Romney-Ryan Medicare Plan Means Higher Premiums In Different States: Study

A privatized Medicare system like the one put forward by the Mitt Romney-Paul Ryan team would lead to higher premiums that would vary in each state if implemented, according to a recent study released by the nonpartisan Kaiser Family Foundation.

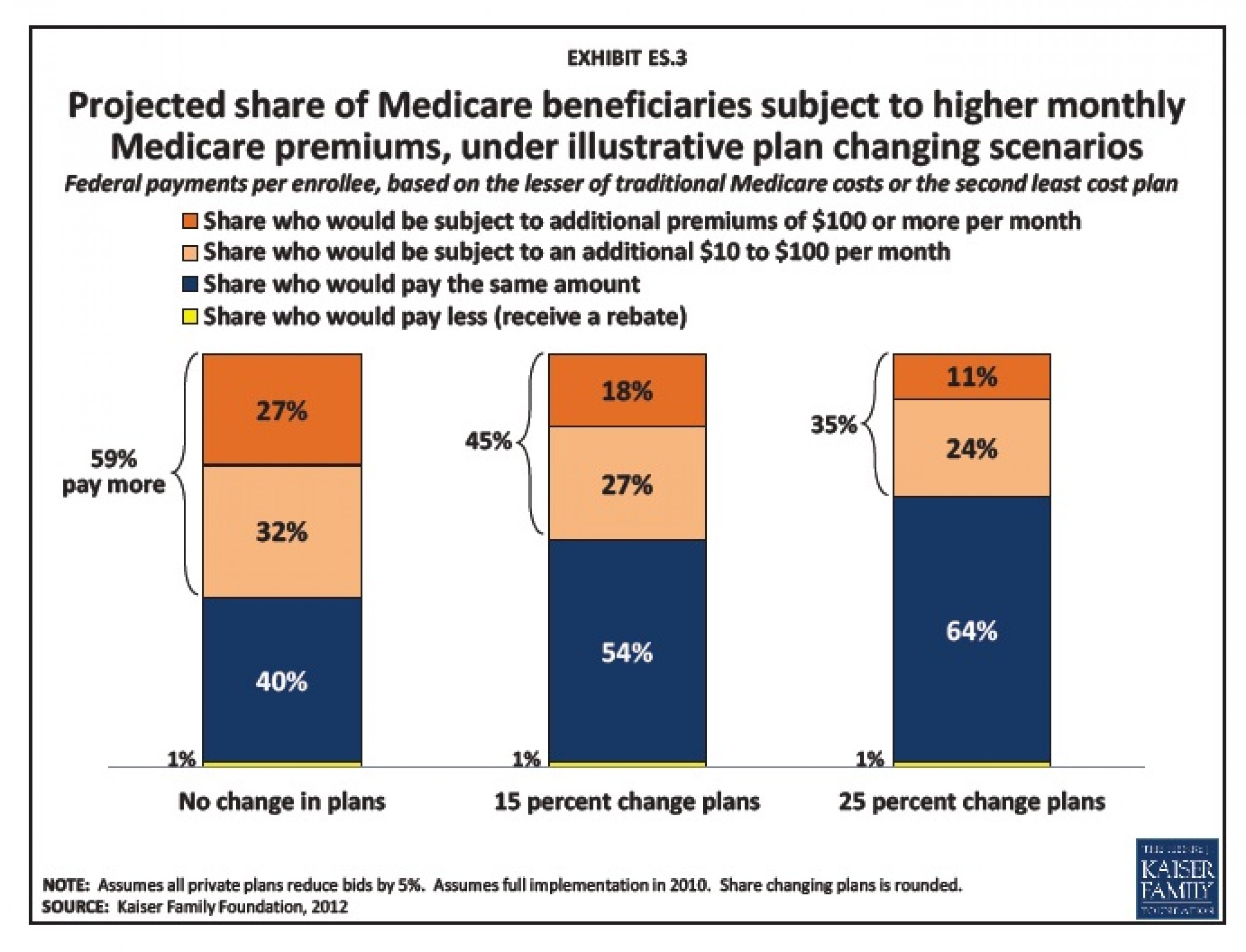

Nearly six in ten Medicare recipients would pay higher premiums to reap the benefits. And if a quarter of all the beneficiaries opt for a low-cost plan in their region, more than a third of them would be hit with the higher premiums, that study concluded.

Though the analysis is modeled from the Republicans' Medicare proposal, Kaiser pointed out that more specifics would be needed before the Ryan plan can be analyzed. Also, under the Kaiser study, the assumption is that the plan would be implemented in 2010 instead of the gradual 2023 phase-in and everyone who is now 55 years old isn’t exempted.

“These findings underscore the potential for highly disparate effects of a premium support system for beneficiaries across the country,” the report stated. “The results show how individual decision making (plan choices), coupled with geographical variations in the cost of traditional Medicare and the private health plans, would play a major role in determining how well beneficiaries fare with respect to premiums under this approach.”

What Kaiser did was assume private plans would lower bids by 5 percent across the board under the new payment structure. It also looked at the effects of a more or less aggressive private bidding plan and the result if a significant number of recipients enroll in low-bidding plans.

Here are some of the key findings in the hypothetical 2010 plan:

- 59 percent of Medicare beneficiaries, about 25 million, would be expected to pay higher Medicare premiums than under the current program if they stayed in the same plan;

- 53 percent, or 18.5 million recipients, in the traditional Medicare program would be expected to pay higher Medicare premiums for coverage under that program because nearly half of them are in counties where traditional Medicare costs were higher than the benchmark.

