Last-Minute Real Estate Tax Break In GOP Bill Will Benefit Trump

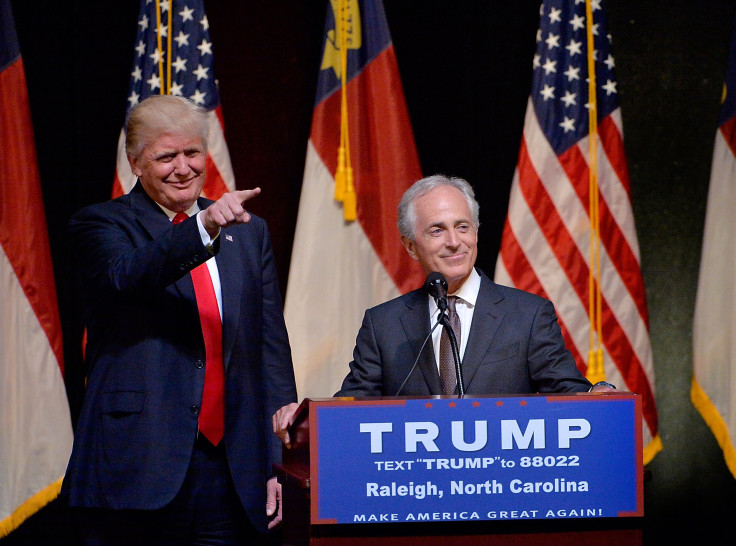

President Donald Trump has made tens of millions of dollars of a specific kind of income that could be subjected to a last-minute tax break inserted into the Republicans’ tax legislation released Friday, according to federal records reviewed by International Business Times. The same is true for Tennessee GOP Sen. Bob Corker — a commercial real estate mogul who suddenly switched his vote to “yes” on the tax bill after the provision was added to the legislation. Previously, Corker was the only Republican to vote against the Senate version of the bill.

Trump told a Missouri crowd on Nov. 29 that he would personally take a hit from the GOP tax plan. “This is going to cost me a fortune, this thing, believe me...I have some very wealthy friends. Not so happy with me, but that’s OK," Trump said. But a variety of experts have concluded that the tax bill overwhelmingly favors the wealthiest Americans — especially those with complex real-estate investments.

The reconciled tax bill includes a new 20 percent deduction for so-called “pass-through” entities, business structures such as LLCs, LPs and S-Corporations that don’t pay corporate taxes, but instead “pass through” income to partners who pay individual tax rates on that money. The Senate version of the bill included safeguards that would only allow businesses to take advantage of the new break if they paid out significant wages to employees. But the new provision, which wasn’t included in either version of the bill passed by the House and Senate, and was only added during the reconciliation process, gives owners of income-producing real estate holdings a way around that safeguard, effectively creating a new tax break for large landlords and real estate moguls.

"This change will primarily benefit wealthy investors with lots of assets and few employees,” Matt Gardner, a Senior Fellow at the Institute on Taxation and Economic Policy, told IBT in an email. “You can't describe this as a job-creation strategy with a straight face, which begs the question of why anyone thinks this last-minute change was a good idea."

The new language wasn’t in the bills passed by the House and Senate, and Democrats cannot offer a floor amendment to eliminate the provision, which experts say would reduce the amount of money that Trump, Corker and other wealthy lawmakers owe to the IRS on their real-estate-related pass-through income.

The revelations about the provision potentially enriching Trump, Corker and other Republican lawmakers drew a swift rebuke from Democratic U.S. Sen. Chris Van Hollen.

“Writing a tax bill that puts the very wealthy and special interests before working families was bad enough – but to slip in a last minute provision that could give even more of a windfall to people like President Trump and some Republicans in Congress is unconscionable,” Van Hollen told IBT. “It’s not too late for my colleagues to do the right thing. I urge them to put politics – and personal profit – aside, and stop this scam that will leave millions of middle class Americans paying more and cause the debt to skyrocket.”

