Supreme Court Health Care Decision: Insurers Say They're Prepared

Health insurance providers say they are prepared for the U.S. health care system changes upheld Thursday by the U.S. Supreme Court, perhaps in part because they increased premiums last year by 9 percent in a climate where families and businesses pay more than double what they were paying just a decade ago.

Whatever the reason for the alarmingly high growth in the cost insurers have been planning for this day for a while.

Unless the Republicans succeed in a repeal, insurers will, among other things, be prohibited from denying coverage for pre-existing conditions by 2014, from capping the amount of care they will pay for, or from kicking out customers who acquire expensive health conditions.

The law will also create a subsidized health insurance exchange that insurers fear will cause employers to stop offering their products, pushing people to the exchange, thus lowering revenue and slimming margins.

In October, for example, Obamacare supporter Wal Mart Stores Inc. (NYSE: WMT) stopped offering health coverage to part-timers and reduced by half its contributions to health savings accounts. Critics of the legislation cited this as a symptom of what companies will do in the face of the impending changes. Supporters have said very few employers offer health insurance to part-timers anyway, and that Wal-Mart's decision was based on the rising cost of premiums, which for employers has risen by 113 percent since 2001, according to Kaiser Family Foundation.

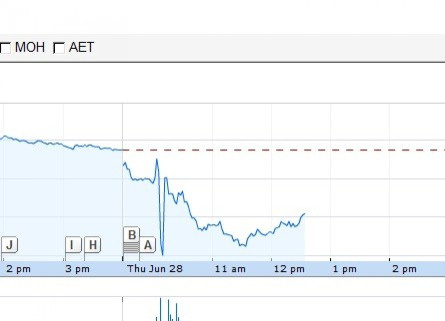

On Thursday, share prices in most of the country's top health insurers were down lower than the S&P 500. Here's what some of the largest health insurers had to say about today's decision:

Hartford, Conn.-based Aetna Inc. (NYSE:AET)

Today's Supreme Court decision does not change our business strategy or commitment to system reforms that make quality care more affordable and accessible. We are prepared for the changes ahead and will continue to fully comply with the requirements of the Affordable Care Act. At the same time, we know that much more must be done to fix the problems that remain in our health care system. We believe there is still time -- if people can come together in a bipartisan way -- to improve quality and affordability. That security is what Americans want and need.

Aetna's share price closed Thursday down $1.11 cents, or 2.95 percent, to $39.85.

Indianapolis, Ind.-based WellPoint Inc. (NYSE:WLP)

The road to implementing health care reform will be a challenge; however, we look forward to working constructively with policymakers and other key stakeholders to build a health care delivery system that provides security and affordability to all Americans, said a statement from WellPoint.

WellPoint saw the largest decline in share price on Thursda; it shed $3.55, or 5.1 percent, to close at $65.90.

CIGNA Corporation (NYSE:CI), based in Bloomfield, Conn.

Bloomfield, Conn.-based Cigna Corp. (NYSE: CI), the 11th-largest health insurance company, said it was incumbent on all of us to ensure all Americans had affordable health care and remove waste, adding that it would work with health care professionals and legislators.

A share in CIGNA lost $1.22, or 2.7 percent, closing on Thursday at $44.18.

Humana Inc. (NYSE:HUM) of Louisville, Ky.

Humana will continue to collaborate with policymakers on both sides of the political aisle, as well as other key stakeholders, to promote health care affordability and to enhance quality, while ensuring a smooth and stable transition to 2014, when several of the health care law's most significant provisions take effect, said Michael McCallister, Humana's chairman and CEO, in a statement.

Humana saw its share price regain its losses for the day on Thursday, adding 2 cents to its share price to close virtually flat for the day at $79.56. The share price had dipped to $75.77 shortly after the Supreme Court annoucement.

© Copyright IBTimes 2025. All rights reserved.