US March Jobs Report Preview: Solid Nonfarm Payrolls Growth To Keep Fed Tapering On Track, Unemployment Rate To Fall Back To 6.6%

Friday’s March jobs report will probably be the first this year to actually present more signal than noise.

The spring thaw likely helped push U.S. nonfarm payroll growth higher last month, confirming the wide-held belief that harsh weather has been the main source of the slowdown in hiring. A decent number would make the Federal Reserve’s job easier as it moves to end its massive stimulus program.

The Labor Department will release the March employment report on Friday at 8:30 a.m. EST.

“As the weather gets back to seasonal norms, the return of the people who were not able to complete any paid work during the winter months will boost the level of employment,” said Capital Economics’ Paul Dales.

Payrolls are expected to have risen by a solid 200,000 in March, according to economists polled by Thomson Reuters, after a 175,000 advance a month earlier. The rebound in employment should push the unemployment rate back down to 6.6 percent, matching the lowest level since October 2008.

The fading of the weather distortions means that average weekly hours worked probably rebounded to 34.4 in March, from 34.2 in February. Meanwhile, after February’s 0.4 percent monthly gain, average hourly earnings probably increased by a more modest 0.2 percent in March.

Weather

While March is likely to prove at least as unseasonably cold as February, capping off a December-March winter period that was the coldest since 2001, the lack of major snowstorms allowed for greater economic activity, particularly construction and manufacturing.

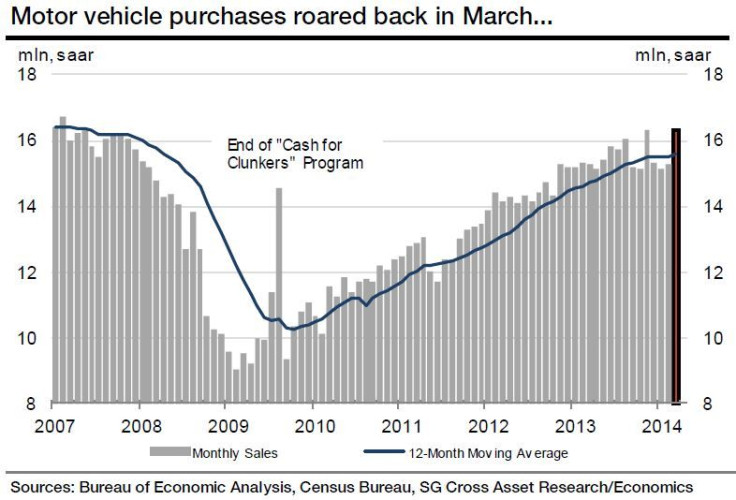

The latest ADP survey revealed that private payroll employment picked up in March, auto sales hit a seven-year high and consumer confidence rebounded to a six-year high.

“Never, ever change your views on the U.S. economy in the midst of winter,” said Societe Generale’s Brian Jones.

She Said, She Said

In her first public speech since becoming Fed chair two months ago, Janet Yellen said that “considerable slack” in the labor market is evidence that the central bank’s unprecedented accommodation will still be needed for “some time” to combat unemployment.

The “scars from the Great Recession remain, and reaching our goals will take time,” Yellen said in her remarks to a Fed community development conference on Monday. “The recovery still feels like a recession to many Americans, and it also looks that way in some economic statistics.”

Earlier this month, Yellen raised concerns during her first news conference following the Fed's Open Market Committee (FOMC) rate decision by saying that the period between the end of the Fed's quantitative easing program, or QE, and the first rate increase could be six months, a faster timeline than many had anticipated. If the Fed continues on its current course, it will finish tapering its bond buying program in November, meaning that six months would fall around April 2015. Stocks plunged on her remark.

However, the Fed chief's remarks on Monday hinted that interest rates would remain at rock-bottom levels for an extended period. The FOMC has kept the benchmark interest rate near zero since December 2008.

