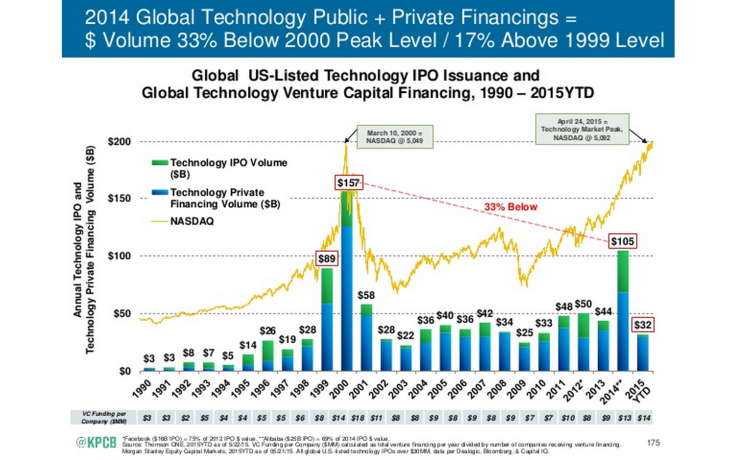

Tech Bubble: One Chart Shows Why 2015 Is Looking A Lot Like 2000

Technology companies are hot -- last year several tech companies went public including Box, Alibaba, and GoPro. According to data from Bloomberg, it was the best year for IPOs in general since 2000. You know, the year when the dotcom bubble popped.

Are we in the midst of another technology bubble? A new chart from Kleiner Perkins venture capitalist Mary Meeker suggests a strong maybe. When you add up the money from technology IPOs and venture capital funding, 2014 totaled $105 billion in technology financing -- more than companies financed in 1999, but less than the total financed in 2000. If valuations continue to grow, the chart suggests, 2015 could end up like 2000 -- implying a bust is coming shortly after the boom.

"In periods of material business disruption -- like those brought about by the evolutions of the Internet -- company creation typically goes through a boom -> bust -> boom-let cycle," Meeker's next slide explains.

These charts comes from Mary Meeker's Internet Trends report, which was presented at Re/Code's tech conference in Rancho Palos Verdes, California on Wednesday.

Last year, Meeker downplayed fears of a tech bubble in her annual report, citing a small number of IPOs. But 2014’s explosive market may have changed her tune.

More charts and insights are available in the full report, which can be found here.

© Copyright IBTimes 2024. All rights reserved.