Windows Phone Tops Blackberry Sales In Europe In Late 2012 [REPORT]

Microsoft’s (Nasdaq: MSFT) high-profile entry into the mobile marketplace wasn’t exactly the auspicious debut that the Redmond, Wash.-based tech company spent so many advertising dollars championing. But the company might still be clawing its way to the top of the smartphone ladder, according to new figures from Kantar Worldpanel ComTech.

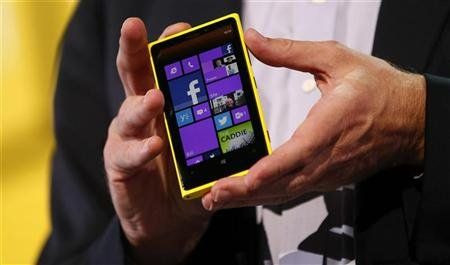

A report released from the market research firm Tuesday found that Windows Phones outsold BlackBerry across Europe during the 12 weeks leading up to Christmas in 2012. This represented 5.4 percent of all sales of smartphones over the holiday period.

“It has been far slower than Microsoft would have liked, but Windows Phone is now starting to gain respectable shares in a number of key European countries,” Dominic Sunnebo, ComTech’s director of global consumer insight, said in a statement.

While smartphones running on Google’s (Nasdaq: GOOG) Android operating system still remain “on top” of the mobile food chain, Sunnebo concluded that the “the rate of growth [Android units] experienced over the past year is beginning to slow as easy wins from first time smartphone buyers begin to reduce.”

The slowing pace of growth for Android devices offers newcomers like Microsoft a brief window of opportunity. But most of the gains made by Windows Phones came at the expense of smaller rivals such as Research In Motion’s (Nasdaq: RIMM) BlackBerry phones and Accenture’s (NYSE: ACN) Symbian devices. Either way, as far as Kantar’s data is concerned, Microsoft seems to have capitalized on it, though maybe not as much as the U.S. tech giant would have liked. Windows Phones posted impressive gains in several countries that more than doubled its market share from the previous year-- 5.9 percent in Great Britain (up from 2.2 percent), 13.9 percent in Italy (up from 2.8 percent) and 1.8 percent in Spain (up from 0.4 percent).

Despite renewed strength the European market, however, Sunnebo was not ready to pronounce Windows a runaway success, saying that “its performance in the Chinese and U.S. markets remains underwhelming. As the two largest smartphone markets in the world, these remain key challenges for Microsoft to overcome during 2013.”

A decline in Symbian devices was understandable given the fact that one of the operating system’s main providers, Nokia (NYSE: NOK), moved over to Windows for its next generation of smartphones. But Microsoft will likely face other rivals such as Sony (NYSE: SNE) and a retooled RIM mobile operation in 2013. RIM is expected to announce new and improved hardware to go with its BlackBerry 10 software at the end of this month. Sony, meanwhile, already unveiled its new flagship smartphone, the Xperia Z, at this year’s Consumer Electronics Show, and CEO Kazuo Hirai hasn’t been shy about his ambition to turn the company into a third pillar of the smartphone market alongside Apple (Nasdaq: AAPL) and Samsung (LON: BC94). All of these smaller players will certainly have their work cut out for them in 2013.

Microsoft shares dipped during trading Tuesday, falling 0.7 percent to $27.05 just after noon.

© Copyright IBTimes 2025. All rights reserved.