, about 25 percent is invested in stuff we do, in alternatives, in real estate and private equity and commodities and hedge funds.” Unlike stock index funds and Treasury bills, those investments generate big fees for financial firms — and critics say they do not generate returns that justify the costs.

Clinton’s campaign did not respond to International Business Times questions about James’ proposal.

Since 2013, Clinton has sent conflicting signals on retirement policy. During the Democratic primary, under pressure from progressive groups, she agreed to support some targeted Social Security increases and promised not to reduce benefits. But in paid speeches to Wall Street firms, according to recently leaked emails, she praised a presidential commission that recommended cuts to the program. Clinton has not publicly endorsed James’ plan, but her campaign’s blank slate on retirement policy provides a clear opportunity for the Blackstone president and his plan, about which he has just co-authored a book, “Rescuing Retirement.”

Proponents view the initiative as an earnest bipartisan effort by a disinterested financial expert who is deeply concerned about America’s looming retirement security crisis. As James’ partner in shaping the initiative, labor economist Teresa Ghilarducci, put it: “Tony is an independent thinker and he really sees a public policy need. He’s a Democrat, he’s one of the chief supporters of Hillary Clinton’s presidency. His company owns a lot of other companies. Tony told me whenever a company gets rid of a pension plan, he knows a middle-class worker can’t retire.”

On the Democratic side, two of President Obama’s top economic aides have praised James and Ghilarducci’s new book. On the Republican side, George H.W. Bush’s former deputy treasury secretary Bill Jasien — who now runs a financial advisory firm — wrote in the book’s forward: “We may disagree on many political issues, but regardless of one’s political alignment, aspects of Teresa and Tony’s Retirement Savings Plan provide an important road map to put American workers back on track…Their plan is built on common sense principles, key to advancing the debate on a bipartisan basis.”

James himself has brushed off notions that he or his firm has any financial stake in his proposal.

“I’m 66, I’m at the end of my career, not the beginning — it doesn’t make any difference to me,” James told IBT during a Washington event in September to promote the book. “The whole point of this is to help do something for a big problem. And I know about the area because I manage retirement assets for pension funds.”

Asked earlier this year whether he had a conflict of interest in proposing such a measure, James told Bloomberg News: “If this gets enacted, there are going to be thousands and thousands and thousands of asset managers that will benefit I suppose because more savings and more investment benefits all asset managers of every stripe.”

“For Blackstone it’s frankly small,” he said. “It’s retail and our funds are already oversubscribed. I don’t think we are going to get much out of it.”

Critics see James’ proposal as an effort by a politically connected private equity mogul to present a Wall Street-enriching scheme as a social good — at a moment when his own firm has faced lower profits, and at a generally challenging time for the alternative investments industry.

That industry relies on investments from state and local pension systems, which over the last decade have invested billions in alternatives in hopes of reaping above-market returns in exchange for higher fees. Recently, though, regulators, pension trustees, investment experts and academics have questioned whether retiree savings should be invested with firms like Blackstone in the first place.

Some pensions are pulling out their money. Other pension systems have been turned into 401(k)-style plans, which are difficult for the alternative investment industry to break into because of federal laws that discourage those plans from buying into riskier, illiquid investments.

In the face of these challenges, James’ proposal could provide a government-mandated flow of money from workers’ paychecks into the high-fee alternative investment industry.

“This new plan depends on sweeping government mandates, the appropriation of trillions of dollars from the private sector that is then handed over to zillionaire investment managers who make no guarantees about rates of returns or discounted fees,” said South Carolina Treasurer Curtis Loftis, a Republican who serves on his state’s pension investment council, which contracts with Blackstone. “The only guaranteed benefit I see in this plan is one for wealthy money managers and their cronies. Wall Streeters reading this plan will understand, without having specifically been told, that having Hillary Clinton and the federal government use its power to aggregate the existing and future retirement funds of working Americans and entrust it to them is the Holy Grail of finance.”

Chris Tobe, a Democrat who advises institutional investors and who served on Kentucky’s pension board, put it just as bluntly: “James’ plan is a deliberate attempt to get around federal protections for retirees because alternative investments are not generally allowed in the 401(k) world. This is about making Blackstone and other private equity firms even richer than they already are.”