- Traditional Medicare recipients would pay on average $60 per month ($720 per year) in additional Medicare premiums. 47 percent of beneficiaries in this program would pay the same amount under a premium support system;

- 88 percent of beneficiaries enrolled in private plans would pay higher premiums. That’s unless they made the change to a benchmark plan. Kaiser explained that this is so because 92 percent of private plan enrollees are in a plan where the bid is higher than the benchmark plan in their area.

- Private plan enrollees on average would pay $87 per month ($1,044 per year) in additional Medicare premiums.

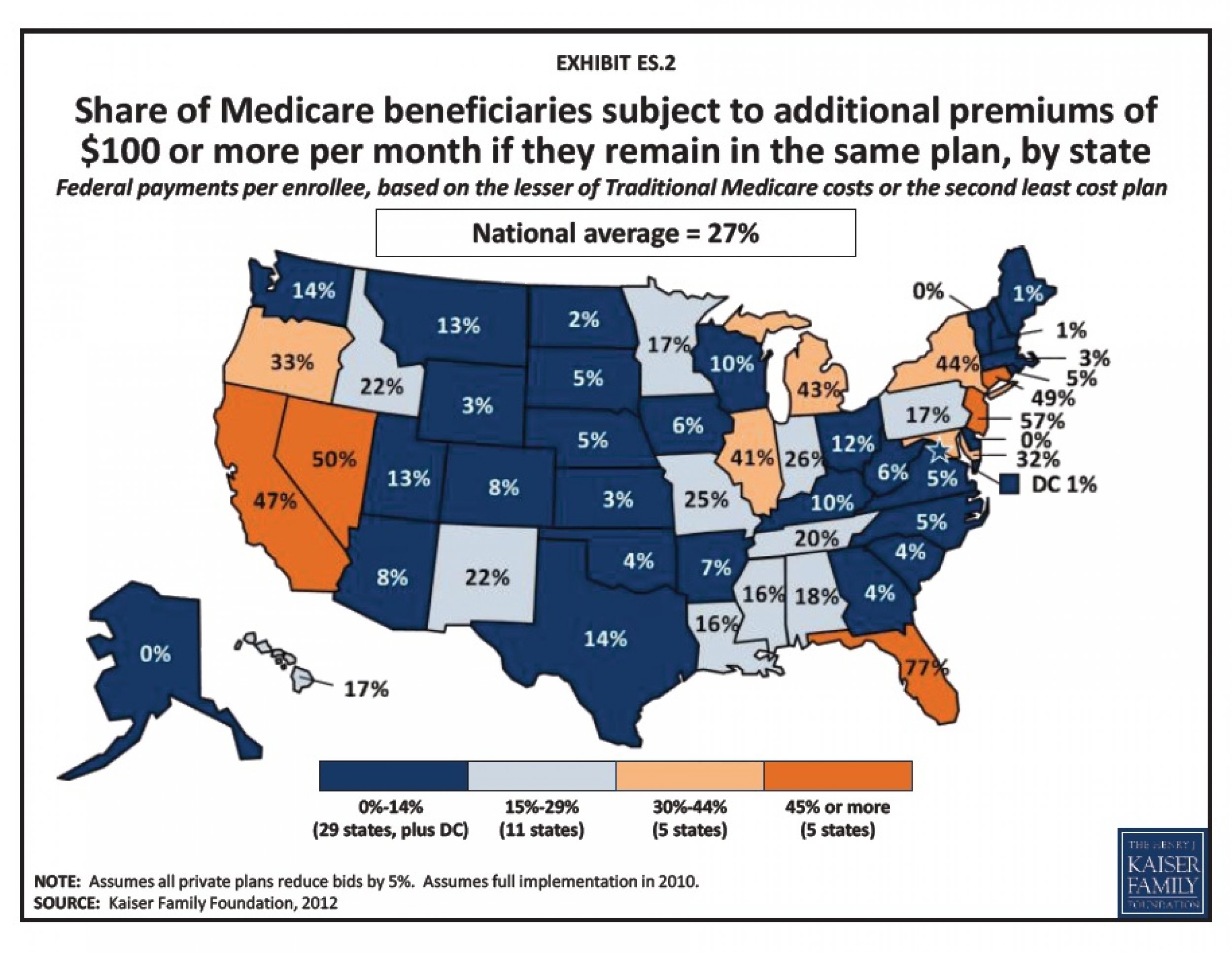

- In terms of geography, the share of beneficiaries who could face higher premiums if they stuck to the same plan varies by state. This ranges from less than 2 percent of beneficiaries in Alaska and the District of Columbia to more than 90 percent of recipients in Connecticut, Florida, Massachusetts, and New Jersey.

- In 29 states and the District of Columbia, less than 15 percent of recipients would pay $100 or more in monthly Medicare premiums.

- In California, Connecticut, Florida, New Jersey and Nevada, more than 45 percent of beneficiaries would pay at least $100 more in Medicare monthly premiums. That’s also unless they made the change to a benchmark plan.

- Half or more of recipients in Florida (77 percent), Nevada (50 percent), and New Jersey (57percent) would be subject to additional monthly premiums of $100 or more, if they remained in the same plan.

- Variations would also be seen within a state with traditional Medicare premiums remaining unchanged in San Francisco and Sacramento counties, but rising by more than $200 per month in Los Angeles and Orange counties.

Almost 75 percent of Medicare's approximately 50 million recipients are in the traditional government program. The other 25 percent have reportedly opted for private Medicare Advantage plans.

Romney spokeswoman Andrea Saul told the Associated Press that the authors of the research have indicated it is not a study of the Romney-Ryan plan.

"Our plan would always provide future beneficiaries guaranteed coverage options with no increase in out-of-pocket costs from today's Medicare," she said.

You can read the full report.

© Copyright IBTimes 2025. All rights reserved.