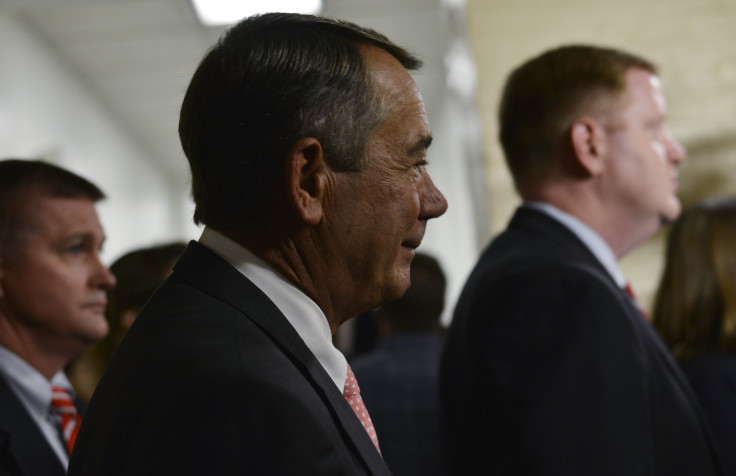

Boehner Resignation: How Does It Change Wall Street's Government Shutdown Expectations?

A consensus has emerged on Wall Street that the resignation of House Speaker John Boehner, R-Ohio, lowers the odds of a government shutdown. When Congress meets to pass a “clean” budget extension -- free of controversial language defunding Planned Parenthood --analysts predict it won't vote to cut off the operational funds that fuel the federal government. Even so, the likelihood increased of a grinding debt ceiling showdown come December.

“In the (very) short term, this is a positive,” wrote Guggenheim Securities analyst Chris Krueger in a note to clients Friday, lowering the firm’s estimated odds of a shutdown from 30 percent to 15 percent.

Analysts from Deutsche Bank and Goldman Sachs predicted that Boehner’s departure made it more likely the government would be functioning come October. “In our view, this significantly reduces the probability of a government shutdown next week,” the Goldman note read, calling Boehner’s decision “a strong signal that he plans to bring the clean extension up for a vote despite opposition from House conservatives.”

Boehner was facing stiff pressure from Tea Party-aligned Republican colleagues for his leadership position. His resignation clears the way for a new leader and potentially eases the passage of a budget deal with Democrats by Sept. 30. GOP Rep. David Jolly told the Washington Post that the “small victory” of Boehner’s resignation would make a shutdown “a lot less likely.”

It’s not just the markets that see Boehner’s exit as a positive sign for avoiding a shutdown. Governance experts have largely reduced their odds of a shutdown as well. A panel of experts convened by the Washington Post agreed that the probability had fallen significantly with Boehner on his way out.

“He took a bullet for the country,” Steve Bell, economic policy director at the Bipartisan Policy Center, told the Post.

But the risk of a shutdown returns in December when the upcoming funding bill runs out. “We are increasing our odds from a 10% probability to a 25% probability of some kind of accident that would keep Congress from raising the debt ceiling in time,” Krueger wrote.

As Wall Street watches the Federal Reserve carefully for signs it will begin raising rock-bottom interest rate benchmarks, the economic impact of a government shutdown loom large. The combination of lost wages of furloughed employees and diminished federal purchases could deliver a sucker punch to an economy on the mend.

The Bureau of Economic Analysis estimated that the 16-day government shutdown of 2013, which saw 800,000 employees furloughed, had a 0.3 percent impact on gross domestic product.

© Copyright IBTimes 2025. All rights reserved.