Clinton has cast herself as skeptical of the “shadow banking” world that Blackstone operates in, and she has said she wants to close a loophole that lets private equity managers pay a lower tax rate than most other workers.

Yet for all of Clinton’s tough talk against Wall Street, James and others associated with Blackstone have been among her biggest fundraisers, and during a recent cocktail party in Washington D.C. to promote the plan, James said he was optimistic that a Clinton win could make his proposal a reality.

“What the election would mean for our plan: Yes, we’ve spent a fair amount of time with a number of Hillary’s policy advisors. So far they have been very encouraging about the plan,” he told the assembled crowd. “I am hopeful she’ll grab this issue once elected, and run with it. I think the signals are warm on that.”

Half Of All Households Older Than 55 Have No Retirement Savings

In his book and during his television appearances pushing his proposal, James has argued that workers in general are not saving enough for retirement — and few dispute his assessment. A General Accountability Office report last year found that in the 48 percent of households of Americans over 55 years old who have some savings in 401(k) or other tax-deferred account, the median household has just $109,000 — which would provide an annuity of about $405 per month for a 65-year old. A full 52 percent of such households have no savings at all.

That leaves Social Security, which now “provides most of the retirement income for about half of households age 65 and older,” according to GAO. But Social Security usually does not provide the 85 percent of pre-retirement income needed to maintain retirees’ living standard; it provides only about 35 percent, according to the National Institute on Retirement Security.

Progressive lawmakers and advocacy groups have been pushing to fund more robust Social Security benefits by lifting the cap on the amount of income that is subject to the payroll tax. That initiative has been promoted by Democratic Sen. Elizabeth Warren, Independent Sen. Bernie Sanders, and most recently President Obama.

Others have trumpeted separate initiatives to expand defined contribution programs. Since 2015, California, Connecticut, Maryland and Oregon have enacted legislation allowing workers who do not already receive retirement benefits to opt into state-run retirement programs. Republican Sen. Marco Rubio — echoing a proposal from the Democratic-aligned Center for American Progress — has called for letting workers with no retirement coverage buy into the Thrift Savings Plan, a low-fee, defined-contribution system for federal employees. It invests only in assets such as stocks, bonds and Treasury bills that do not generate big fees for Wall Street firms.

“Blocked Out Of Having The Most Sophisticated Investments”

Into this simmering policy debate has come Blackstone’s James and his co-author Teresa Ghilarducci.

A labor economist, Ghilarducci is a trustee for the United Auto Workers Medical Benefits Trust, an informal retirement policy adviser to the Clinton campaign and a professor at New School’s Schwartz Center for Economic and Policy Analysis.

Ghilarducci has long been a critic of the 401(k) system, arguing that its tax breaks disproportionately benefit wealthier Americans and that its fees are too high. In 2007, she outlined a draft of a guaranteed retirement savings proposal in a paper for the left-leaning Economic Policy Institute.

Her plan called for a 5 percent payroll tax — partially offset by replacing existing tax breaks for 401(k)’s — which would fund guaranteed retirement benefits in customizable payout plans. The plan would create a $600-a-year tax credit for savers, and the payroll tax levy (which mimics savings programs in Australia, Britain and New Zealand) would generate $500 billion a year, according to Dean Baker, an economist at the Center for Economic and Policy Research.

The original proposal directed the revenue into accounts “administered by the Social Security Administration and managed by the Thrift Savings Plan.” The plan, Ghilarducci said, would — together with Social Security — provide the average earner with 71 percent of their working income in retirement.

In 2010, Ghilarducci’s proposal got a boost from the Obama administration, whose Middle Class Task Force endorsed the concept of the savings accounts. Then in 2015, Ghilarducci and New School researchers published a paper proposing a new roadmap to implement the plan. The paper, though, included an important change: Rather than saying retirement savings would be managed by an existing government entity that invests in low-fee vehicles like stocks, bonds and T-bills, the report said “funds would be managed by commercial money managers, similar to regular defined benefit pension funds.”

Though seemingly small, the tweak — and the reference to modeling it off traditional pension systems — transformed the proposal into a potential jackpot for hedge funds, private equity firms, real estate investment houses and venture capital companies.

