US December Jobs Report Preview: Ending 2013 On Solid Nonfarm Payrolls Numbers, Unemployment Rate To Hold At 5-Year-Low

The U.S. labor market probably finished 2013 on a fairly strong note, economists predict ahead of Friday’s government jobs report. This could prompt top Federal Reserve officials to reduce bond purchases for a second time when they meet in late January.

The Labor Department will release the December employment report on Friday at 8:30 a.m. EST.

U.S. employers are expected to have added 195,000 jobs in December, down slightly from the 203,000 jobs created in November, according to the consensus of 61 economists polled by Thomson Reuters. This would still represent a modest improvement from the three-month average pace of payroll gains of 193,000 through November. Projections ranged from 125,000 to 235,000.

Meanwhile, the unemployment rate is expected to hold steady at a five-year low of 7.0 percent. Economists look for average hourly earnings to rise 0.2 percent and average weekly hours to remain at 34.5 hours in December.

“The data have turned decisively stronger at the end of the 2013, with GDP growth tracking 3.0 percent in the fourth quarter after the strong 4.1 percent gain in third quarter,” economists at Bank of America Merrill Lynch, led by Ethan Harris, said in a report last Friday. This is a marked improvement from the first half average growth rate of 1.8 percent.

The economy was hit with significant fiscal tightening at the beginning of 2013: Federal taxes were hiked in January under the "fiscal cliff" deal and the sequester spending cuts went into effect early in the year. “The economy was able to handle the drag and has proved resilient. This leaves us feeling optimistic about the prospects for stronger growth to persist in 2014,” Bank of America Merrill Lynch economists added.

The gain in the second half of 2013 has been driven by the consumer. For the last three months of 2013, Bank of America projects real consumer spending grew at a solid 4.0 percent pace – thanks to, at least in part, to positive wealth effects.

The S&P 500 (INDEXSP:.INX) gained 29.6 percent in 2013, and home prices are on track to be up at least 10 percent on the year. This follows notable gains in 2012. Auto sales in the U.S. increased 7.6 percent last year to 15.6 million, the best for the industry since 2007.

A pickup in consumer spending should leave businesses feeling more confident and willing to invest, which is indicative of better labor market conditions.

Areas Of Concern

But not everything is looking up. There remain areas of concern.

Unemployment insurance: Jobless benefits for 1.3 million long-term unemployed Americans expired on Dec. 28, 2013, reducing the maximum duration of benefits to the 26 weeks, from a national weighted average maximum of about 55 weeks, and up to 73 weeks in some states. This could hurt consumer spending. Enacted in 2008 at the start of the recession, it had been extended every year since then. This year, Goldman's Alec Phillips said “expiration is likely, but not yet a done deal.” Benefit expiration is likely to reduce labor force participation and artificially lower the unemployment rate.

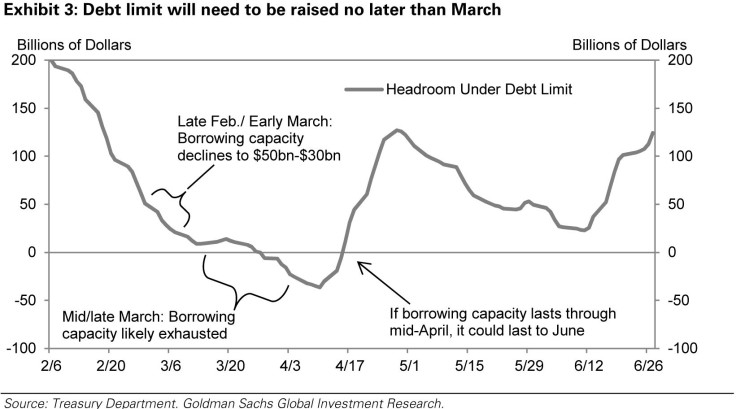

Fiscal deadlines: Congress once again faces familiar fiscal deadlines: spending authority expires Jan. 15, and the debt limit must be raised, or suspended once again, probably no later than March. “The Jan. 15 deadline poses little risk in our view,” Phillips said. “The bigger unknown is the debt limit.”

Fed Tapering

Last month, the Fed took its first step to end the $85 billion monthly bond-buying program. The central bank said it is reducing the program by $10 billion in January and would cut the monthly amount of purchases in $10 billion increments at subsequent meetings. At that pace, it will complete the bond-buying program toward the end of 2014. However, the Fed also made it clear that the pace is not predetermined and that it will be data-dependent.

Minutes from the Dec. 17-18 Federal Open Market Committee meeting, to be released on Wednesday at 2 p.m. ET, could give further insight into the reasons behind the decision and offer clues about how quickly the Fed will wind down the stimulus.

“Greater confidence among participants that risks to the growth outlook have become more balanced, as opposed to being tilted to the downside, was likely an important factor, and recent data developments will likely buoy the conviction that the economy is on a firmer footing heading into 2014 than was perceived to be the case a few months ago,” Peter Newland, a U.S. economist in New York at Barclays Capital, said in a note Friday.

Fed Chairman Ben Bernanke will be succeeded by Fed Vice Chair Janet Yellen when he steps down at the end of this month. The U.S. Senate on Monday voted 56 to 26 to approve Yellen as the Fed’s next chair. She is the first woman to chair the U.S. central bank.

© Copyright IBTimes 2025. All rights reserved.