What Plunging Oil Prices Mean For US Consumers, Petroleum Producers, Oil Service Companies

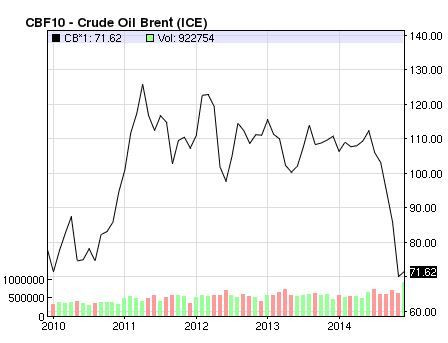

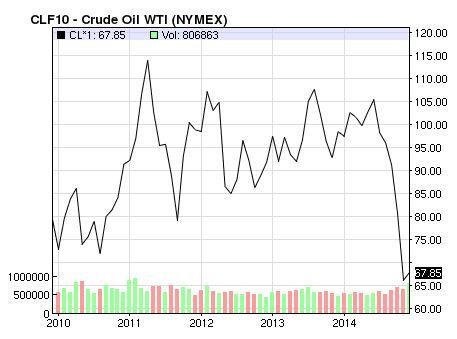

Energy analysts are wondering how low crude oil prices will fall after the more than 3 percent drop in global prices on Black Friday. The international benchmark for crude oil, known as Brent blend, dipped below $70 a barrel for the first time in four years. West Texas Intermediate (WTI), the benchmark U.S. crude oil, plunged 10 percent the same day to a four-year low of $65.69 a barrel.

Crude oil prices have experienced various ups and downs in the last two decades, but that was before U.S. producers found a commercially viable way to extract crude oil and natural gas from shale rock. Analysts say the new boom in shale production could have lasting effects on the international price of oil, which peaked last June at $115 per barrel.

“This price cycle is unlike other price cycles because it’s more structural, which means there is growing unconventional oil production in the U.S. and Canada. We have never had that before,” Fadel Gheit, managing director and senior analyst at Oppenheimer & Co., said.

Prices may have further to fall. Last Thursday, the Organization of the Petroleum Exporting Countries (OPEC) surprised global markets during a key meeting by maintaining its collective production at the current ceiling of 30 million barrels a day. Before the meeting, some analysts speculated that the cartel might cut production in an attempt to keep prices from dipping further.

The decision to maintain production levels suggests OPEC’s power to manipulate global oil prices has diminished. Supply is here to stay, said Gheit. “The genie is out of the bottle, and you cannot put it back in,” Gheit said. “No matter how low oil prices get, OPEC will not be able to shut down unconventional production."

Oil prices are under pressure not only because OPEC will continue to produce large volumes and because of the U.S. shale boom but also because the world's biggest consumer of petroleum is demanding less and less of it. Five years ago the U.S. imported as much as 65 percent of crude oil. Now, however, imports comprise less than 50 percent of what the nation uses. Gheit expects this percentage will continue to decline as the U.S. consumes less and produces more. “It’s only a matter of time before our imports continue to dwindle,” Gheit said.

As oil prices continue to drop, analysts are slashing their forecasts, with some predicting it could decline as much as 40 percent to around $40 a barrel. The average per-gallon price for gasoline in the U.S. is about is $2.75. If crude oil, from which gasoline is refined, falls to $40 per barrel, that could translate to around $2 per gallon gasoline, said Jeff Grossman, president of BRG Brokerage Inc.

The shale boom is creating clear winners and losers. Americans are enjoying heightened consumer confidence, which should benefit the U.S. economy, since consumer spending accounts for nearly two-thirds of the nation’s economic activity.

Among domestic losers of cheaper crude oil are oil service companies. That's because petroleum producers only hire oil service companies if they believe the price they will get from shale oil and gas will at least cover their costs. For some petroleum producers the current price of oil and gas is less than their production costs.

Cheaper oil is also putting extreme pressure on OPEC member countries such as Venezuela, as its economy lacks the financial cushion to endure lower oil prices, Jamie Webster, senior director of Global Oil Markets at IHS Energy, said. However, Kuwait, the United Arab Emirates (UAE) and Saudi Arabia will remain winners in the long term because they are better positioned to withstand lower oil prices since they can make up some of the lost revenue by maintaining supply volumes and because their production costs are among the lowest in the world.

After hitting a five-year low, Brent rebounded and gained over 3 percent on Monday to end at $72.54 a barrel while U.S. benchmark WTI jumped over 4 percent to $69 a barrel from Friday’s close. On Tuesday, Brent crude fell 1.27 percent to $71.62 on London’s ICE Futures Exchange while WTI futures for January delivery increased 1.72 percent to $67.81 on the New York Mercantile Exchange.

“I think we’re close to the bottom,” Gheit said. “But the question for companies and investors now is not how much oil prices will fall, but how long oil prices will stay low.”

© Copyright IBTimes 2024. All rights reserved.