PRECIOUS ROUNDUP - Off highs on Chinese policy action; gold falls least

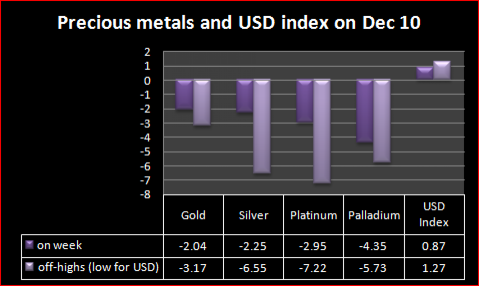

Precious metals fell across the board in the week to December 10 as a cooling China weighed on demand hopes but the yellow metal performed better amid lingering worries over the euro-zone debt and dollar's ability to play safe-haven.

Gold had touched a new record and silver rallied to a fresh 30-year high earlier in the week after the euro-zone related issues forced investors to view a global economic recovery as still more fragile and seek safer avenues.

Spot gold ended at $1,385.65 per ounce on Friday, 2.04 percent down in the week and 3.17 percent weaker than $1,439.95, the new record it hit on Tuesday.

Silver that rose to a fresh 30-year high of $30.68 dropped by 6.55 percent to $28.67 as on Friday, where it was down 2.25 percent on week.

Platinum rose only to a 3-week high of $1,734 an ounce this week and ended it at $1,676, down 2.95 percent from the previous Friday.

Palladium slipped to 731.72 on Friday, down 4.35 percent in the week and 5.73 percent weaker than the multi-year high of 776.22 touched last week.

China

China raised bank's reserve requirements for the sixth time this year on Friday to combat inflation. Analysts while reacting to the PBoC (People's Bank of China) action said the increase in RRR fell short of a policy rate hike, which was a necessity given the consistently strong economic data and demand for commodities from the country.

Data showed on Friday that the trade balance of world's second largest economy stood at $22.9 billion in November, not far away from the $27.2 billion surplus recorded for the previous month.

Market participants are now looking at the Chinese inflation data due on Sunday. Some expect the number to top 5 percent for November and see the prospects of an immediate rate hike by PBoC. Retail sales and industrial production for November are also scheduled for the weekend.

Some analysts are of the view that by cutting lendable resources of banks just ahead of the data, the central bank probably kept the policy tightening in the backburner for this year.

Europe

Ireland agreeing to a bailout package by European Union and International Monetary Fund and its parliament progressing in the way of implementing the same provided little respite to market concerns on the debt crisis of the region as investors shifted focus to bigger economies of the common currency area such as Spain and Portugal as 'emerging problems'.

Ireland on Friday pushed through the third main vote for a budget that proposed 6 billion Euros of spending cut and harsh tax hikes which were the pre-conditions for the bailout.

Any development that will signal deepening of the euro-area crisis can impact commodities as a subsequent loss of the euro can strengthen the greenback, decreasing their investment appeal. Problems in euro-zone will also weigh on the recovery hopes and cut demand outlook for commodities globally.

US data and dollar

Data from the US last week such as weekly jobless claims, November import price index, October consumer credit and trade balance and November consumer sentiment index by Reuters/Michigan -all were stronger than expected and to a certain extent, they helped offset the weaker-than-expected jobs data in the previous week.

The US dollar index that fell to a 10-day low of 79.063 on December 3 rose as high as 80.404 this week before ending at 80.07, 0.87 percent stronger than previous week's close.

However, the market is still doubtful about the greenback's ability to shoulder the safe-haven demand during tough times as the economy is still not out of a situation where more quantitative easing can be a necessity.

Next week

This weekend's Chinese data will help market players shape a better view on the time and scale of more policy actions by the 'dragon', which will have direct impact on the demand outlook for commodities.

US Fed's December policy announcement is due on Tuesday, which will be scrutinized for the central bank's view on evolving scenario in the world's largest economy. It is not expected to alter the official rate.

That apart, inflation of consumer as well as producer prices in the US, industrial output and employment data from the European Union will likely play crucial on the data front.Philadelphia Fed's manufacturing survey, Housing starts and Industrial production data from the US and Germany's business climate assessment by IFO and ZEW economic sentiment indicator are other few releases to watch.

© Copyright IBTimes 2025. All rights reserved.