Trump And Corker Made Millions Off Pass Through Income

Federal filings reviewed by IBT show that in 2016, Trump disclosed that he earned between $41 million and $68 million of rental income from 25 pass-through LLCs and LPs — most of which are invested in real estate. Those properties are collectively worth between $527 million and $704 million, according to the documents. Trump’s senior adviser and son-in-law Jared Kushner also lists dozens of income-generating real estate pass-through entities on his financial disclosures.

Trump announced in January he would put his assets in a trust for the duration of his presidency, and later that month he released a summary of the trust. But the full trust agreement has not been made public, and a ProPublica report in April found that Trump can remove profits from the trust at any time without disclosing those transactions. Trump has turned his eponymous organization to his sons Donald Jr. and Eric, but he refused to divest from the company despite calls from ethics watchdogs to do so. The White House did not immediately respond to a request for comment.

Corker’s 2016 financial disclosure form says that he earned between $1.2 million and $7 million of annual rental income from real-estate related LLCs that year. Those properties are worth between $16 million and $35 million. The value of Trump and Corker’s real-estate partnerships and rental income for 2017 has not been disclosed.

As of 2015, Corker was the fourth-richest member of the Senate with a net worth of nearly $70 million, according to the Center for Responsive Politics. Corker first began amassing his fortune through his construction company, but eventually moved into real estate. The Senator, who made headlines when he warned the president’s recklessness could lead the U.S. into “World War III” in October, has announced he will not run for reelection in 2018. Corker was not one of the Congressional conferees tasked with negotiating the tax bill.

“Senator Corker is not a member of the tax-writing committee and made no requests for specific provisions throughout this debate," Micah Johnson, Corker's communications director, told IBT in an email. Johnson also told IBT Corker was unaware of the new real estate tax break when she asked him about it in response to IBT's questions.

"His sole focus has been on making the bill more fiscally sound. At the end of the day, he supported the legislation because he believes our country will be better off with it than without it," Johnson said.

When the Huffington Post asked Corker if the bill’s impact on his own finances had crossed his mind earlier in the week, he replied “Have I thought about it? Uh, no.”

In July, Corker said that the national debt was “the greatest threat to the nation,” even larger than escalating tensions with North Korea. "We have $20 trillion in debt and we're continuing to do things that make that worse every day," Corker said on CNBC. "And I believe unless something abruptly changes very soon, we will have a fiscal calamity, and it's going to make all the other ills that we're dealing with in the nation pale." However, when it came time to decide whether to support the final GOP tax bill that will add up to $1.5 trillion to the debt, Corker indicated he would join his party in voting “yes” on the bill.

Trump and Corker are not the only lawmakers who could get a new tax break on the type of income targeted by the new provision. IBT previously reported that 13 Republican lawmakers directly overseeing the tax bill — including U.S. House Speaker Paul Ryan — make up to $16 million a year from the kind of real-estate related pass-through entities that could benefit from the tax bill.

Experts told IBT they could not calculate precisely how much of a tax benefit Trump, Corker or the GOP lawmakers could make from the provision, because the benefit is based in part on the original value of the real estate assets, not the current value. The original value of the assets is not disclosed on federal disclosure forms.

In a summary released just before the final bill was made public, Republican lawmakers said “strong safeguards” on the pass-through income deduction would help to “ensure that Main Street tax relief goes to the local job creators it was designed to help most.”

But experts say the new provision would mean the deduction could be taken by real estate partnerships with few employees.

“The new bill expands the pass through loophole to now even cover firms that don’t pay much or any wages to employees. Real estate partnerships and others with property but not employees would be the beneficiaries,” David Kamin, a New York University law professor who served as a special assistant to the president for economic policy in the Obama administration, told IBT in an email. “We don’t know the details of Donald Trump’s tax situation because he hasn’t released his tax returns. But, this is the kind of loophole that has the potential to cut the taxes of some of the richest Americans by many millions per year.”

In addition to the new real estate provision, the final tax bill will also lower the top tax rate for the richest Americans, like Trump and Corker, from 39.6 to 37 percent.

© Copyright IBTimes 2025. All rights reserved.