Ghilarducci told IBT that she made the change because she had “evolved to be more aspirational” in creating a plan that would invest retirees’ money in both traditional stocks and bonds and in alternative investments that she asserted can deliver better returns. Soon after the revision, she was asked to lunch by James, whose firm is one of the world’s biggest private equity, hedge fund and real estate investors.

“We talked a lot about the inefficiencies of the system and how unfair it is,” she said. “If you are in a 401(k), the government protects you against being in a sophisticated investment product because you aren’t a sophisticated investor. But that means that everybody with a 401(k) or IRA are blocked out of having the most sophisticated investments. And we both thought that is unfair.”

As an icon of the private equity industry, James is an unlikely champion of retirement security. A recent Harvard University study found that private equity firms have transformed bankruptcy law into “an efficient financial engineering tool for insider sales—and for dumping pensions” — with 51 companies abandoning their pension plans “at the behest of private equity firms since 2001.”

Nonetheless, a spokeswoman for Blackstone, Christine Anderson, said that when it comes to the retirement crisis, “Tony has been talking about this for years.” As the 2016 presidential campaign heated up, James signed onto a new version of Ghilarducci’s plan that reduced the new payroll tax to 3 percent, split between employers and employees, and partially offset by a tax credit. They said the government would guarantee the principal of the account, regardless of market conditions.

“Under the Retirement Savings Plan, everyone in America who works without a pension plan, no matter how little or how much they make, from Uber drivers to CEOs, would have their own Guaranteed Retirement Account,” James said in his CAP speech. Retirees’ savings managed by private financial firms would generate far better returns than 401(k)s, he said. “The beauty of investing more effectively is that the higher return itself pays for a large part of the retirement gap — and it doesn’t cost anyone anything,” he said.

Some data supports James’ comparison: Traditional pension systems outperformed 401(k)-style plans by 0.7 percent between 1990 and 2012, according to a recent study published by Boston College’s Center for Retirement Research. A similar study from retirement consultant Towers Watson found that pension systems “consistently outperformed” 401(k)s.

‘This Proposal Is About Wall Street Getting More Assets’

“It is healthy to be suspicious of bankers,” Ghilarducci told IBT. “Tony is an officer of the company and he of course doesn’t do anything that hurts the company.”

The James-Ghilarducci plan in fact offers substantial potential benefits for companies like Blackstone. It would provide Wall Street with a new, government-guaranteed revenue stream, and would also help the industry circumvent legal and market obstacles to reach a wider swath of the retirement savings business.

Alternative investment firms have tried to break into the $4 trillion 401(k) market for years, but their products, such as real estate and long-term private equity investments, are less easily transferable to cash, making them a difficult fit for 401(k)s. On top of that, 401(k)s are regulated by federal rules that discourage illiquid, high-risk investments — and make 401(k) overseers vulnerable to lawsuits if they move workers money into such investments. A new federal rule could further complicate alternative investment firms’ efforts to access the retail market because it “suggests that there are certain investments that are so costly, complex, or opaque that they cannot be recommended to retirement investors,” said Barbara Roper of the Consumer Federation of America.

The James-Ghilarducci plan would effectively circumvent many of those obstacles, allowing alternative investment firms to access billions of retail customer dollars that have been out of reach.

For Wall Street, the biggest benefit could be new fee revenue.

The plan’s 3 percent payroll tax would generate roughly $300 billion a year. The average public pension fund has 17 percent of its assets in alternative investments: If the James-Ghilarducci proposal followed that same formula, alternative investment industry firms like Blackstone would get half a trillion dollars of new assets under management over the course of a decade. With the industry-standard management fee between 1 and 2 percent, that represents between $500 million and $1 billion in new management fees each year — and that does not include the even more lucrative 20 percent fee the alternative investment industry typically charges on investment gains.

The cash infusion for Wall Street would come at a critical moment: In the last few years, investment experts such as Warren Buffett, George Soros and Jack Bogle have suggested that investors should avoid putting money in alternative investments because, they argue, the stock market delivers better returns and incurs far lower fees. A 2015 study from Johns Hopkins University’s Jeff Hooke found that over the previous five years, low-fee index funds outperformed pension systems that invested in higher-fee alternatives.

Hedge funds returns have trailed the S&P 500; venture capital returns have been uneven and a 2013 study showed that the pension funds that paid the highest fees to alternative investment firms had some of the worst performance.

