Will Google's Stadia Move The Needle For AMD's Gaming Business?

Shares of AMD (NASDAQ:AMD) rallied on March 20 after Alphabet's (NASDAQ:GOOG)(NASDAQ:GOOGL) Google revealed that its new cloud gaming platform, Stadia, would be powered by AMD's custom chips. However, AMD's gains faded by the end of the day, and investors are probably wondering if Stadia will actually move the needle for the chipmaker.

Understanding AMD's gaming business

AMD currently supplies custom APUs (accelerated processing units) for Sony's PlayStation 4 and Microsoft's Xbox One.

These APUs merge a CPU (central processing unit) and GPU (graphics processing unit) onto a single die, making it more streamlined and cost efficient to produce than stand-alone CPUs and GPUs.

AMD's APU sales account for a large portion of its EESC (Enterprise, Embedded, and Semi-Custom) chip revenues. That segment also produces its Epyc data center chips, which are intended to crack Intel's near monopoly in the server chip market.

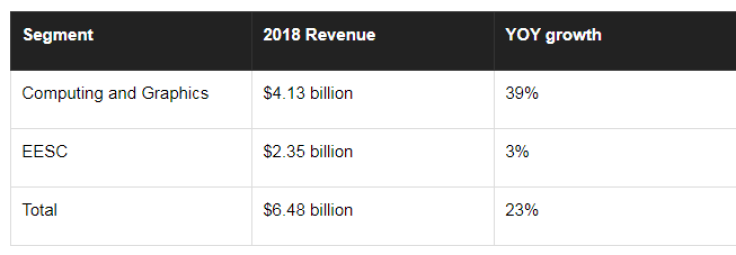

Here's how the EESC business fared last year in comparison to AMD's larger Computing & Graphics segment, which produces its x86 CPUs and discrete GPUs for PCs:

AMD's computing and graphics business outperformed its EESC business by a wide margin last year for two reasons. First, its new Ryzen CPUs and Radeon GPUs gained ground against Intel and NVIDIA's chips, respectively, mostly because they offered comparable performance at lower prices.

Second, sales of the PS4 and Xbox One, which both arrived over five years ago, decelerated as the market matured. AMD reported "significant growth" in its Epyc data center revenues last quarter, but that market remains small relative to gaming console APUs.

How Stadia could boost AMD's EESC business

Stadia is being touted as a potential challenger to the PS4 and Xbox One, but it isn't a physical gaming console. Instead it's a cloud gaming service that streams video games to any screen like interactive streaming videos.

In this setup the game is hosted remotely on Google's servers, so a local device -- like a PC, smartphone, tablet, or smart TV -- doesn't need a high-end CPU or GPU. It merely needs a decent video card and a high-bandwidth connection so the controls feel instantaneous. Access to these games will likely be offered via a monthly subscription model like Netflix.

The cloud gaming market is still nascent, with only a few noteworthy services like Sony's PS Now and NVIDIA's GeForce Now. However, it's expected to grow significantly as Google's Stadia and Microsoft's upcoming xCloud platform expand the market.

Morgan Stanley estimates that AMD generated about $50 million in cloud gaming-related revenues during the fourth quarter, which equals 12% of its EESC revenues and 4% of its total revenues. That percentage could rise as Google installs AMD's chips in its Stadia servers.

But it could be a double-edged sword

Google's partnership with AMD is a clear vote of confidence in the chipmaker's GPU and data center technologies. However, it could also be a double-edged sword for AMD because cloud gaming services like Stadia could disrupt demand for traditional gaming consoles.

Sony and Microsoft both hinted that their next-gen consoles will be focused on cloud gaming services. Various reports also suggested that Microsoft could launch a cheaper version of the Xbox with less horsepower for cloud gaming. However, the arrival of Stadia indicates that gaming consoles could eventually disappear and be replaced by subscription-based services.

If that happens, it's unclear if rising demand for gaming GPUs in cloud data centers can offset declining sales in the gaming console market -- but it's a balancing act that AMD investors will need to carefully track if the cloud gaming market takes off.

This article originally appeared in the Motley Fool.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Teresa Kersten, an employee of LinkedIn, a MSFT subsidiary, is a member of The Motley Fool's board of directors. Leo Sun has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Netflix, and Nvidia. The Motley Fool owns shares of MSFT. The Motley Fool has a disclosure policy.