South Korean Labor Woes Strike Hyundai,Kia Again As General Motors Backing Out Of Korean Car Manufacturing

South Korean auto manufacturing workers are unhappy, again.

On Wednesday, unionized workers for the country’s top automaker Hyundai Motor Co. (KRX:005380) and its cousin Kia Motors Corporation (KRX:000270) voted to walk off the job, setting the stage for a strike following the end of a mandatory 10-day mediation process involving the country’s labor relations commission.

That period ends on Monday, which means auto production could stop Tuesday.

The move comes just a year after the last strike that battered production and amid declining earnings, stiff competition in compacts and crossovers in the U.S. and a sluggish domestic auto market.

"Our goal is not a strike," a union spokesman told The Korea Herald. "The company should offer positive proposals if it does not want a disruption.”

The Hyundai union represents about 46,000 members while Kia’s union membership numbers 30,486. Both unions voted in favor of striking, with strong majorities topping 70 percent after their demands for salary hikes.

Specifically, Hynudai’s workers are demanding a 130,500 won ($120) increase in monthly pay, performance-based bonuses and a one-time cash payment representing almost one-third of what the company made in profit last year, $2.4 billion according to Agence France-Presse.

“We’ve seen a decline in our earnings because foreign brands quickly eat into our domestic market share and the economy at home and abroad remains sluggish,” said a message from Hyundai’s management explaining why it won't meet union demands.

Last year, Kia reported losing more than a trillion won due to labor strikes. Hyundai has faced production-battering strikes in all but four of the past 20 years; three of those were from 2009-2011. Some years the loss in production was minimal, amounting to less than 25,000 cars. In 2006, striking workers cost the automaker production losses that topped 120,000 cars.

Hyundai has three assembly plants in South Korea that produced 1.9 million vehicles. It built 2.56 million units abroad in China, the U.S., India, Turkey, the Czech Republic, Brazil and Russia.

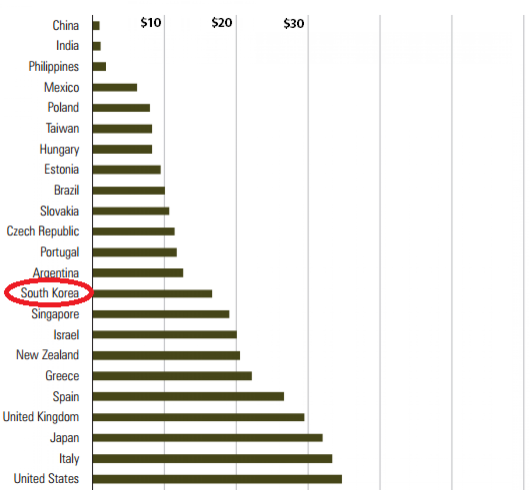

Earlier this week, executives from General Motors Co. (NYSE:GM) told Reuters that the company is rethinking its dependence on South Korea for one-fifth of its global production due to rising labor costs and what it considers heavy-handed union tactics.

“We need to make sure we mitigate risk in (South Korea), not over the next 2-3 years but over time, not to become too dependent on one product source,” said one of the sources. “If something goes wrong in Korea, whether it is cost, politics, or unions, it has an immediate impact.”

GM greatly expanded manufacturing activity in South Korea after it bought Daewoo Motors in 2002. GM produces 9.5 million cars in the country, most of which are exported.

© Copyright IBTimes 2024. All rights reserved.