Why Fed’s First Rate Hike Is Still Far Off

The March Federal Open Market Committee statement attempted to convey a status quo message, but markets apparently saw it differently and some economists believe a rate hike is still far off.

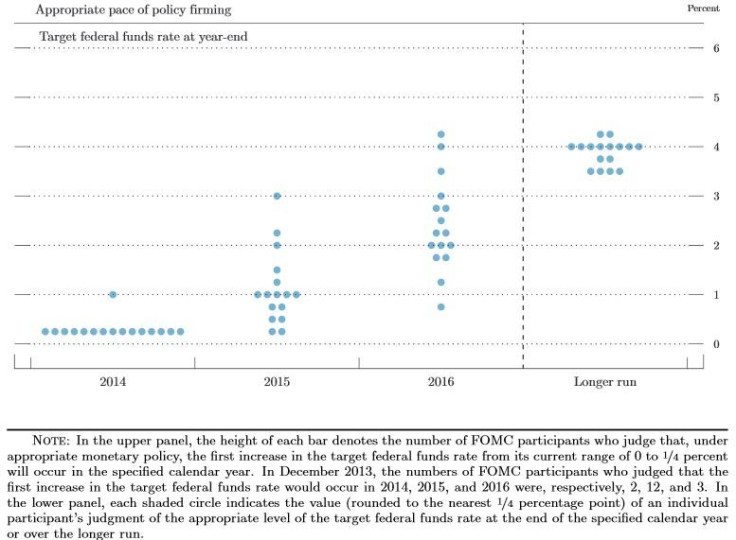

Both bond and equity markets sold off sharply on what they see as a mildly hawkish shift in the “dot plot” of Federal Reserve rate projections.

“The problem is that the Fed is no longer telling us specifically what indicators it is looking at or, more importantly, how it might react to changes in those indicators,” Paul Ashworth, Capital Economics' chief North American economist, said. “All we have is a long and vague laundry list.

“Given this obfuscation, the only concrete information we have to go on is the Fed's explicit rate projections,” Ashworth added.

The dot plot collects the views of all 16 participants and not just the 9 voters on this year’s FOMC. Thus, nearly half the dots are drawn from individuals with no say in policy decisions.

“Nonetheless, with the quantitative thresholds now gone, the markets have placed even greater weight on the information, misleading or not, that the dots convey,” Michael Hanson, senior U.S. economist at Bank of America Merrill Lynch, said.

Fed Chairwoman Janet Yellen’s overall dovish tone and attempts to downplay the dots largely fell on deaf ears.

Yellen said during her first post-FOMC press conference on Wednesday that the dots “will move a little bit this way or that,” but “I really don’t think it’s appropriate to read very much into it.”

The “dots” showing the appropriate funds rate projected by meeting participants edged up by 25 basis points for the end of 2015, and the number of officials viewing 2016 as the appropriate liftoff year shrank from three to two.

“The latter change was a surprise to us as the economic outlook had not changed meaningfully since December and comments by Chicago Fed President Charles Evans prior to the meeting had suggested that he was moving from 2015 to 2016 for the first hike,” Jan Hatzius, Goldman Sachs' chief economist, said, adding that the “dot plot” also suggests strongly that Yellen's own liftoff date is 2015.

In addition, a misstep by Yellen during her press conference may have served to confirm the market’s bias for moving the date of the rate hike closer in time.

In the statement, the FOMC said that rate hikes were unlikely “for a considerable time” after the end of the third round of quantitative easing known as QE3. When asked to define “considerable,” Yellen said it could be interpreted as meaning that rates might begin to rise six months or so after the Fed concluded its asset purchases. If QE ends in October, the first rate hike could be as soon as April next year.

Nevertheless, Goldman’s Hatzius thinks the first rate hike is still a long way off, for four reasons:

1. Markets shouldn’t read too much into the “six months” comment or the upward move in the dots. The former seemed like the kind of misstep that sometimes occurs in high-pressure public speaking situations, while the significance of the latter was heavily and repeatedly downplayed by Yellen.

2. It is unclear whether the temporary factors -- weather and inventories -- explain all of the negative economic activity surprises since the start of the year. This means the FOMC’s probability-weighted forecast for the liftoff date is probably later than its modal forecast.

3. The timing of policy liftoff is likely to be quite sensitive to the inflation path.

4. There's the risk that financial conditions could tighten more quickly in the run-up to the first rate hike than the committee is willing to tolerate.

Hence, Goldman’s baseline forecast remains for an early 2016 hike. That said, the risks have shifted to the side of an earlier hike.

© Copyright IBTimes 2024. All rights reserved.