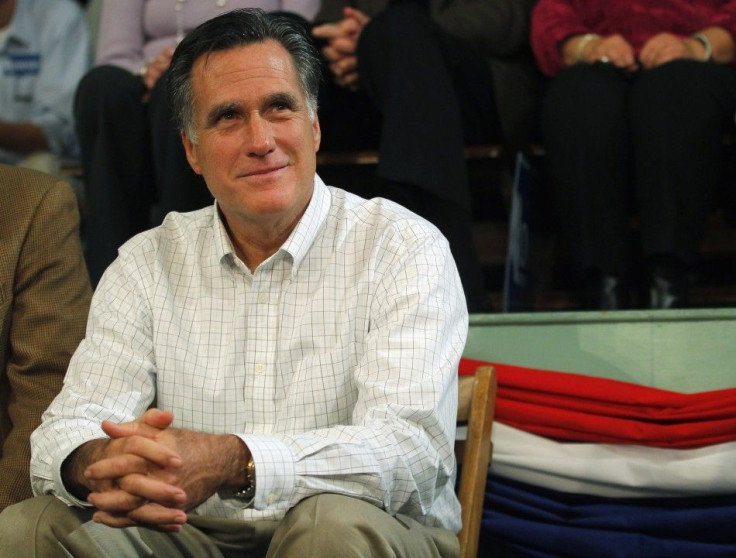

Romney Still Getting Millions from Bain Capital: Report

(Reuters) - Republican White House hopeful Mitt Romney receives millions of dollars a year in a retirement agreement with Bain Capital, nearly 13 years after he left the private equity firm he helped start, the New York Times reported Monday.

In the final deal of his private equity career, Romney negotiated an agreement with his former partners that has paid him a share of Bain's profits ever since, bringing his family millions in income each year and bolstering the fortune that has helped finance his political aspirations, the paper said.

After Romney left Bain, the company grew into a global investing behemoth, buying and restructuring companies. His retirement agreement, the Times noted, may expose him to criticism that while pursing a career in public life, he has grown wealthier partly from Bain laying off workers at companies it has bought - a charge that routinely resurfaces on the campaign trail.

A second point of controversy could be that his Bain profits may qualify for a lower tax rate than ordinary income under a tax provision favorable to private equity managers - a point of contention in fierce arguments over whether tax rates on the wealthy should be raised.

Romney is a leading candidate to become the Republican nominee to challenge President Barack Obama next November.

He has been highlighting his business experience, saying it gives him a better understanding than the president and his Republican rivals of how to energize the U.S. economy and create jobs. At the same time, he has deflected criticism of layoffs caused by private equity deals by noting he left Bain in 1999.

LAYOFFS, TAXES

The Times said records and interviews show that in the years since then he has benefited from at least a few Bain deals that resulted in upheaval for companies, workers and communities.

One deal involved KB Toys, a Pittsfield, Massachusetts, company that one of Bain's partnerships bought in 2000. The Times said that three years later, when Romney was governor of that state, Bain began laying off thousands of employees.

Bain also helped lead the private equity purchase of the big radio station operator Clear Channel Communications, a deal that eventually resulted in 2,500 job cuts.

Since Romney's payouts come partly from Bain's share of profits on its customers' investments, that income probably qualifies for the 15 percent tax rate on capital gains rather than the 35 percent wealthy taxpayers pay on ordinary income, the Times said.

The Internal Revenue Service allows investment managers to pay this lower rate on profits, known in the industry as carried interest. Such options are not available to the ordinary taxpayer.

Spokesmen for Bain and Romney were not immediately available for comment on the report, published overnight in New York.

The newspaper said that Romney had declined to release his tax returns, while his campaign refused to say what tax rate he paid on his Bain earnings. It said a Bain spokesman declined to comment on the retirement agreement, citing confidentiality.

This was a typical market deal. Bain Capital has no incentive to overpay Governor Romney, and they didn't, Andrea Saul, a spokeswoman for Romney, was quoted as telling the paper.

While some former business associates said they considered the retirement deal generous, others said Romney might have had even more from Bain had he not wanted a quick move into public life. He made a very sweet deal, he had a very good exit, one former Bain partner told the Times.

But my guess is, given the actual economic value of Bain Capital at the time, Mitt walked away with less than he could have if he did not take into account the adverse publicity and attention that a battle with former partners would have caused if he had negotiated and played hardball.

According to the newspaper, in 1999 Bain had about $4 billion in assets under management, 100 or so employees and a single office, in Boston. In 2005, Bain had over $21 billion in its funds. Today, Bain manages about $66 billion overall, with 900 employees and 10 offices in six countries.

(Reporting by Philip Barbara; Editing by Alastair Macdonald)

© Copyright Thomson Reuters 2024. All rights reserved.