Wage Pressure

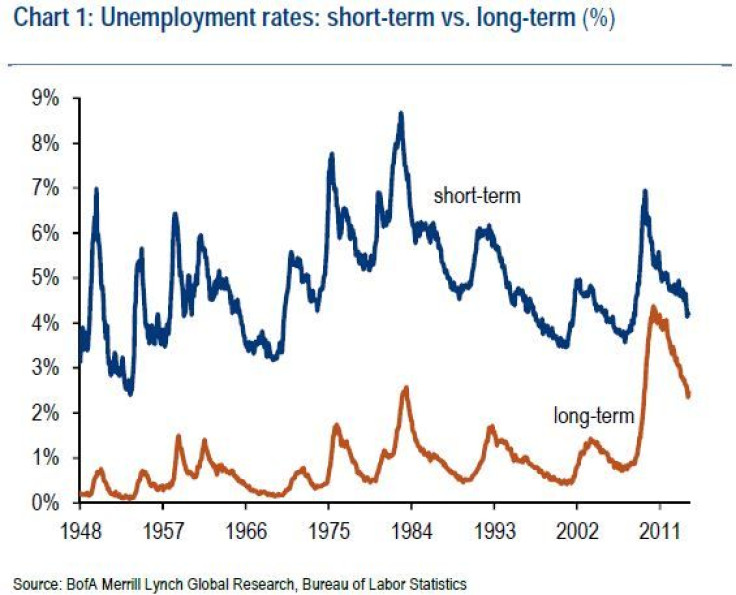

That said, there is a growing consensus that the decline in the short-term unemployment rate has set the stage for wage pressure to build. If wage growth accelerates faster than the Fed’s current expectation, it could eventually prompt a more aggressive monetary tightening.

At 4.2 percent in February, the short-term unemployment rate is well below its long-run average of 5.2 percent, whereas the long-term rate was still 2.5 percent, double its 1.2 percent historical average.

“If there is little prospect of the long-term unemployed returning to work even in a healthy economy then, as the short-term unemployment rate continues to decline, it would be a mistake for the Fed to persist with such an easy monetary policy,” said Capital Economics’ Paul Ashworth.

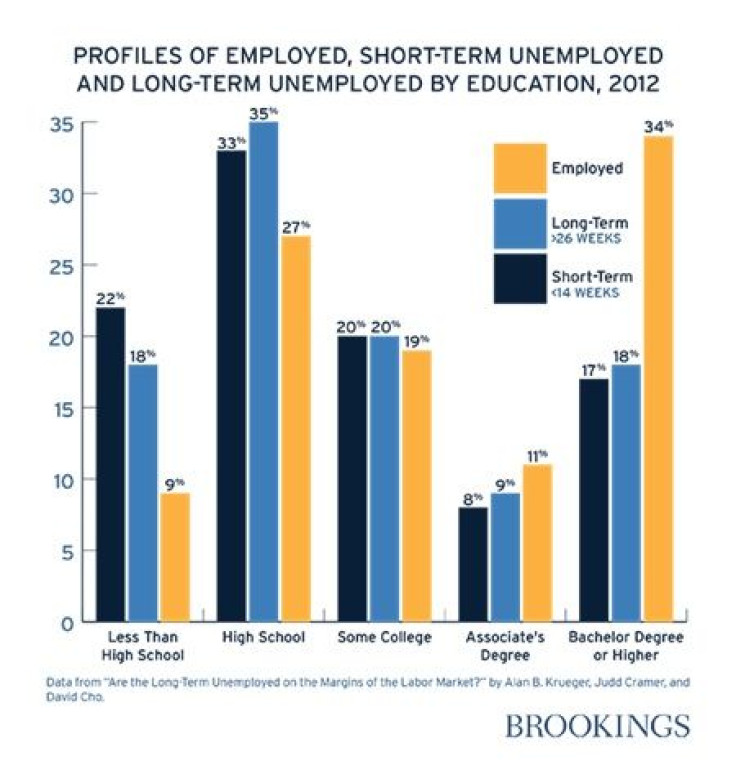

Some have argued that the Fed could allow price inflation to run above its 2 percent target for some time in an attempt to tackle the long-term unemployment problem. But based on the evidence in a Brookings paper, ultra-loose monetary policy isn't going to solve what is now a structural characteristic of the U.S. economy.

“The evolution of wage growth this year will be a key input for the policy debate,” said Barclays’ Peter Newland.

© Copyright IBTimes 2024. All rights reserved.