In terms of private equity, while that industry’s proponents — including Blackstone CEO Stephen Schwarzman — say their firms outperform the stock market, recent research challenges that claim, and the industry just experienced one of its weakest quarters. At the same time, academic experts and regulators have warned about hidden fees that eat into investors’ returns. The Securities and Exchange Commission last year sanctioned Blackstone for having “failed to fully inform investors” about fees in a case involving funds that listed James as one of their key overseers.

Some major institutional investors appear to be responding to the warnings. Just this month, officials at the California State Teachers Retirement System — one of the largest pensions in the world — announced that high fees had convinced them to follow other major pension systems and pull $20 billion out of its investments with private money managers.

Ghilarducci told IBT that concerns about fees were valid, but that the new federal program would use its market power to negotiate lower levies. Even if the effort to reduce fees was not successful, she argued, their proposal would still give retirees a better deal than 401(k) plans.

“If you are in a defined benefit plan that is paying too many fees to Blackstone, you are still better off than if you are in a Fidelity plan for a 401(k),” she said.

That’s a difficult case to make, though, when some private equity titans — including Blackstone’s own top dealmaker — have suggested the industry may not be able to deliver the high returns it promises in exchange for its high fees.

All told, economist Eileen Appelbaum told IBT, the James-Ghilarducci plan is built on earnings projections that are fanciful.

“The plan’s promise of 6 to 7 percent returns is likely to prove unrealistic, and they fail to discuss the risks inherent in the risky investments that would have to dominate the savings portfolio that could yield such returns,” said Appelbaum, who co-authored the book “Private Equity at Work” and published a study suggesting lower private equity returns are a new normal.

“This proposal is about Wall Street getting more assets under management because that is where they make their money,” she said. “Why would we put more retirement savings into private hands when Social Security or the Thrift Savings Plan could do the same at almost no cost?”

"Pay-to-Play Violations Are The Cornerstone of The Alternative Investment Market”

Whatever the merits of a particular policy proposal, enactment will be a matter of political muscle — and that has been on display during James and Ghilarducci’s autumn events to promote “Rescuing Retirement,” the book version of their proposal.

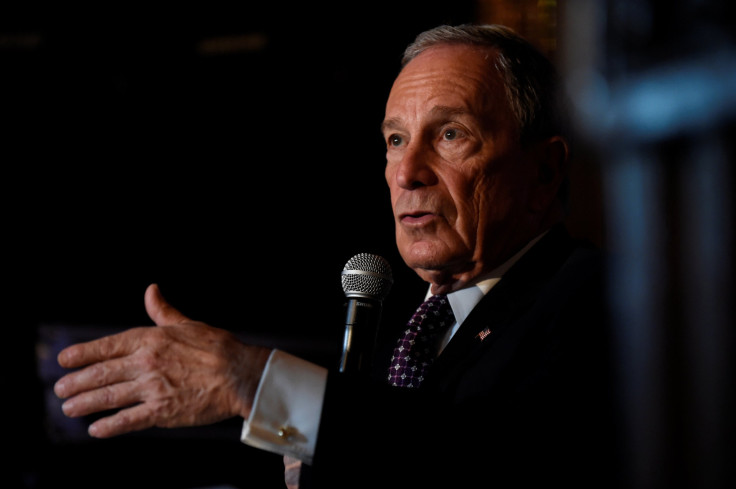

Billionaire former New York Mayor Michael Bloomberg spoke at a packed New York event, which was also attended by Andy Stern, the former head of the Service Employees International Union. House Democratic Leader Nancy Pelosi and senior Democratic Sen. Debbie Stabenow of Michigan attended the pair’s Politico-sponsored Washington event.

Meanwhile, James and others connected to Blackstone have financially aided Clinton's White House bid.

James is listed as a “Hillblazer” on Clinton’s campaign website, meaning he has donated and/or raised at least $100,000 for her campaign. The Wall Street Journal reported that James held a $33,400-a-person fundraiser for the Hillary Victory Fund at his Manhattan home in December 2015. Blackstone and James also held a lavish reception at the Democratic National Convention in July 2016, and James held another fundraiser for Clinton at his home last month, raising $1.5 million, according to the Associated Press.

