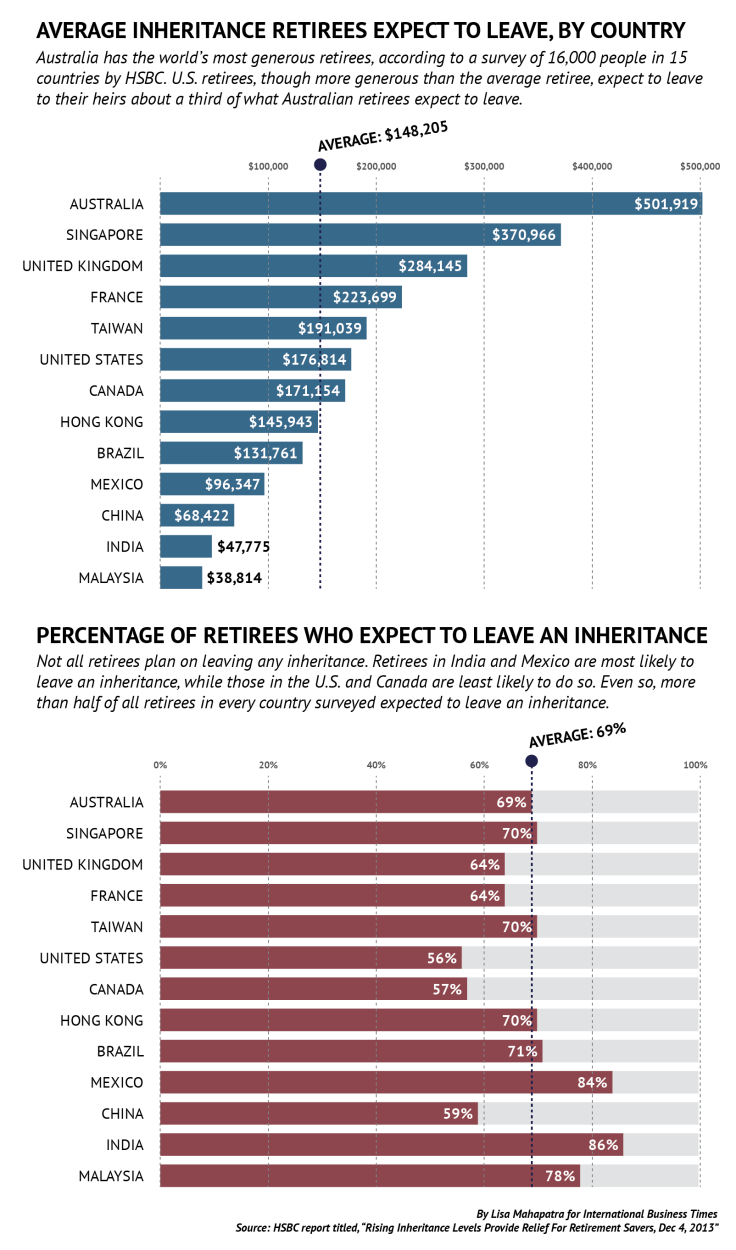

US Retirees Expect To Leave $175,000 To Their Heirs, Says New HSBC Study [CHARTS]

Not only do more than half of U.S. retirees expect to leave an inheritance, they expect to leave around $175,000 on average, according to a new study from HSBC, which surveyed 16,000 people in 15 countries.

The study also found that many people are not willing to wait until death to pass on their wealth to loved ones. Around 35 percent of working-age people in the U.S. said they had received a significant financial gift or loan from a family member, according to the report.

But U.S. retirees were far from being the most generous in the world. That honor went to Australians retirees, who said they planned on leaving a little more than $500,000 on average.

Retirees in India and Mexico planned on leaving smaller sums to heirs, which makes sense since both countries have relatively low per capita income. However, they were also most likely to actually leave an inheritance. Eighty-six percent of Indian retirees said they planned on leaving an inheritance, and 84 percent of Mexican retirees said the same.

© Copyright IBTimes 2024. All rights reserved.