Blackstone employees have given a total of more than $107,000 to Clinton’s campaign, according to data compiled by the nonpartisan Center for Responsive Politics (CRP). David Jones and Richard Sullivan, who until 2015 were listed as Blackstone lobbyists, have been among Clinton’s largest fundraising bundlers.

In all, the private equity and hedge fund industries that could benefit from James’ retirement proposal have given Clinton’s campaign more than $2 million, according to CRP. When counting donations to outside super PACs supporting her, the watchdog group says Clinton’s presidential bid has been supported with $58 million from the securities and investment industry — with alternative investment industry moguls among the top donors.

James has said he is not aiming to be appointed Treasury Secretary. But along with his fundraising, James and Blackstone have sought to build relationships with key Washington players on retirement policy.

For instance, James and Ghilarducci’s proposal touts legislation from House Democratic Vice-Chairman Joe Crowley that would direct many employers to open individual retirement accounts for their employees. Crowley's office has promoted the initiative as one that would have the new accounts invest retiree savings in "a limited number of low-fee index fund options." However, the bill includes a provision that would give federal officials latitude to potentially invest the new money in alternative investments. Blackstone donors are collectively the third largest donor to Crowley during his congressional career, and Crowley has raised more than $1.6 million from donors in the securities and investment industry, according to CRP.

Outside of Congress, Blackstone has donated between $500,000 and $1 million to the Clinton Foundation, and the Associated Press reported that "eight Blackstone executives also gave between $375,000 and $800,000 to the foundation." James has also built bridges to the Clinton-linked Center for American Progress, beyond his donations and seat on its board.

In emails released by Wikileaks, CAP president and CEO Neera Tanden encouraged Clinton campaign chairman Podesta to forge a relationship with Blackstone executive Jon Gray, and Clinton’s campaign looked to arrange a meeting between James, Gray and former Treasury Secretary Tim Geithner. A separate email shows James arguing to Podesta that his retirement proposal is a better idea than simply expanding Social Security — which would offer no profit potential for Wall Street.

“We do not believe the problem can be solved by making Social Security better funded and/or adding a higher minimum benefits,” he wrote. “Expanding Social Security doesn't help middle class people very much,” he argued, and “increasing Social Security would mean adding to FICA taxes.” He also said: “Social Security is such a fraught issue with people so dug in, we worried that opening it up for fundamental change was not implementable from a pragmatic standpoint.”

While Ghilarducci said she supports expanding Social Security, doing so would be more politically difficult than enacting a separate program, she argued — especially since her initiative gets a boost from its association with an industry power player like James.

“Tony certainly helps get an audience that the left couldn’t get,” she said. “The political reality is, you have to have resources and coalition building.”

Another political reality is this: The James-Ghilarducci plan could strengthen the financial industry’s political influence over retirement investments.

Under their proposal, “Retirement portfolios would be created by a board of professionals who would be fiduciaries appointed by the president and Congress,” James and Ghilarducci wrote in a New York Times editorial. “The fees and investments would be much less prone to corruption because the managers’ income would not depend on the investments.”

Alternative investments, though, are notoriously opaque. The contracts between financial firms and pensions are secret, making it difficult to evaluate whether they are being competitively bid or whether they involve undue influence. A recent whistleblower lawsuit in New Mexico accused Blackstone of being part of an influence-peddling scheme, which Blackstone has denied, and USA Today in 2009 tracked how Blackstone officials had made donations to public officials in states that had awarded the company pension management deals.

Seeking to tamp down donor influence, the SEC enacted rules in 2010 aiming to prevent campaign contributions from influencing political appointees’ decisions about which financial firms get to manage retirees’ savings. But lawyers interviewed by IBT said the SEC’s rule covers only state and local retirement systems — not the federal government.

James told IBT he supports the SEC expanding its rule to cover any new investment board created by his proposal. But if the SEC did not take that step, there would be little to prevent financial firms from donating major money to a president, whose appointees could then steer billions of new retiree savings to those same firms.

"Pay-to-play violations are a cornerstone of the alternative investment market," said former SEC attorney Edward Siedle. "It's often the only way that money managers can get elected officials to evade their fiduciary duty and invest in low-transparency, high-cost, high-risk investments that consistently trail the S&P 500. Any retirement plan that would allow that to happen at the federal level would be insane."

© Copyright IBTimes 2025. All rights reserved.